European cargo carriers monthly: mixed start to the year for airlines

10 / 02 / 2016

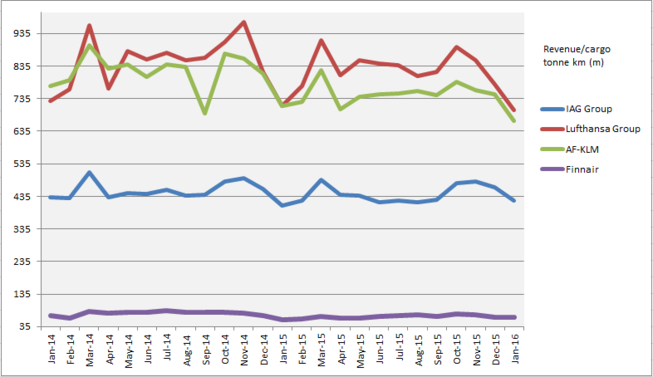

The start of 2016 has seen a divergence in the air cargo performance of European airlines, with Finnair and IAG both recording demand increases, while Lufthansa and Air France KLM saw demand drop.

Possibly the most surprising performance of the four carriers in January came from Finnair, which recorded a double-digit demand increase of 17.4% on last year to 64.5m revenue tonne km (RTK).

It is the first time since August 2014 that the carrier has managed to record a year-on-year demand increase.

Data source: companies. Graphic source: Air Cargo News

When asked by Air Cargo News how it had managed the increase, the carrier said there was no particular reason for the increase, just better demand, especially on Japanese and Korean routes.

It should also be noted that January 2015 was the first full month that the airline was without its Helsinki-Hong Kong freighter operation, which it decided to scrap as it expands belly capacity with the delivery of A350 XWB aircraft, increasing cargo capacity by 50% by 2020.

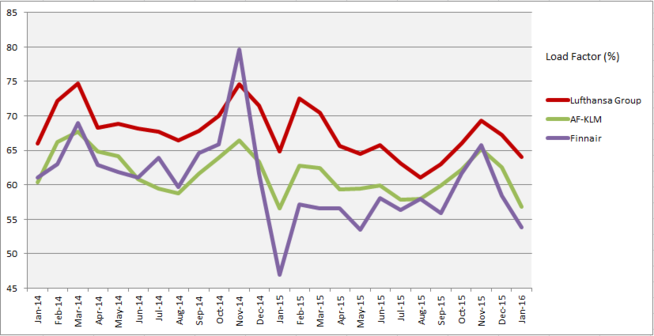

In terms of capacity, the airline recorded a 2.5% increase and as a result of demand increasing ahead of supply, its load factor for the month jumped from 46.9% in 2015 to 53.8%.

Finnair was not the only carrier to start the year positively; the IAG Group, which includes Iberia, British Airways and Aer Lingus, saw January cargo demand increase by 3.7% year on year to 422 cargo tonne km (CTK).

The increase was partly down to the addition of Aer Lingus’ cargo volumes – IAG did not own the airline this time last year – but also because of the 12.3% increase in CTK recorded by Iberia.

British Airways saw cargo demand decline by 1.2% for the month.

For Lufthansa, which now no longer reports Lufthansa Cargo figures separately, it was a difficult start to the year as Air Cargo News figures show it registered a 2% drop to 699m revenue cargo tonne km (RCTK).

It is the ninth month in a row that the German airline group has recorded a decline in cargo demand and comes as it removes two of its MD-11 freighters from service in response to the current market conditions.

A freighter service between South America and Frankfurt, which was popular with flower shippers, is also being axed for commercial reasons.

In terms of cargo capacity, there was a 0.7% drop and as a result load factors were down to 64% from 64.8% last year.

The demand situation was also tough at Air France KLM, where there was a 6.5% decline in cargo traffic to 667m RTK.

However, moves to reduce cargo capacity, down by 6.8% year on year, helped offset the decline in demand and it actually managed to record an increase in its load factor to 56.8% from 56.6% a year earlier.

This decline in capacity is reflective a reduction in total capacity at the airline group of 0.4%, while it has also been withdrawing freighter tonnage.

Data source: companies. Graphic source: Air Cargo News