American cargo carriers monthly: Demand improvements for American and United

17 / 05 / 2016

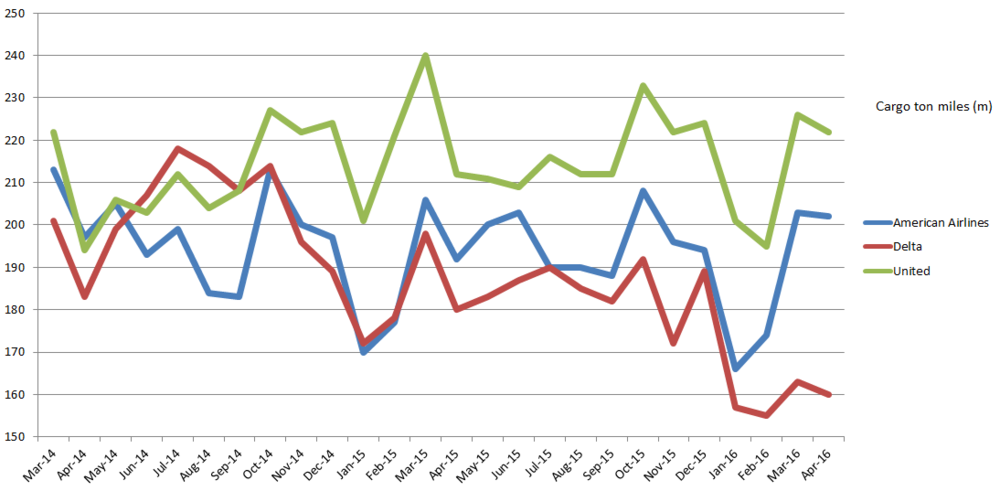

US air cargo carriers recorded signs of improvement in April as American Airlines and United Airlines both saw cargo volumes return to growth.

The increase registered by American and United is the first time since September last year that two of the three big American cargo carriers have registered a year-on-year jump in demand.

United Airlines saw April demand increase by 4.5% year on year to 222m cargo revenue ton miles. The increase was the first registered by the airline since October.

This year, volume comparison up until April have been affected by the one-off boost gained during the first quarter of last year as a result of industrial action at US west coast container ports.

The 4.5% jump is roughly in line with the airline’s performance last year when it achieved a 5.2% cargo volume increase for the full year.

American Airlines increased its cargo volumes for April by 5.5% compared with the previous year to 202m cargo ton miles.

It is the first time since September last year the airline has registered an increase in demand against a year earlier. The increase was even enough to push year-to-date cargo volumes ahead of 2015 levels.

The increase in demand echoes the performance of European rivals, which also had a positive April.

It wasn’t all good news for North American carriers in April as Delta Air Lines continued its difficult run of form with another double-digit demand decrease.

The airline’s cargo volumes have been tracking well behind its rivals for a number of months now and April is the third double-digit decline registered in 2016.

This time, demand dropped by 10.7% on the previous year to 160m cargo ton miles. The last time the airline managed to record an increase was February in 2015 when it likely received a boost from the US west coast situation.

The airline has said its cargo demand declines are related to the deployment of new tonnage. The airline also this week announced it would slow capacity increases as a result of weakening indicators for the passenger business.

Domestic capacity will only be increased by 2.5% during the fourth quarter of the year while international capacity will be flat, or even cut, in the second half of 2016.

It will also defer the delivery of four widebody aircraft from 2018 to either 2019 or 2020.

On a brighter note for Delta, all three of the American airlines saw less of a drop of in demand between the peak month of March and April compared with previous years.

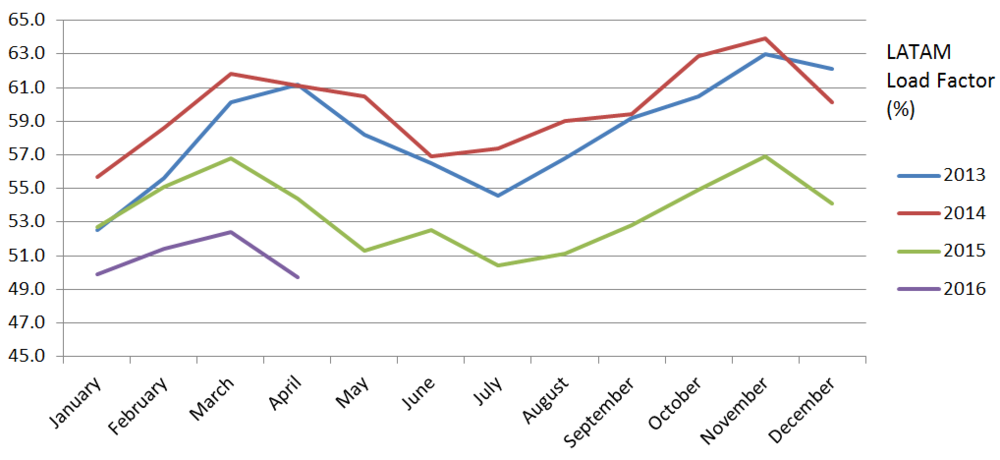

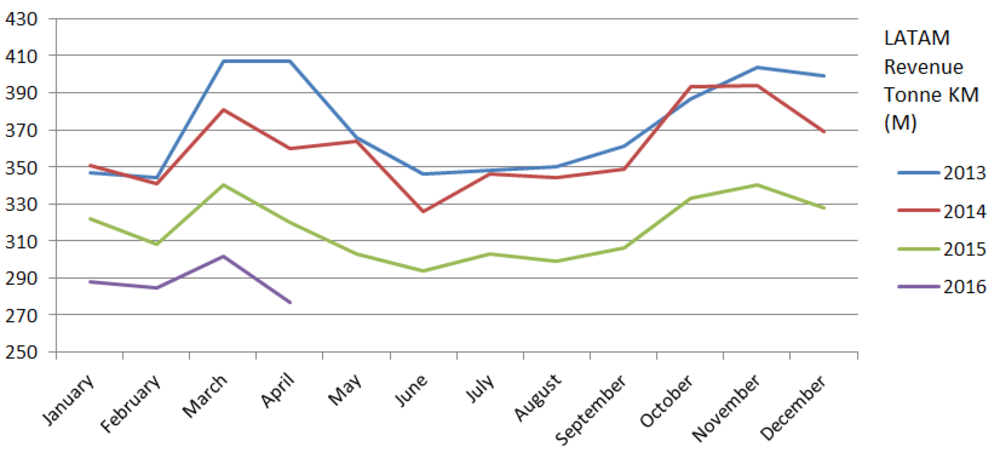

For the Latam Group April was another tough month as its cargo load factor dropped to its lowest level since Air Cargo News records begin in 2012.

The airline saw demand slide by 13.9% year on year to 277m cargo tonne km. It has been adjusting capacity, with freighters taken out of service, but this was not enough to stop its cargo load factor slipping to 49.7% compared with 54.5% a year earlier.