DSV’s takeover of UTi to create world’s eighth largest air forwarder

09 / 10 / 2015

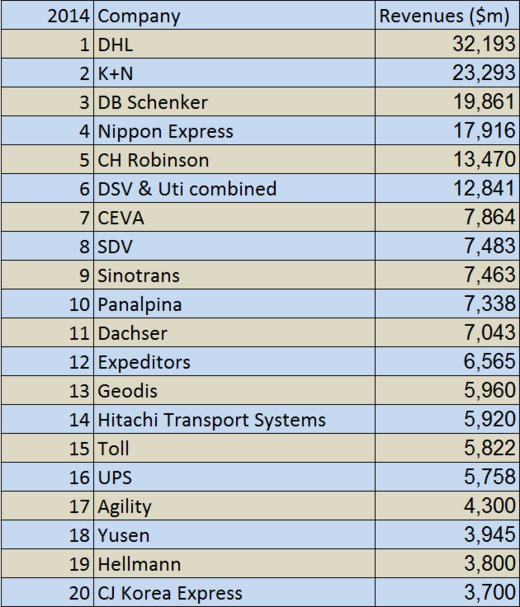

DSV’s takeover of UTi is set to push the Danish firm into the world’s top ten airfreight forwarders from its current position just inside the top 20.

Based on 2014 volumes from consultancy Armstrong & Associates, the takeover will see DSV’s airfreight volumes increase to 655,662 metric tons from 287,662.

This would make it the world’s eighth largest airfreight forwarder (see table below), up from its current position of seventeenth.

In terms of revenues, the proposed deal would see DSV maintain its sixth position but the increase in revenues to $12.8bn would drastically close the gap to fifth placed CH Robinson.

UTi’s 2015 fiscal year airfreight revenues of $1.2bn, represent 29.8% of total revenues and are its largest service line. For DSV, its airfreight revenues represent around 17% of its total, with road its largest service line.

Speaking on a conference call shortly after the $1.35bn takeover bid was announced, DSV said it expected to be able to improve UTi’s profitability to bring it in line with its levels.

It was asked this question in light of UTi’s profitability over the last few years. In its 2015 fiscal year ended January 31, the forwarder made an operating loss of $116m.

However, DSV said it believed the issues were related to the size of its network compared with its volumes. By combining the volumes of the two forwarders, profitability would be improved.

DSV said that the two companies had a similar mix of customer types — largely in the small and medium enterprise sector.

It didn’t anticipate any problems with the integration as it has plenty of takeover experience, having taken over large players such as ABX and Frans Maas in the past.

Its priority, if the takeover goes ahead, would be to “keep the good people on board” and “keep a good dialogue with customers during the transitional stage so they know they can rely on us”.

With regards to branding, it said it was too early to say whether it would keep the UTi name.

Late last year, DSV was involved in failed talks to take a strategic stake in UTi.

Analyst Transport Intelligence (Ti) said the deal was “hardly a surprise”.

“The conversations last year between the two appear to have foundered on the price DSV was willing to pay for UTi,” it said.

“However since then the value of the equity of the Californian based forwarder has crashed from over $10 to under $5. The implications were obvious.”

DSV will acquire UTi at the price of $7.10 in cash per ordinary share. The total transaction implies an enterprise value of approximately $1.35bn.

Ti doesn’t expect UTi shareholders to reject the deal with the offer price around 50% higher than UTi’s shareprice at close of play on October 8.

Ti chief executive John Manners-Bell said: “DSV has transformed itself into one of the leading truly worldwide and diversified logistics service providers.

“Although it will have to work hard to refashion UTi’s various businesses, if it gets it right it will lay the foundations for substantial growth on a global scale. The purchase is a risk but a modest and calculated one.”

DSV will use equity financing, in the level of DKr5bn during the next twelve months, to “maintain a prudent capital structure”.

The transaction is conditional on receipt of the relevant regulatory approvals and other customary closing conditions. Closing is expected in first quarter 2016.

The move will see DSV expand in contract logistics and road freight activities outside Europe.

The combined companies will also have a more balanced geographical footprint with approximately 61% of revenue in Europe, Middle East and North Africa, 17% in Americas, 16% in Asia (APAC) and 6% in Sub-Saharan Africa.

Data source: Armstrong & Associates. Graphic source: Air Cargo News

Data source: Armstrong & Associates. Graphic source: Air Cargo News