1983-1992: A decade of M&A

02 / 08 / 2023

As part of efforts to celebrate 40 years of Air Cargo News, the editorial team set themselves the unenviable task of reviewing the biggest stories over the past four decades. To begin, 1983-1992.

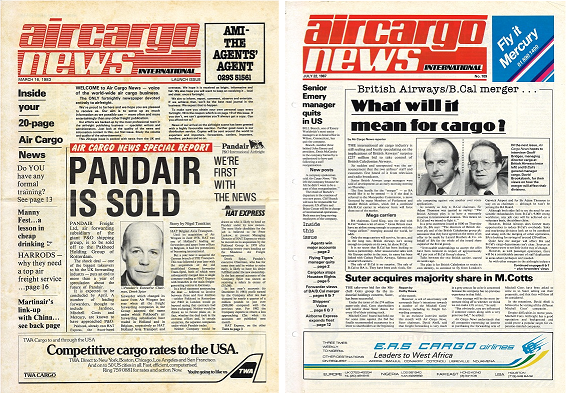

March 16, 1983 saw the launch of a new title covering the airfreight industry – the fortnightly Air Cargo News International (ACNI). The front page contained a major scoop for the fledgling publication – “Pandair is sold” read the main headline.

The publication’s editorial director, Nigel Tomkins, reported that the UK’s largest airfreight forwarder, Pandair, was about to be bought by the Pakhoed Holding Group of

Rotterdam, where it would be combined with the Dutch firm’s existing HAT Express forwarding business.

The “shock deal” put an end to more than a

year of speculation about the P&O-owned freight forwarder’s future, Tomkins wrote.

Elsewhere in 1983, European airlines were concerned about the intentions of US express giant FedEx, which began eyeing operations across the Atlantic.

‘FedEx threat to Euro freight’ read the front‑page headline on November 23.

The story stated that FedEx was in the process of deciding where it would set up its European hub – it eventually selected Brussels – and was also looking to buy a company to gain a foothold, in the end choosing US courier firm Gelco, which had an established European network.

Elsewhere, computers were making an early impact on the air cargo industry, although there was some trepidation and the high cost of implementation meant they were limited to the larger players.

And top US freighter operator Flying Tigers almost stopped its European operations before a transatlantic boom helped save its flights to Europe and the UK.

1984

The boom that saved Flying Tigers’ transatlantic operations was one of the main ongoing stories in 1984.

A February 4 ACNI cover reported “Air cargo boom will continue” as the airfreight business was heading back to the

pre-recession times of the 1970s.

This was at the start of the year. By the November peak season – helped by a weak pound fuelling US demand – services on the transatlantic route were “Booked solid”.

Trucks were being turned away from handlers and forwarders were facing weeks of delays. One airline was even reported to

have closed its doors for two days to manage demand. Elsewhere, ACNI reported that UPS – like FedEx – was also considering setting up European operations.

At the time, it was not clear whether the express firm would look to partner with an

existing operator or add its own flights.

Computers were again in the headlines in 1984 as the Cargonaught computer system was launched at Schiphol Airport, promising paperless cargo… if only they knew.

The year also saw the launch of the Cargo Airline of the Year Awards, now part of the Air Cargo News Awards, with the first winner of the prestigious competition being British Airways Cargo.

1985

The expansion of the express operators again made the headlines in 1985, with DHL stealing a march on FedEx by setting up operations in Brussels.

However, in June came the big news everyone had been waiting for: FedEx’s first flight across the Atlantic.

One of the express firm’s Boeing 727 freighters touched down at Brussels on a routing from New York JFK, which included stops in Gander Newfoundland and Stansted, marking the start of European operations.

Reports of UPS’s plans to start up a European operation also continued in October when it was announced that the express firm would take pre-booked space on Trans World Airlines and Lufthansa flights.

The cargo boom on the transatlantic route continued in 1985, eventually fuelling shipper complaints over the high cost of shipping cargo on the trade lane, with carriers reportedly forcing customers to pay for express services.

However, signs that the boom could be coming to an end were also there. In March, the publication reported a capacity surge on the route and by May there were reports that rates were set to tumble.

Security was also a topic, after a series of terrorist plots targeting the aviation market that led to expectations of new screening regulations for cargo. The big question posed by ACNI was who should pay for the new requirements.

1986

1986 marked the start of a testing time for the industry, with several big names going under and some game-changing acquisitions.

To kick off the year, UK freighter operator Tradewinds looked set to go under when parent company Lonrho withdrew funds.

The airline was eventually bought out but spent the next few years on the brink before eventually disappearing from the market.

The ongoing expansion of the express operators continued in 1986, with UPS investing $4bn in freighters. Later, ACNI carried the front-page headline: “INVASION – US parcels giant set to blitz Europe”.

UPS had just added seven new service agents and there were rumours that the airline would soon launch its own transatlantic flights.

Elsewhere, McGregor Sea and Air Services (MSAS) acquired rival Jardine in a move that created the world’s fifth-largest airfreight forwarder. The acquisition also created the UK’s largest cargo agent.

North Atlantic airfreight rates also tumbled during the year, putting airlines under pressure.

At the end of the year Flying Tigers – the world’s largest freighter operator – looked to be in trouble as it found itself $500m in the red and was set to be put up for sale unless costs – in particular, for pilots – could be reduced.

1987

There was an update on top freighter operator Flying Tigers’ situation in January when it was announced that staff had agreed to pay cuts that would help push the airline back to profitability.

And in February, UPS finally launched its own flights to Europe, with four-times-a-week DC-8 flights between Louisville, Newark and Cologne.

Airfreight rates continued to come under pressure during the year. In May, the publication reported that dipping cargo yields were being fuelled by overcapacity and “irresponsible cargo space dumpers”.

The low prices were wreaking havoc with airline revenue targets for the year, according to one story.

In July came the news that British Airways would buy UK rival British Caledonian Airways in a surprise deal worth $237m as the airlines faced up to emerging global giants.

From a cargo perspective, there were expectations of some redundancies in roles that were duplicated.

Meanwhile, some forwarders welcomed the global network that the combined entity would be able to provide. Others were concerned about the impact on competition.

In September, freight forwarder Pandair was back on the front page when rumours began to emerge that US-based Air Express International (AEI) could be about to purchase the Dutch-owned business.

The $20m deal was confirmed in October. Pandair at the time was loss-making as it looked to expand in the US. AEI, however, was looking to expand its presence in Europe.

1988

The year started with the rumour that freighter operator/freight forwarder EmeryWorldwide could be about to go

under.

In April, news came of a mystery bid for the company, which had recently purchased Purolator Courier, and, in May, former FedEx chief Art Bass was believed to be trying to

raise capital to launch a takeover.

The takeover failed to materialise in 1988 but a report in July highlighted the financial issues faced by the firm following its costly takeover of Purolator.

Other top stories for the year, included news that DHL could soon start North Atlantic freighter operations. TNT acquired Air de Cologne, freight forwarder CF Airfreight launched its own freighter operations and UK freighter firm Tradewinds was once again in a fight for survival.

Towards the end of the year, UPS was reportedly aiming for global domination. The company announced it would open new hubs in Singapore and Hong Kong to complement its operations in Louisville and Cologne. The move extended UPS’ network to 40 countries.

1989

The big news of 1989 was the FedEx takeover of Flying Tigers. In January, news emerged that FedEx had placed an $880m bid for the world’s largest all-cargo airline.

Flying Tigers was fully integrated into FedEx by August and the famous cargo name disappeared from the market. The deal did raise some questions, with forwarders concerned about a long-term rival controlling the company that ships their freight.

One forwarding casualty of the deal was Instone Freight Forwarding, which found its contracts with Flying Tigers ripped up after the deal was completed.

The takeover of Flying Tigers was not the only large takeover deal announced in the year. In February, speculation emerged that Consolidated Freightways (CF) could be interested in a bid for troubled Emery.

The deal made sense: CF had a strong presence in the US but lacked an international network, something that Emery could provide.

The deal was confirmed in March, with CF paying a total of $230m for Emery – creating a combined entity with annual revenues of

$1.7bn.

Elsewhere in 1989, there were concerns that British Airways could be entering freight forwarding, and UK freighter operator Tradewinds was again close to going under.

There were also several reports of a rapidly emerging UK freight forwarder, Rockwood International Freight. The company had spent £30m in 12 months with the purchase of the Interfreight Group in West Germany, the Netherlands and the UK.

The company had also taken over Walford Meadows, Mercury Airfreight, BVS International and Dawson Royle & Willan.

1990

In 1990 Rockwood’s rapid growth through acquisitions came back to haunt it as the company took drastic measures to improve a badly stretched financial position, including slashing credit control by dropping customers across Europe.

The efforts were not enough and by July the company had gone into liquidation.

Emery, bought by Consolidated Freightways in 1989, continued to face financial difficulties and its new owners ordered the company to make cuts to return to profit.

The changes clearly worked, as the freight firm was heading toward profitability by the end of the year.

1990 also saw the end of the UK’s largest cargo airline, Tradewinds. After struggling to stay profitable over recent years, the company ceased trading at the end of September.

However, the biggest story of the year was the impact of the Gulf War when Iraq invaded Kuwait in August 1990.

The immediate impact of the war was a sudden rise in rates as the price of fuel rapidly increased. There were also surcharges introduced for flying in the Middle East region.

The Middle East crisis sent airline operating costs soaring and saw customers facing hefty ticket and cargo tariff increases, ACNI wrote on September 7.

Meanwhile, the gradual opening of the Soviet Union began to make waves in the cargo market as several joint ventures began to offer Soviet freighters.

Metro Cargo Airlines and NPC Informetika struck up a partnership to operate Il-76TD aircraft, while Air Foyle became the agent for Antonov’s AN-124s.

1991

The impact of the Gulf War continued in 1991 as airlines saw profits drop. Exacerbating the impact of the war, the world was facing an economic slowdown.

“The strain of the worldwide recession and the explosive increase in the price of jet fuel have driven the industry to the point of near paralysis,” said one industry commentator.

The war ended in late January and air cargo was on alert for a “Gulf cargo bonanza” driven by the need to rebuild in Kuwait.

Elsewhere in 1991, the introduction of Soviet aircraft to the West continued asHeavyLift Cargo Airlines formed a joint venture with Volga-Dnepr to offer AN-124 capacity.

ACNI also reported an uptick in trade between Western countries and those of the breakaway Soviet states.

The end of the year saw the collapse of Pan American World Airways, better known as PanAm – one of the world’s most recognisable brands. The company was the largest international airline in the world but its failure to establish a domestic US network and the high fuel prices caused by the Gulf War resulted in the

carrier running at a loss.

Meanwhile, US overnight cargo airline Flagship Express Services had also gone under by the end of the year.

1992

This year saw the industry settle back down after a tumultuous couple of years.

The big story from the opening month of the year was the grounding of the UK’s Anglo Cargo Airlines as the charter market came under pressure, suffering from a slump in demand in combination with overcapacity.

As well as Anglo Cargo Airlines, Ethiopia’s EAS Cargo Airlines also suffered from the market decline caused by a recession biting in several key markets.

In response, airlines had been looking to offload their freighters, with the Boeing 707 prime among those for sale.

The market downturn was not confined to charter carriers. Express operators were also suffering, and FedEx took the decision to park a large number of freighters in the desert while it waited for the market to pick up.

The operator even temporarily withdrew its European operations in favour of

using capacity on partner airlines’ aircraft.