Cargo the bright spot for airlines as revenues expected to soar

10 / 06 / 2020

Air cargo is expected to be the “bright spot” for airlines in 2020 as revenues are forecast to hit near-record levels, according to the latest IATA market outlook.

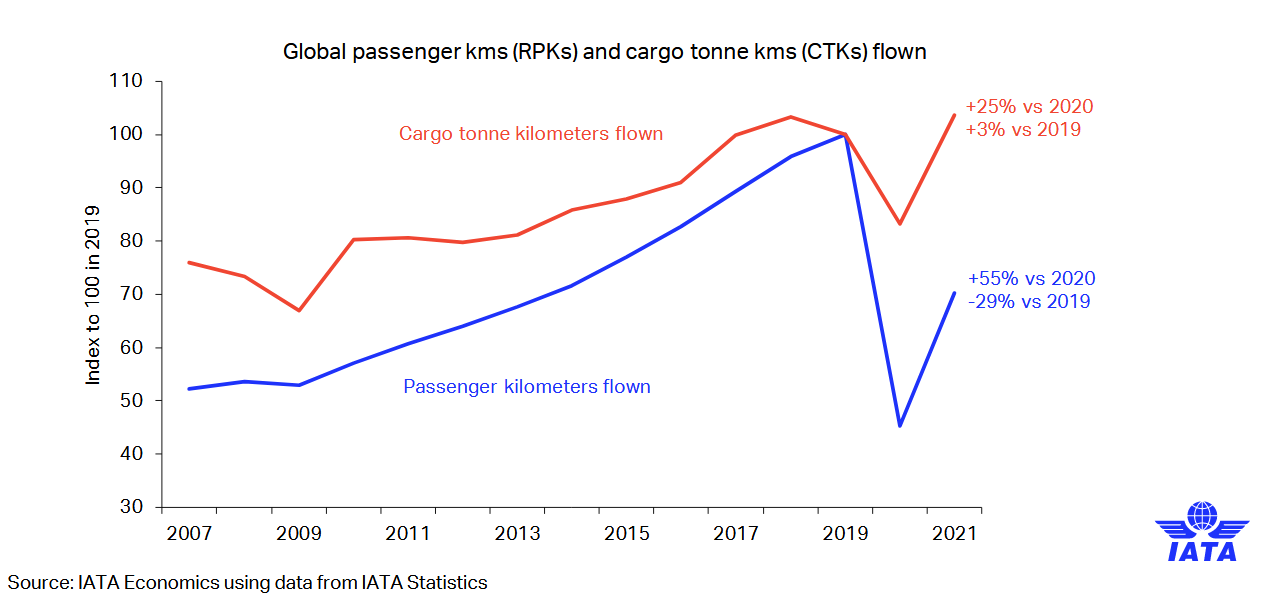

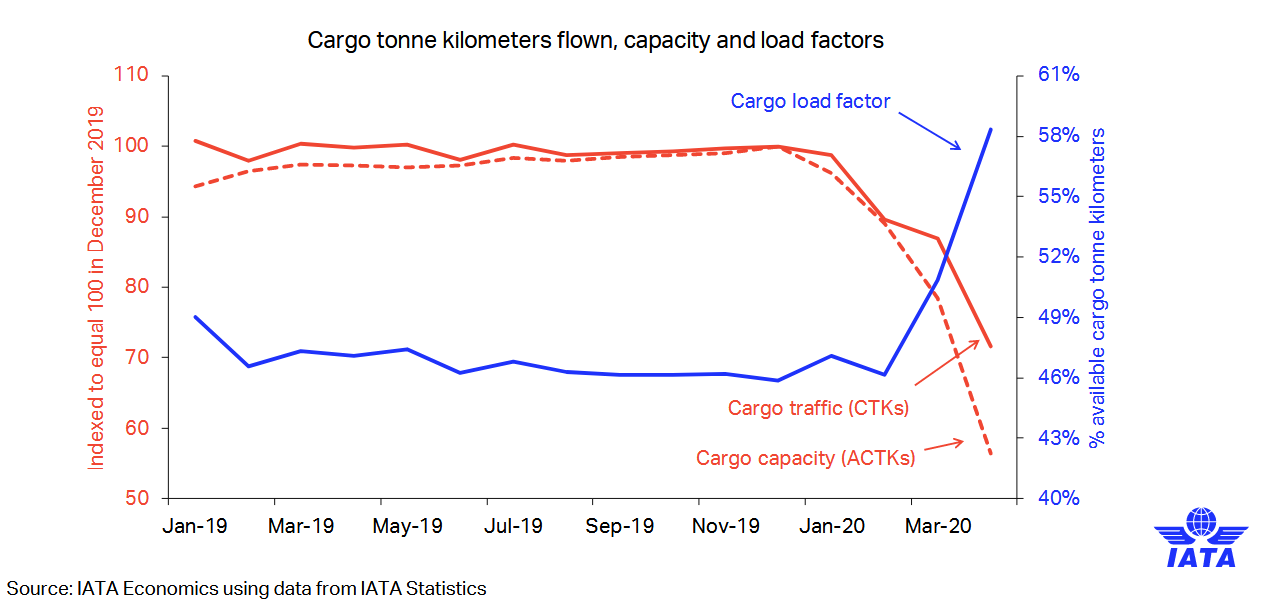

The airline association said that cargo volumes will decline by 16.8% this year to 51m tonnes, but a severe shortage in cargo capacity due to the unavailability of belly cargo on (grounded) passenger aircraft is expected to push rates up by some 30% for the year.

As a result, IATA predicts that cargo revenues will reach a near-record $110.8bn in 2020, up from $102.4bn in 2019. As a portion of industry revenues, cargo will contribute approximately 26%, up from 12% in 2019.

The overall picture for airlines remains bleak: airlines are expected to lose $84.3bn in 2020 for a net profit margin of -20.1%.

Revenues will fall 50% to $419bn from $838bn in 2019. In 2021, losses are expected to be cut to $15.8bn as revenues rise to $598bn.

The loss for this year, which surpasses the $30bn loss made during the financial crisis in 2008 and 2009, confirms the extent of losses suffered by airlines during the crisis and brings a 10-year run of profits to an end. In December, IATA had projected industry profits could reach almost $30bn this year.

The $84.3bn loss virtually wipes out the $91.3 billion net profits the industry posted over the past three years.

Airlines in all regions will suffer. IATA estimates net losses will represent negative margins of between 15-30% of revenues across the different regions in 2020.

While IATA expects a sharp improvement in passenger demand in 2021, albeit still below 2019 levels, a tough cost and yield environment will keep airlines in the red.

Detailing the latest outlook, IATA chief economist Brian Pearce explained: “In this particular forecast we have taken a view that Covid-19 will steadily be contained, so we have not built in a second wave of Covid-19.

“We are basing it on a phased opening of markets, but have been rather cautious on the return of business travel and passenger confidence, and have built in the impact of the recession, which will damage the ability of people to travel.

“We are still expecting to see a significant rise of revenues in 2021, that will allow airlines to substantially reduce their losses, but we wouldn’t expect to see those losses eliminated in 2021. We are still expecting net losses of $15.8 billion.”

He added: “That is a similar pattern to the one we saw in the global financial crisis in 2008 and 2009. Obviously much larger, but if you look back at that period, the depth of the crisis, followed by a better performance but still a loss, before a recovery in the subsequent years.

“We haven’t put out a forecast beyond 2021. If you follow the trend, 2022 looks like it could be a year for a return to profit and certainly that would be in line with our longer-term forecasts in growth in passenger markets.”