Air cargo boosts K+N in 2020

03 / 03 / 2021

Kuehne+Nagel’s (K+N) airfreight business registered improvements in profits and revenues last year, while the overall business reported declines.

K+N said that 2020 was characterised by a weak first and a strong second semester.

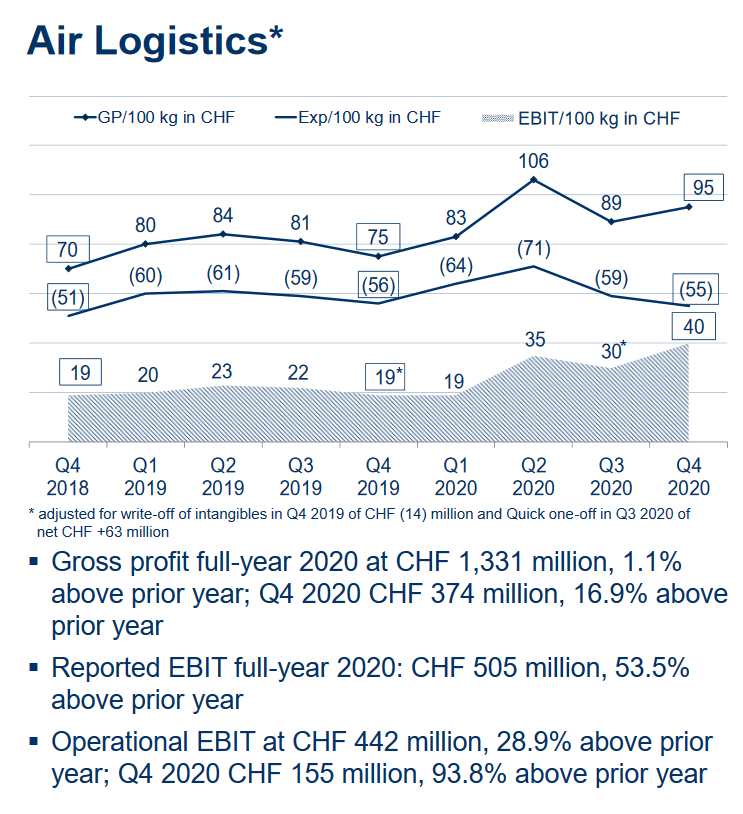

The forwarder’s airfreight business saw revenues for the year increase by 11.6% year on year to SFr5.2bn, gross profits improved by 1.1% on 2019 to SFr1.3bn and earnings before interest and tax (ebit) was up by 53.5% to Sfr505m (see tables at end of article).

Ebit figures benefited from a one-off gain of SFr63m in relation to the purchase of Quick International and a SFr14m write off of intangibles in 2019.

Meanwhile, airfreight volumes for the year declined by 12.8% to 1.4m tons.

The improvement in profits and revenues despite a decline in volumes comes as airfreight rates increased rapidly last year due to the loss of bellyhold capacity.

“Air Logistics has proven to be the preferred transport solution in dealing with the Covid-19 crisis,” the forwarder said. “The high demand for Kuehne+Nagel’s expertise in pharma and essential goods led to excellent results.”

So far, DSV is the only other top-five forwarder to have reported results, but its figures were distorted by the purchase of Panalpina.

DSV’s airfreight division saw revenues in 2020 increase by 64.9% year on year to Dkk44.8bn, gross profits per ton reached Dkk8,075 against Dkk6,155 in 2019 and volumes increased by 18.8% to 1.3m tons.

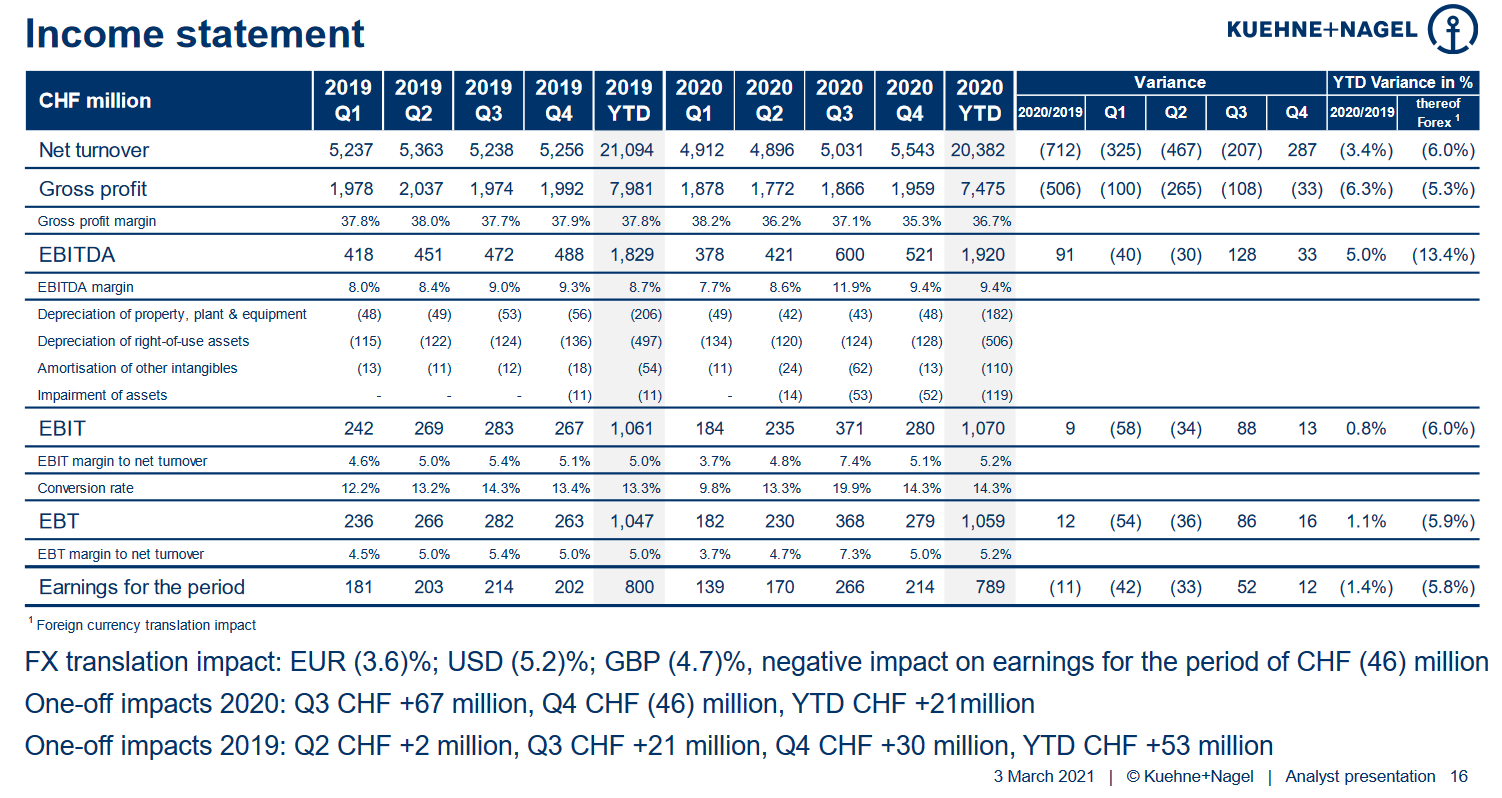

Overall, K+N saw 2020 revenues decline by 3.4% year on year to SFr20.4bn, ebit was up 0.8% to SFr1bn and earnings were down 1.4% to SFr789m.

The revenue and earnings decline comes as its sea, road and contract logistics divisions all reported declines in those metrics.

“K+N achieved a remarkably good result in an environment marked by crisis,” it said. “Operational profit was above the previous year; total reported net earnings of the year decreased only slightly compared to 2019.”

Detlef Trefzger, chief executive, K+N International AG, said: “Last year we proved what makes Kuehne+Nagel successful: within a very short period of time, we adapted to the volatile market environment. We won new business and at the same time were able to position ourselves as a reliable and responsible partner for our customers and suppliers.”

Looking forward, the company recently announced the planned purchase of Apex Logistics, a deal which will make it the largest airfreight forwarder.

Apex generates yearly turnover in excess of $2.3bn and in 2020, the company handled total airfreight volume of approximately 750,000 tons and sea freight volume of 190,000 20ft container equivalent units (TEU).