What would a combined DB Schenker and DHL mean for airfreight volumes?

22 / 12 / 2022

Credit: tratong/ Shutterstock

Last week Deutsche Bahn assigned its management board to examine and prepare the case for a potential sale of up to 100% of its shares in DB Schenker.

Speculation immediately turned to who could be a potential buyer for the forwarding unit if state-owned Deutsche Bahn does decide to pursue a sale.

According to Germany’s Manager Magazin, one company that has emerged as a potential buyer is Deutsche Post (DP) DHL.

The report suggests that the German postal, logistics and express giant could look to make a move before a rival such as DSV or Maersk reaches out.

Air Cargo News contacted Deutsche Post DHL to comment on the reports, but the company declined to comment on speculation.

But what would a combination of the two companies look like – in terms of buying power – for the airfreight market?

The quick answer is that a combination of the two entities would create a behemoth.

Up until 2020, DHL Global Forwarding had been ranked as the world’s largest airfreight forwarder while DB Schenker had been ranked third.

Both slipped down the list last year as fast-growing Danish forwarder DSV moved up into third spot and Kuehne+Nagel (K+N) managed to take the top spot as both companies grew through acquisitions.

But the Denmark- and Switzerland-based companies would be dwarfed by a combined DHL/DB Schenker.

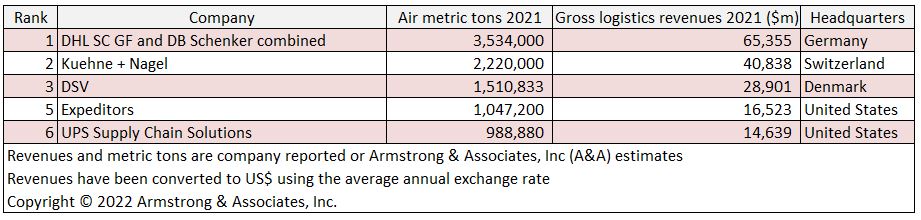

Based on the 2021 figures, a combined DHL and DB Schenker would become the world’s largest airfreight forwarder with volumes of 3.5m tonnes compared with K+N’s 2.2m tonnes.

This is of course only an indicator as there is no doubt that the combination of the two companies would see them lose some customers for various reasons, while it also does not take into account this year’s performance, but it gives an idea as to the size of the combined entity.

DSV is also one of the potential candidates for takeover.

The Danish forwarder has grown rapidly in recent years through acquisitions and has in the past expressed an interest in DB Schenker should it be put up for sale.

Based on the 2021 figures, were DSV to buy DB Schenker, it would become the world’s largest airfreight forwarder, leapfrogging both K+N and DHL with annual volumes of around 2.5m tonnes.

Meanwhile, writing on LinkedIn, supply chain consultant Cathy Morrow Roberson said that she was leaning towards a break up of DB Schenker as the most likely outcome if it is put up for sale by Deutsche Bahn.

However, she also said that Geodis could be interesting to watch as a potential buyer, while the cash-rich ocean carriers have been looking to expand their presence in logistics over the last couple of years.

Maersk is a good example here. The shipping giant has been investing in forwarding over recent years – this year it purchased Germany’s Senator – and has started up its own airline as it looks to expand beyond only ocean shipping.

Maersk completes $644m Senator acquisition as it looks to air cargo