Air cargo demand growth reaches six year high

03 / 05 / 2017

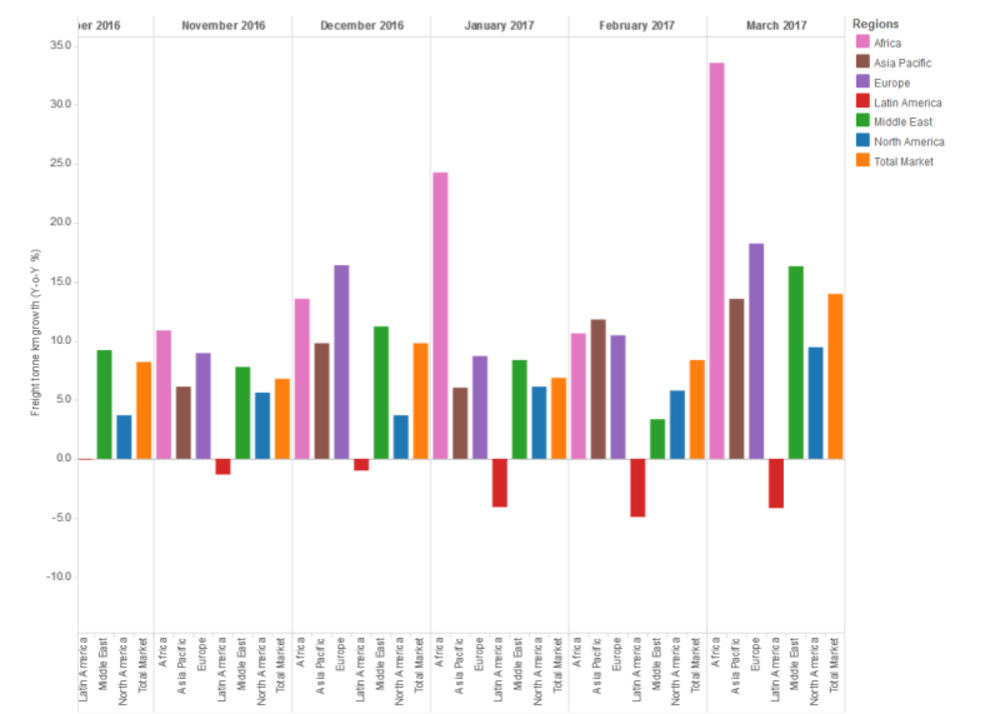

Air cargo traffic grew at its fastest rate since late 2010 in March as the industry continues to benefit from an uptick in world trade and export orders.

The latest figures from airline body IATA show that in freight tonne km terms traffic increased by 14% year on year in March, which is the fastest pace of growth recorded since October 2010, a recession bounce-back year.

Yesterday, figures released by analyst WorldACD showed that volumes increased by 14.6% year on year in March.

Airlines based in Europe and Asia Pacific accounted for two thirds of the improvement in freight volumes with the remainder split evenly between North American and Middle Eastern carriers.

Click on chart below to view interactive version

During the first quarter, and adjusting for the 2016 leap year, demand improved by 11%.

IATA said the pick-up in airfreight since the middle of last year has coincided with a broader improvement in world trade conditions.

IATA pointed out that business surveys continue to indicate healthy export order books for global manufacturers, while the new export orders component of the global purchasing managers’ index remains close to a six-year high.

The organisation did warn that export orders looked like they may slow towards the end of the year, but added that the increasing importance of niche areas such as pharmaceuticals and cross-border e-commerce may help the industry to de-couple from wider world conditions.

IATA director general and chief executive Alexandre de Juniac said: “March capped a robust first quarter with the strongest year-on-year airfreight growth in six-and-a-half years.

“Optimism is returning to the industry as the business stabilizes after many years in the doldrums.

“There is, however, still much lost ground to recover while facing the dual headwinds of rising fuel and labour costs.

“It remains critical to use the improvement in the industry’s fortunes as an opportunity to enhance the value offering by implementing modern customer-centric initiatives that streamline processes and reduce costs."

While traffic increased at double digit levels in March, capacity was up by the lower amount of 4.2% and as a result total market load factors reached 47.4% compared with 43.5% last year.

Looking at how the various regions performed, Asia-Pacific airlines’ freight volumes expanded 13.6% in March 2017 and capacity increased by 4.8%.

Demand has strengthened considerably on all key routes to and from Asia over the last six months with the exception of Asia to North America, IATA said.

North American carriers posted an increase in freight volumes of 9.5% during the month and increased capacity by 2.8%. The further strengthening of the US dollar continues to boost the inbound freight market but is keeping the export market under pressure.

European airlines saw demand improve by 18.2% during the month as the ongoing weakness of the euro persists in boosting the performance of the European freight market, which has benefitted from strong export orders over the last few months.

Middle Eastern carriers’ year-on-year freight volumes increased 16.3% in March 2017 and capacity increased 2.7%.

The year-on-year growth rate has recovered after having moderated in late-2015 and is now back in line with the long-run average, IATA said.

Latin American airlines experienced a contraction in demand of 4.2% in March 2017 compared to the same period in 2016 and capacity decreased by 1.9%.

“Demand is now 18% lower than at the peak in 2014. The region’s carriers have managed to adjust capacity, which has limited the negative impact on the load factor.”

African carriers’ posted the largest year-on-year increase in demand of all regions with freight volumes growing 33.5%. "Capacity increased by 6.3% over the same time. Demand has been boosted by very strong growth on the trade lanes to and from Asia following an increase in direct services between the continents," said IATA.