Air cargo eyes a year of uncertainty and opportunity

03 / 01 / 2024

Photo: Travel mania/ Shutterstock

Geopolitical uncertainty and unpredictability could fuel demand for air cargo as shippers move to benefit from the stability of services.

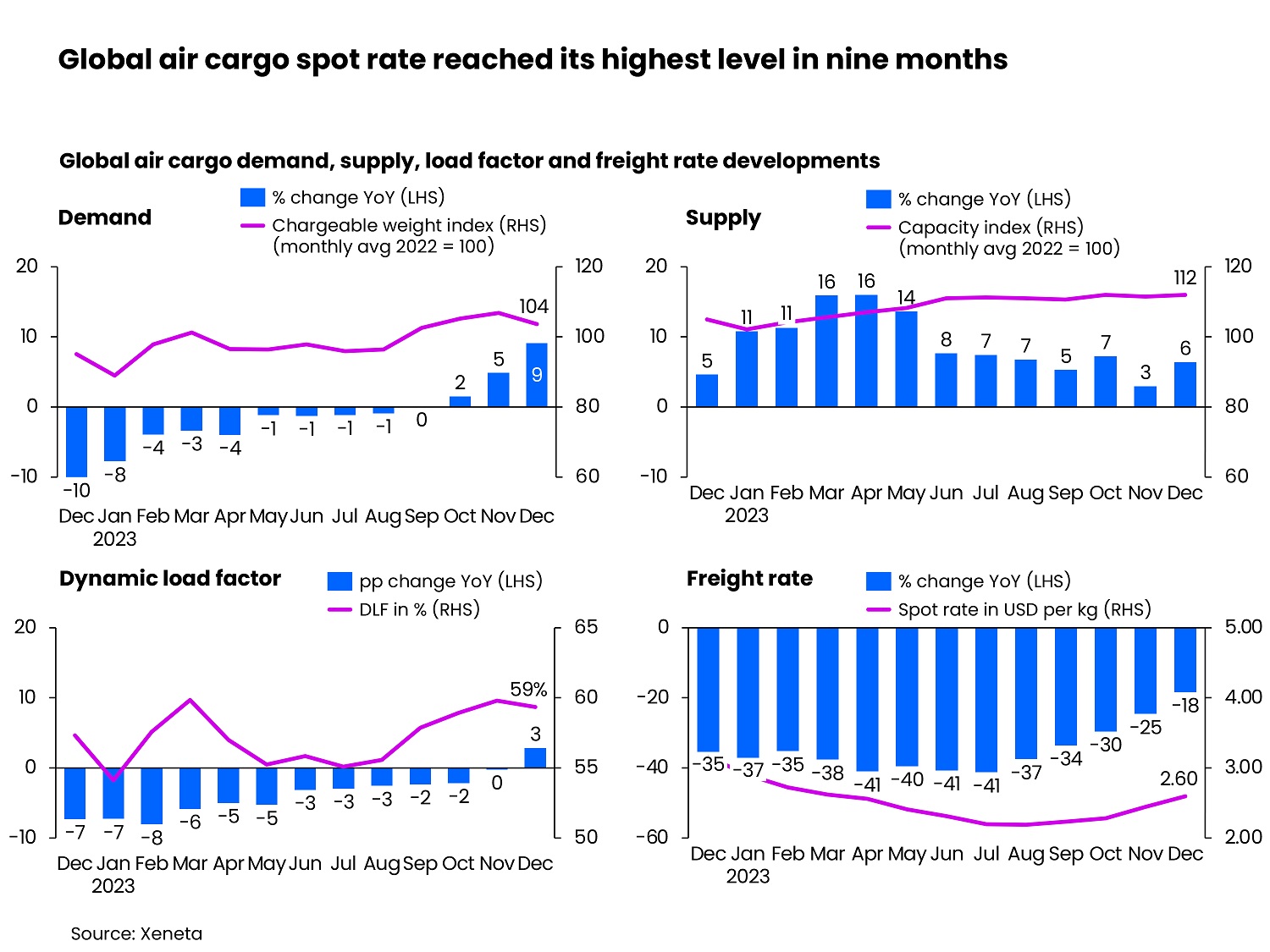

Figures from data provider Xeneta show that air cargo demand increased by 9% year on year in December – although this is partly a reflection of a weak end to 2022 – while spot rates reached their highest level in nine months of $2.60 per kg and the dynamic load factor increased by 3% to reach 59%.

And Xeneta chief airfreight officer Niall van de Wouw said this could mark the start of a new cycle for air cargo, with shippers likely to appreciate stability returning to the market allowing them to “more accurately predict the transportation costs for the products they are selling”.

He pointed out the ocean freight market is facing disruption due to attacks in the Red Sea.

Van de Wouw said: “There’s still a lot of friction in the global supply chain market and that means there will be opportunities for some sectors. If big ocean carriers are not going through the Red Sea, it might delay a million or more containers, with all the knock-on effects.

“And the fact that you don’t know how long this situation will continue means some shippers will pay for the predictability of air cargo to lessen the impact of the current ocean freight disruption.

“In contrast, air cargo seems to be in a more ‘steady state’. It is important for airlines and forwarders to focus on the elements they can control, such as cost and reliability, and to be ready for when the opportunities arrive.”

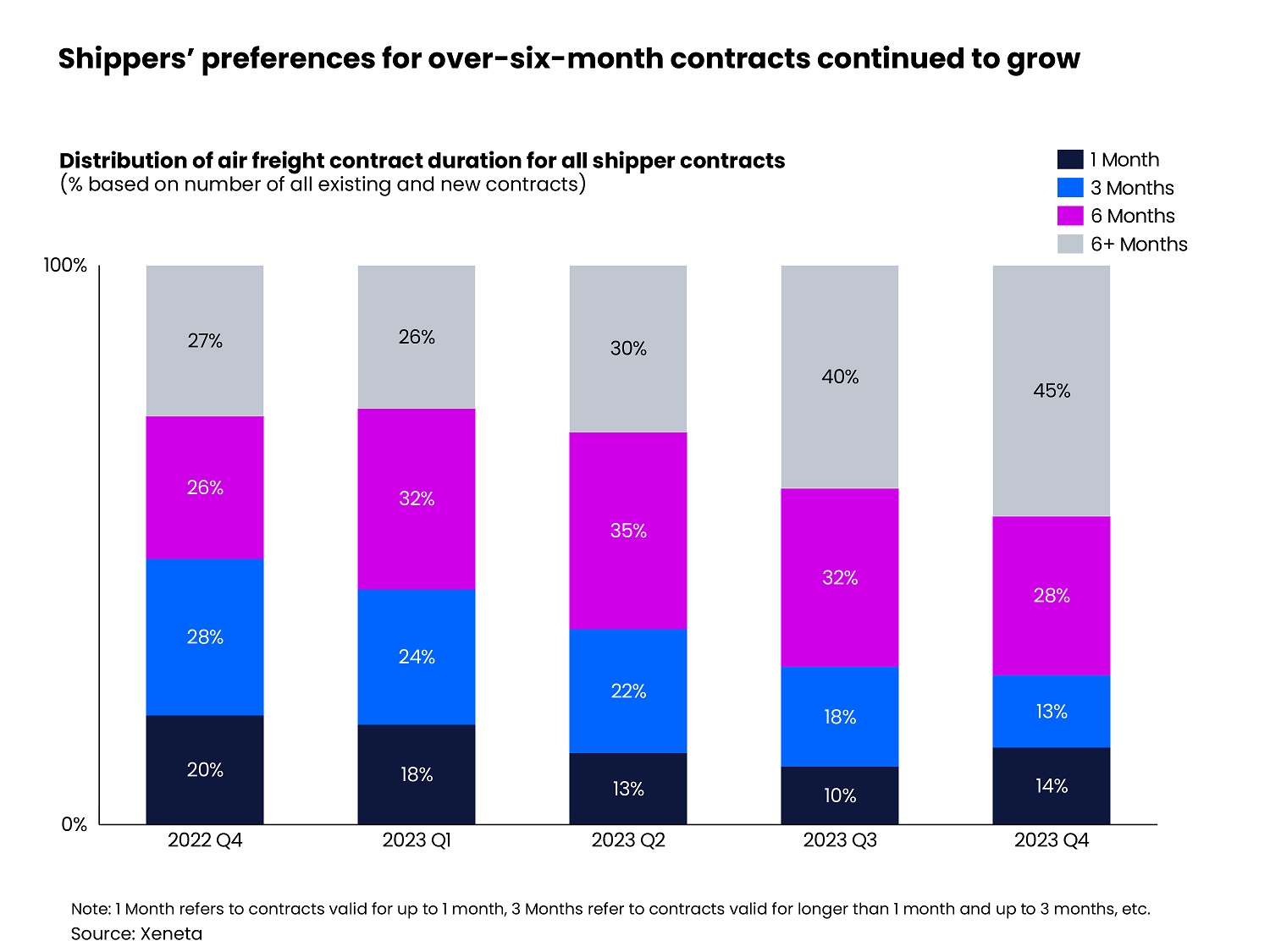

He added that the improved stability in air cargo was seeing shippers switch back to long-term, fixed-rate contracts.

In the last quarter of 2023, Xeneta figures show that contracts of more than six months accounted for 45% of total contracts signed, up by around five percentage points on the third quarter of the year.

Meanwhile, six-month contracts amounted to another 28% of the total market.

“This was in stark contrast to the pandemic era when most shippers had to manage rates valid for up-to-one-month only,” Xeneta reported. “By the fourth quarter, the share of up-to-one-month rates was only 14%.”

Analysing December’s data, Van de Wouw said that the market was slightly busier than expected but added that the industry shouldn’t be tempted to draw too many conclusions because the Christmas and New Year holidays make it an odd month.

“We also need to factor in that December 2022 provided a low comparison base given the very muted demand seen 12 months ago,” he said.

“This latest data appears to reflect stronger but temporary local market performance on key lanes as opposed to signalling a global economy that is doing much better.

“Our market outlook forecast for 2024 remains unchanged with an anticipated 1-2% growth in demand and a 2-4% rise in supply,” he said.

Regional rate performance

Xeneta figures show that the air cargo spot rates from Europe to the US stood at $2.42 per kg in December, up +21% month over month.

“The reduction in capacity helped to push up rates on this lane. Similarly, corresponding spot rates from China and Southeast Asia to Europe both rose 9% to $4.49 per kg and $2.91 per kg respectively.”

Meanwhile, strong e-commerce demand pushed the China to US air spot rate up 6% in December to $5.12 per kg.

“In line with this, the airfreight spot rate ex Southeast Asia to the US climbed 14% to $4.50 per kg as outbound Southeast Asia shipments tend to transit via other Asian countries before heading into the US.”

By the week ending 31 December, the China to US spot rate fell by a considerable 20% to $4.54 per kg from its peak three weeks earlier.