Air cargo in longest slump since global financial crisis

09 / 10 / 2019

Air cargo is now in its longest slump in demand since the global financial crisis in 2008.

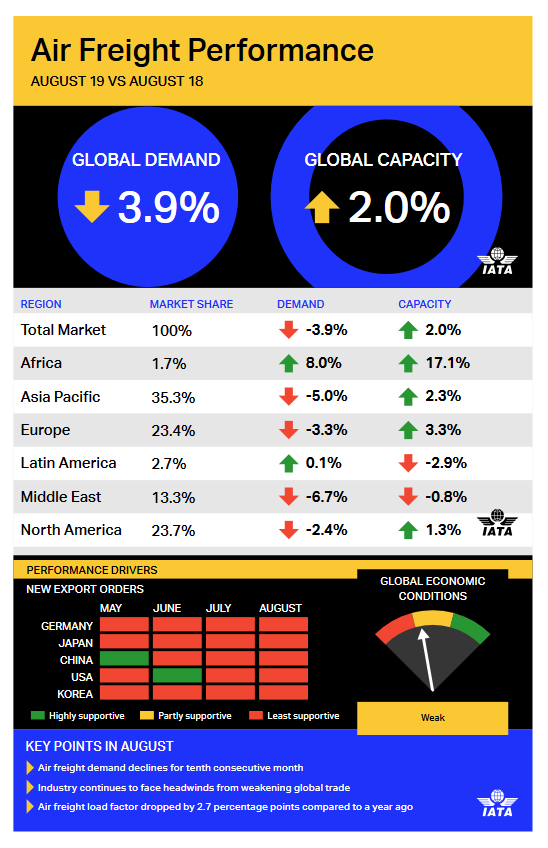

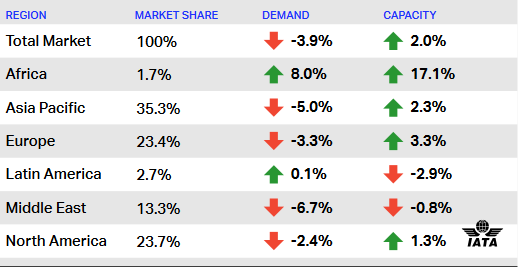

The latest figures from IATA show that demand in freight tonne km (FTK) terms declined by 3.9% year on year in August.

IATA director general and chief executive said the figures were “deeply concerning”.

“The impact of the US-China trade war on air freight volumes was the clearest yet in August,” he said.

“Not since the global financial crisis in 2008 has demand fallen for 10 consecutive months. This is deeply concerning.

“And with no signs of a détente on trade, we can expect the tough business environment for air cargo to continue.

“Trade generates prosperity. Trade wars don’t. That’s something governments should not forget.”

To compound the decline in demand, capacity in available FTK terms in August increased by 2% compared with a year ago and therefore cargo load factors slipped 2.7 percentage points to 44.6%.

IATA said that key economic indicators pointed to a continuation of the tough trading conditions.

“Global trade volumes are 1% lower than a year ago,” IATA said. “Trade in emerging countries has been underperforming that of advanced nations throughout most of 2019.

“This is due to higher sensitivity of the emerging economies to trade tensions, rising political instability and sharp currency depreciation in some of the key emerging markets.”

IATA pointed out that global export orders continue to fall – the global Purchasing Managers Index (PMI) remains in contraction territory and its tracking of new manufacturing export orders has pointed to falling orders since September 2018.

“And for the second month in a row, all major trading nations reported falling orders,” IATA added.

Looking at regional performance, it was once again carriers based in the Asia Pacific region that suffered as a result of the downturn.

The IATA stats show that Asia Pacific airlines saw airfreight demand contract by 5% year on year in August as a result of the trade war and “the slowdown in the Chinese economy”.

“The temporary shutdown of Hong Kong International Airport – the largest cargo hub in the world –added additional pressure,” IATA said. “With the region accounting for more than 35% of total FTKs, this performance is the major contributor to the weak industry-wide outcome.”

North American airlines saw demand decrease by 2.4% in August as they were also affected by the trade war as well as falling business confidence.

On routes between Asia and North America, seasonally adjusted volumes are down by almost 5% compared with last year.

European airlines posted a 3.3% drop in freight demand in August due to weaker manufacturing conditions for exporters in Germany, softer regional economies and ongoing uncertainty over the UK’s withdrawal from the European Union.

In the Middle East, airlines saw volumes decrease by 6.7%, which was the sharpest drop of any region.

“Escalating trade tensions, the slowing in global trade and airline restructuring have impacted the region’s performance since the fourth quarter of 2018,” IATA said.

Latin American carriers managed to buck the trend – just – and reported an increase in freight demand of 0.1% in August. This performance was behind that of recent months.

Low economic growth compounded by the US-China trade war and political instability in some countries have impacted the region’s performance. Recent currency volatility in the region’s key economies have also contributed, IATA said.

Finally, African carriers reported an 8% year-on-year increase in FTKs but capacity was up by the larger amount of 17.1% on a year ago.