Air cargo market improves in September

02 / 11 / 2015

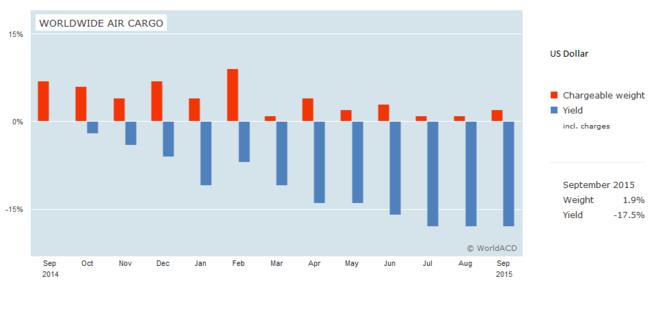

Air cargo traffic and yields continued to pick up in September following on from the general malaise experienced over the second quarter.

The latest data from analyst WorldACD show that volumes increased by 1.9% year on year in September while yields picked up by 0.4% on a month earlier.

This was the first month-on-month yield improvement since February.

“The origin Africa continued to lead with a volume growth of 4%, similar to this month’s growth for the origins Europe and Asia Pacific.

“The Gulf Area recorded a volume decline of 21%, heavily influenced by the shift in Eid al-Adha from October last year to September this year.”

Looking at what caused the growth, WorldACD said non-general cargo volumes increased by 7.8% in September compared with a year earlier.

“This increase was mainly caused by growth in the transport of dangerous goods (+12%), perishables and pharmaceuticals (both +9%),” the analyst said.

“In pharmaceuticals, Europe strengthened its dominant position (+11%), whilst in perishables, the traditional “powerhouses” Africa and Latin America lost some ground.

“However, in overall US dollar revenues for all product categories together, Africa and Latin America lost much less than the other areas.”

The analyst also drew some conclusion about how the year will be judged in terms of air cargo, suggesting each company would view 2015 differently because of currency influences.

It said that while volume growth would be seen “modest” at 2.7% year on year for the first three quarters, dollar yields had experienced their largest decrease in many years.

It said that at country level, Australia, Bangladesh and Vietnam stand out with a nine-month volume growth of more than 20% year on year, with Vietnam managing that growth with yields dropping very little.

“When expressing worldwide revenues in dollar or yuan, we see a considerable year-on-year decrease of 12% and 10% respectively.

“In a sharp contrast, the same revenues expressed in yen or euro show an increase of 4% and 8%.

“If nothing else, this difference reveals that it will not be easy to qualify the year 2015 as uniformly bad for air cargo. When it comes to individual companies’ results, factors other than worldwide averages come into play.

“Companies with a good balance between revenues and cost in specific currencies, will see their results influenced less by rates of exchange than companies not having such a fit. Thus, the 14% decrease in US dollar yields will not necessarily mean the same level of bad news for all airlines.”