Air cargo traffic, capacity and revenues continued to recover in Q4

11 / 01 / 2024

Source: Jaromir Chalabala/Shutterstock

Air cargo traffic, capacity and revenues continued to recover in late 2023. According to IATA, world air cargo traffic expanded 8.3% year-over-year, as measured in cargo tonne-kilometres (CTKs), in November 2023, the best month for industry traffic growth since December 2021.

After 17 months of consecutive decline, traffic tepidly began growing again in August 2023, and has grown every month since then, in no small part due to easy comparison with very weak numbers in the third and fourth quarter of 2022.

Early reports for December 2023 traffic also point to continuing market improvement. Whilst much of the recent traffic, capacity and yield numbers are heartening to air cargo capacity providers, the case for guarded or “cautious optimism” for year 2024 remains.

IATA data and anecdotal reports from airlines show that market strength is concentrated in the Asia Pacific and Middle East, both in terms of region of airline domicile and region-to-region international flows.

North America, and to a lesser extent European markets, are not seeing as much strength, which helps to explain the glum in market reports centric to those regions.

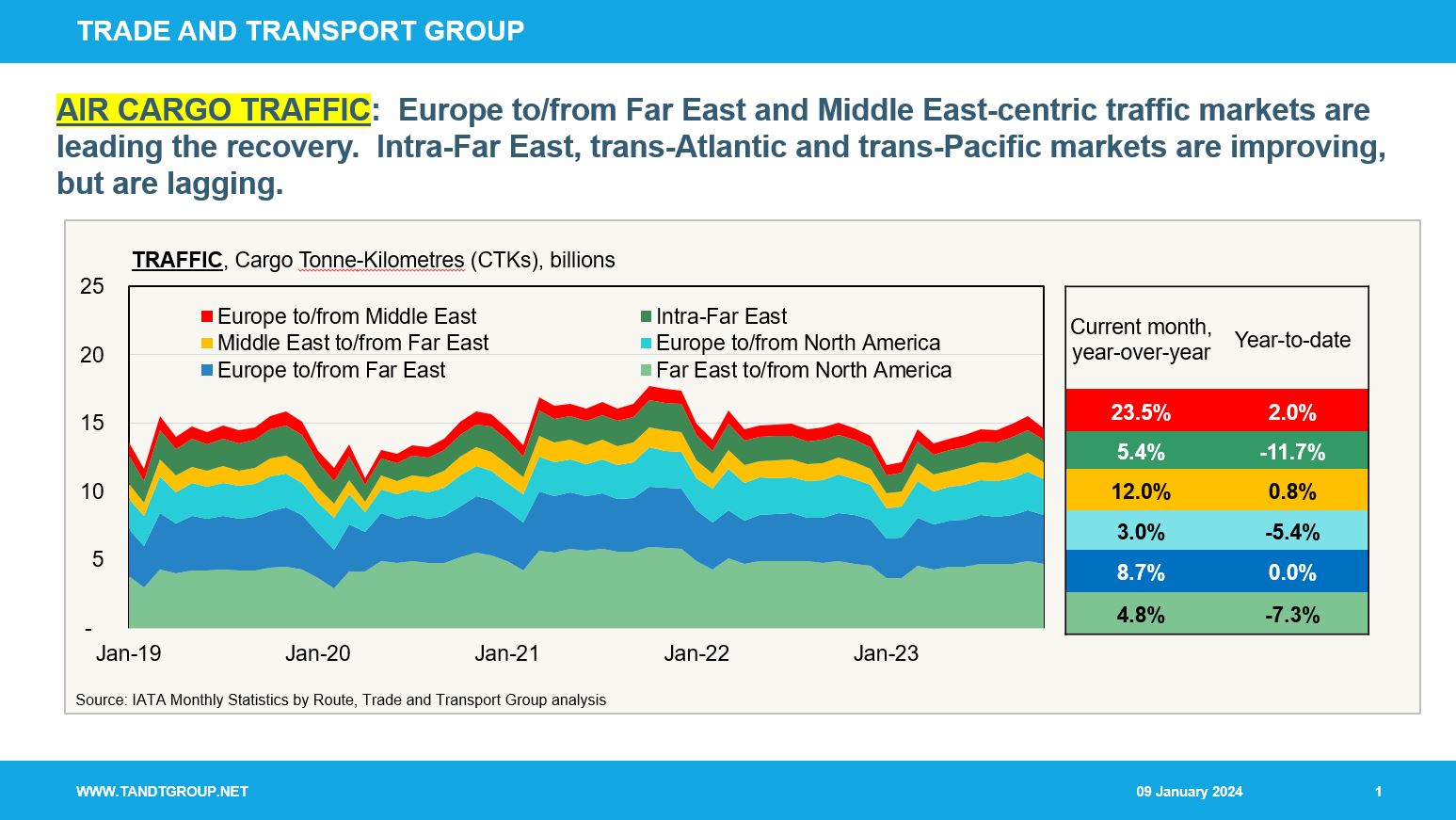

According to IATA data, Europe to/from Far East and Middle East-centric traffic markets are leading the traffic recovery.

In general, all major international air trade lanes are improving, but the intra-Far East, trans-Atlantic and trans-Pacific markets are recovering more slowly.

Source: Trade and Transport Group

The driving force for the current air cargo recovery appears to be mostly cross-border e-commerce shipments exported via air from China.

The air cargo traffic recovery began mid-year 2023, driven by air exports of e-commerce shipments to primarily Europe, followed by North America.

As reported in the Wall Street Journal in late 2023, China-based e-commerce providers Shein and Temu each ship over 1m packages per day to the US, as compared to about 20m per day via Amazon.

To minimise sorting and handling in the US, most Shein and Temu shipments are pre-sorted by zip code at Chinese warehouses before being sent via air freight to the US and handed off to final mile companies.

Average transit times are relatively quick: an estimated 76% of Shein shipments arrive within 10 days versus 5-8 days for most Temu shipments.

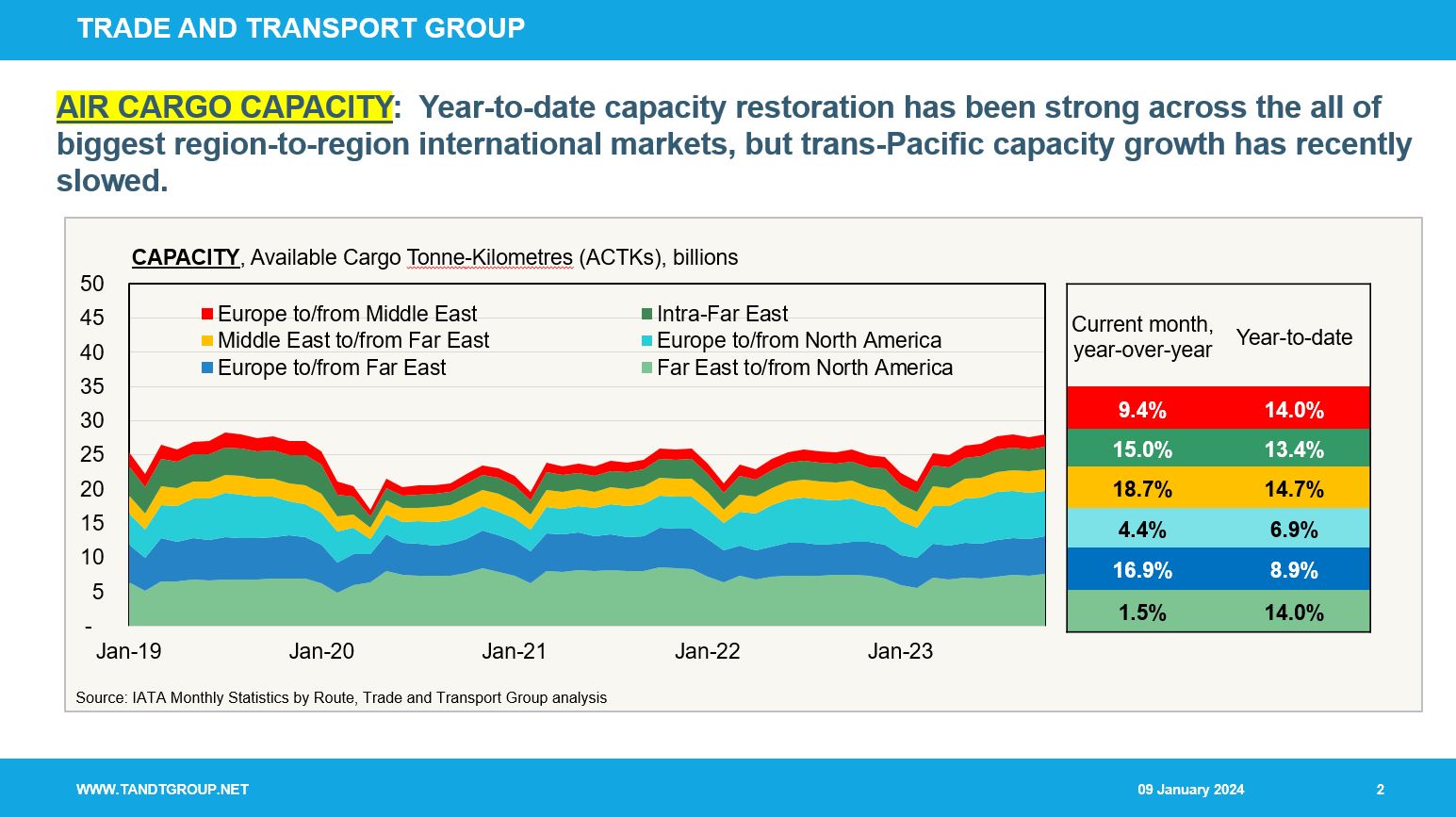

The strength of the air cargo traffic recovery has been based on the capacity recovery on long-haul trade lanes in the post-Covid era.

Globally, air cargo capacity, as measured in available cargo tonne-kilometres (ACTKs), now exceeds pre-Covid era numbers by roughly 2%, but that number belies the fact that passenger airplane lower hold (or “belly capacity”) has not been fully restored in either the transpacific or Asia Pacific to/from Europe markets.

The closure of Russian and Ukrainian air space due to the Russian invasion of Ukraine, as well as the slow restoration of PRC-domiciled airline belly capacity, have contributed to a higher-than-normal reliance on freighter capacity in those two major east-west markets.

Source: Trade and Transport Group

In turn, this situation has helped to keep air cargo yields much higher than their pre-Covid levels.

While the major international region-to-region markets have seen year-to-date capacity restoration of roughly 7% or greater, the capacity growth on the transpacific air trade lane has slowed dramatically in recent months.

A continued slow recovery in capacity on trans-Pacific air trade lanes may slow the ongoing recovery in traffic volumes.

Given the turmoil in air cargo over the past four-plus years, overall world air cargo rates remain nearly 40% higher than their late 2019 levels.

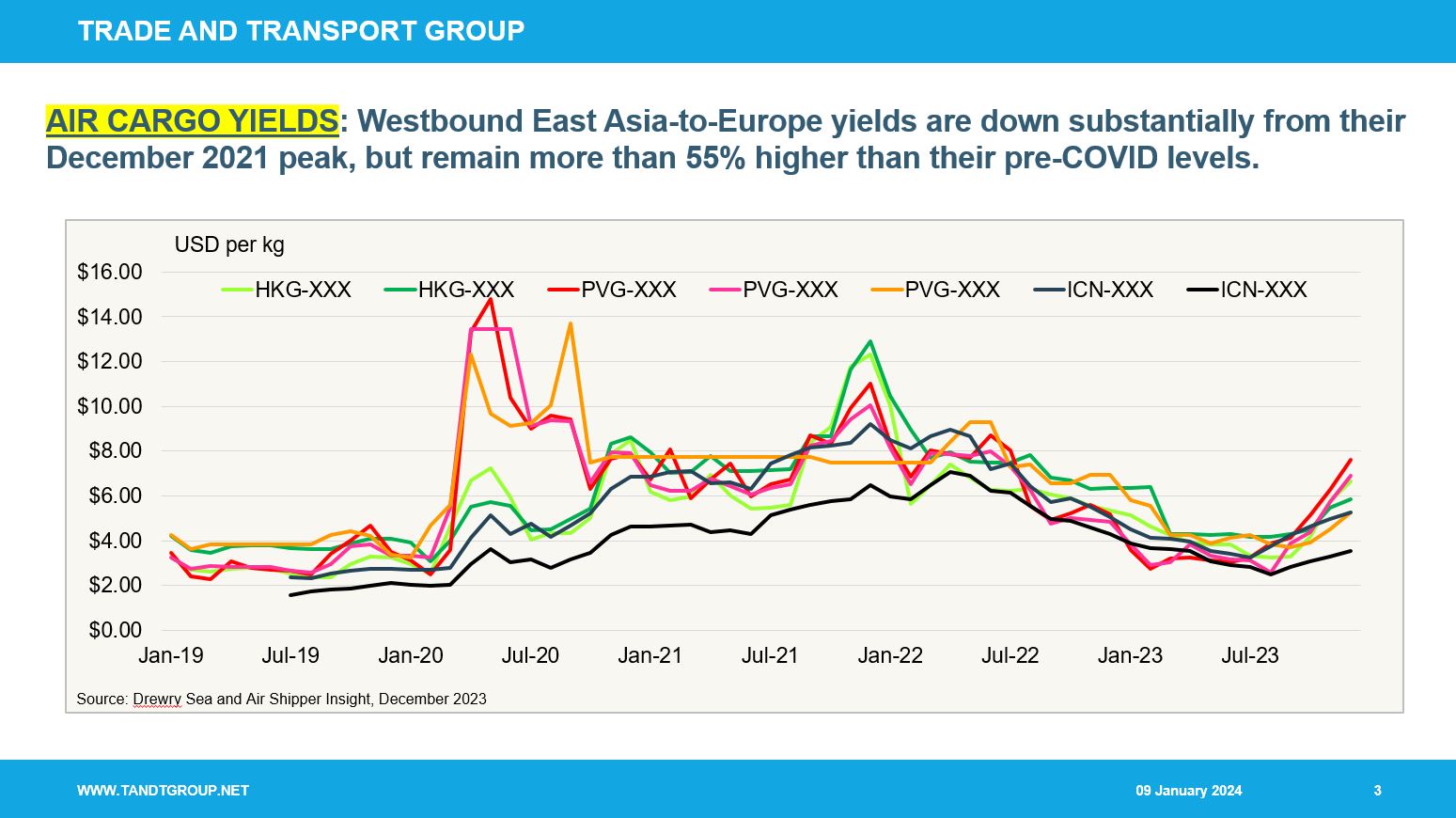

Headhaul rates on eastbound transpacific routes and westbound Asia-Europe routes began rising in mid-2023 after 18 months of declines relative to the extraordinary levels in late 2021 due to global supply chain disruption during the Covid-19 pandemic.

A good illustration of these trends is found in westbound East Asia-Europe air cargo yields.

Given the surge in e-commerce outbound from Asia (read mostly China) to Europe, air cargo rates for seven major markets were 55% higher than pre-Covid levels per a recent report from Drewry.

While the latter 2023 pick-up in air cargo traffic due to e-commerce is cause for optimism, the historic driver of air cargo growth, industrial activity, remains in the pro-longed doldrums.

For any observer of freight transport, this missing air cargo growth driver should be a cause for concern.

Manufacturing purchasing manager index (PMI) data for December 2023 generally has shown a decline in manufacturing activity around the world, but, encouragingly, Mexico and India have been performing well.

These two countries may offer opportunities for growth in early 2024 beyond the boom that is the outbound PRC e-commerce market.

Source: Trade and Transport Group

Tom Crabtree has been a managing Director at Trade and Transport Group since January 2023. Trade and Transport Group is a small, highly specialized strategy consulting firm and analytical solutions provider to companies and institutions operating in the global transportation and logistics space.