Air cargo’s rollercoaster ride set to end in 2024?

28 / 11 / 2023

Photo: Travel mania/ Shutterstock

The air cargo rollercoaster ride of the last few years is looking like it could end in 2024 with “classic seasonality” set to return, although there could still be some bumps along the way.

In its market outlook for 2024, data provider Xeneta predicts that air cargo volumes will rise by 1-2% next year, while supply is expected to increase at a higher level of 2-4%.

The low growth rate comes as muted consumer spending is expected to continue.

Xeneta chief airfreight officer Niall van de Wouw said that the low growth and calmer market could be a chance for shippers to “catch their breath” after the volatility of the past few years.

Van de Wouw said: “The key indicators are not great from a demand point of view. It’s muted and there’s a lot of uncertainty in the world.

“People and companies are a bit more conscious of how they are spending their money and we will likely not see demand pick up in any meaningful way in 2024.

“Yes, we will see a return of classic seasonality, but it will be muted seasonality.”

However, Van de Wouw said that there were several areas that could put some pressure on the market.

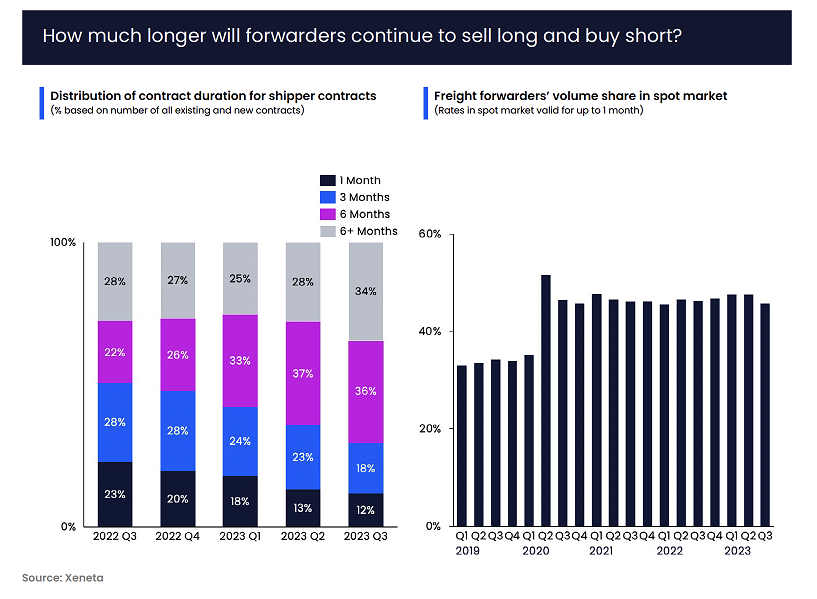

For instance, he said that at the moment shippers are securing long-term contracts from forwarders, while forwarders are buying from airlines on the spot market.

This could cause problems for forwarders – and knock on to shippers – if the market does suddenly change.

“If the rates go up, there is a serious issue,” he said. “We saw it recently out of Vietnam where 70% of volume is bought on the spot market.

“Rates suddenly went crazy prior to Golden Week and freight forwarders told shippers they could not honour the contracted service.

“This could happen on any market and is a real risk for next year unless freight forwarders and airlines can find common ground on long-term rates.”

Source: Xeneta

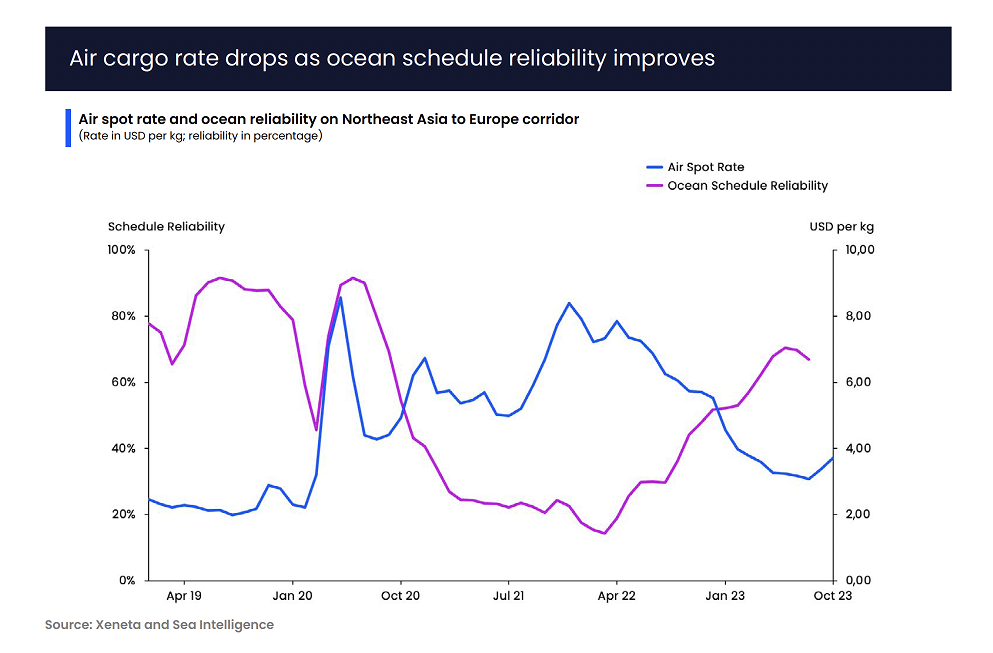

Xeneta is also expecting capacity additions to put pressure on rates, along with environmental sustainability and improving schedule reliability in ocean freight shipping.

However, ocean shipping also faces its own issues, such as the Panama Canal drought and the April ending of the European block exemption for ocean carriers that allowed them to form large alliances.

They will still be allowed to form alliances after April, but not to the same extent.

Simon Heaney of supply chain consultant Drewry has warned that the move could result in carriers downsizing service portfolios in terms of frequency and connectivity.

“That would reduce, not increase, competition on a port-pair basis and push up freight rates,” he said.

If these issues begin to disrupt ocean shipping reliability, it could be fillip for air cargo.

“97% of global containerised goods are transported by the ocean,” said Van de Wouw. “Given the volumes involved, if the ocean industry mess things up, even to a small degree, then there is always money to be made in the air.

“Reliability in ocean is improving, but it only takes one black swan event for the situation to change and rates to increase rapidly.”

Overall, Van de Wouw thinks that next year will be calmer for airfreight, but one unexpected event could result in another rollercoaster ride.

“No one has a crystal ball, but you only have to look at the drought in the Panama Canal, threat of volcanic eruptions in Iceland and conflict in the Middle East to understand how delicate and sensitive to world events the airfreight industry is,” he said.

“If we do get a black swan event in 2024 then strap yourselves in for another ride on the rollercoaster.”

Source: Xeneta