Airfreight demand growth “comes off the boil” in May

01 / 07 / 2015

Cargo demand growth “came off the boil” in May, while capacity additions have resulted in a further weakening of load factors.

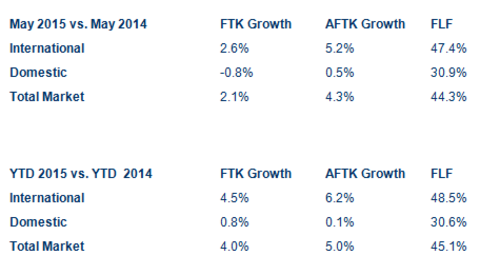

Figures from the International Air Transport Association show that demand growth in freight tonne km terms increased 2.1% year on year in May, which is the slowest growth rate recorded this year, compared with growth of 4% for the first five months.

Meanwhile, capacity expanded by 4.3% during the month and as a result of supply increasing ahead of demand, load factors slipped to 44.3% compared with 44.7% in April.

IATA said that carriers in most regions, with the exception of those based in the Middle East, saw weak demand growth or even contractions.

Airlines in North and Latin America and Europe reported that their freight business was smaller in May 2015 than in the same month of 2014. Carriers in Asia-Pacific experienced slow growth as a result of poor import/export performance.

“Cargo growth has undoubtedly come off the boil,” said IATA director general Tony Tyler. “The expansion in volumes we saw in 2014 has ground to a halt, and load factors are falling.

“Some economic fundamentals still point to a rebound in the second half of the year, but we have to recognise that business confidence is flat and export orders are in decline.

“There is also the risk of a shock to the economic system of a ‘Grexit’ from the Eurozone.”

The IATA figures show that Asia-Pacific carriers reported demand growth of 2.8% in May compared to May 2014, below a capacity expansion of 6.7%.

European carriers saw demand decline by 1.3% in May, compared to a year ago, while capacity grew by 2.7%.

North American airlines reported a fall in demand of 2.9% year on year while capacity was cut by 4.2%. Stronger growth, however, is expected in coming months as the effects of poor weather and US seaport congestion fade.

Middle Eastern carriers saw demand grow by 18.1%, on the back of increased trade within the region, as well as shippers taking advantage of the Gulf carriers’ hub strategy. Capacity expanded 19.4%.

Latin American airlines reported a fall in demand of 10.5%, while capacity grew by 4.7%.

“A general increase in regional trade activity has not yet manifested itself in stronger airfreight demand, possibly due to continued weakness in Brazil and Argentina, two of the region’s largest economies,” IATA said.

African airlines experienced a 3% rise in demand and a 1.3% increase in capacity.

Analyst WorldACD also reported a weakening of growth in May, with its figures showing a 1.8% improvement on a year earlier.

“The areas Europe and North America, volume-wise among the best performing areas only one month ago, were the laggards this time around, together with Central & South America, an area that has been suffering for a while,” it said.

“The growth in May came specifically from Africa and the Middle East & South Asia (MESA), with year-on-year increases of 8% and 5.5% respectively.

“MESA was also the fastest growing destination. Interestingly, the Americas did best when it comes to yield comparisons with May 2014.”

Perishable and pharma cargoes led the growth, increasing by 7% and 13% respectively.

Source: IATA

Source: World ACD