Asian Cargo Monthly: Demand flies in April

31 / 05 / 2017

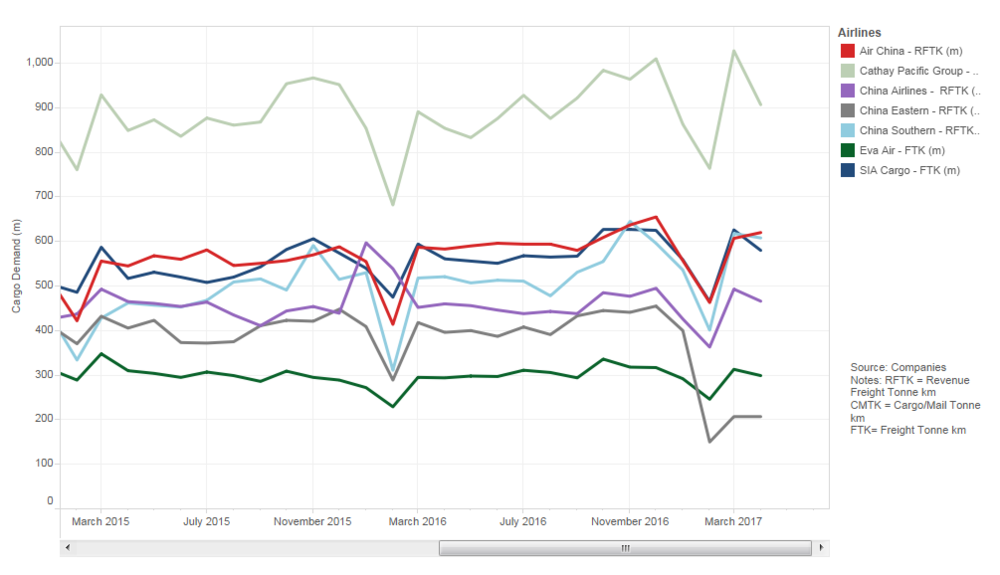

Asian airlines continued their run of success on the cargo demand front in April, with the region’s major carriers all registering traffic growth on a like-for-like basis.

The region’s largest cargo carrier, Cathay Pacific, saw cargo traffic increase by 6.2% in April to 907m cargo and mail tonne km. The increase comes despite the Easter holiday falling in April this year compared with March in 2016.

Click on chart for interactive version

For the year-to-date, cargo traffic at the Hong Kong-headquartered airline is up by 8.6% year on year.

Cathay Pacific General Manager Cargo Sales & Marketing Mark Sutch said: “Our cargo business continued to show encouraging year-on-year tonnage growth.

“Demand from Hong Kong and key Asian markets to North America, Europe and India remained buoyant. Intra-Asia movement was boosted by strong e-Commerce traffic as well as capacity reduction in the market.

“Yield has continued its upward trend. We recently announced an agreement with Atlas Air Worldwide to wet-lease two Boeing 747-8 Freighters, which will supplement capacity on our existing network.

“This will enable us to provide our customers with increased options and services from June, when most market indicators are suggesting a solid year for air cargo.”

Capacity, meanwhile, increased by the lower amount of 2.6% compared with last year and as a result its cargo load factor reached 65.7% against 63.5% in April 2016.

Last week the airline announced it would cull 600 jobs from its Hong Kong headquarters and that the director of cargo role would be combined with the director of commercial.

The region’s second largest cargo carrier, Air China, saw traffic improve 6.3% year on year in April to 620m revenue freight tonne km. This is the airline’s fourteenth year-on-year increase in a row and compares with a year-to-date improvement of 5%.

The airline also saw its cargo load factor for the month improve, with utilisation reaching 56.9% compared with 54% last year.

China Southern registered the largest improvement in traffic during the month with a 16.8% increase on last year to 608m revenue tonne km. The fast growing carrier has not registered a decline in traffic since March 2015 and over the first four months of the year it is ahead of 2016 by 15%.

Cargo load factors improved to 54.3% compared with 51.1% last year.

China Eastern is the only airline to register a decrease in demand for April as traffic was down 50.5% year on year to 207m revenue freight tonne km as it sold its stake in freighter operator China Cargo Airlines.

When the effects of the sale are stripped out of the comparison, China Eastern actually registered a traffic increase of 15%.

Elsewhere, China Airlines saw traffic improve by 1.3% year on year in April, Eva Air registered a 1.7% increase and SIA Cargo, which will be re-integrated into the parent group, was up 3.4%.