European cargo carriers monthly: Another mixed month for airlines

10 / 03 / 2016

The latest airline statistics have revealed another mixed month for Europe’s leading combination carriers’ cargo volumes.

While Lufthansa and Air France KLM both recorded another year-on-year decline in cargo demand in February, IAG and Finnair saw demand increase.

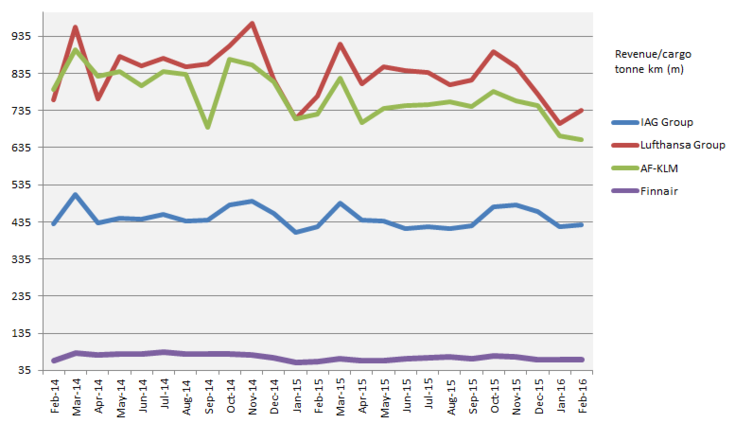

The IAG Group, which owns British Airways, Iberia and Aer Lingus, saw its cargo volumes increase by 1.4% year on year to 428m cargo tonne km.

The increase was largely down to the addition of Aer Lingus’ cargo volumes to its total as IAG acquired the Irish airline last year.

However, Iberia also contributed to the increase as its demand jumped by 8.6% on February last year.

These two increases were enough to offset the 2.9% decline recorded at British Airways, which accounts for more than three quarters of the group’s total air cargo demand.

Expanding Finnair was also able to report an increase in cargo demand for February as its volumes increased by 8% to 63.2m revenue tonne km.

It is the second month in a row that the airline has managed to record a demand increase.

When asked by Air Cargo News last month how it had managed the increase, the carrier said there was no particular reason for the increase, just better demand, especially on Japanese and Korean routes.

It should also be noted that January 2015 was the first full month that the airline was without its Helsinki-Hong Kong freighter operation, which it decided to scrap as it expands belly capacity with the delivery of A350 XWB aircraft, increasing cargo capacity by 50% by 2020.

In terms of capacity, there was a 10.4% increase as the airline’s new aircraft continued to take effect.

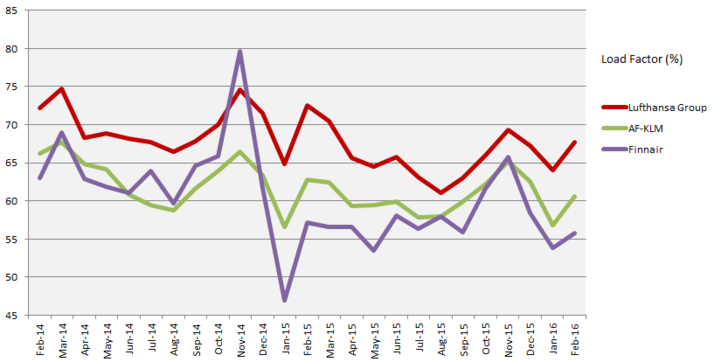

As a result of supply increasing ahead of demand, its load factor declined to 55.8% compared with 57.1% a year earlier.

The largest – in cargo terms − of the four combination carriers, Lufthansa, continued to record demand declines.

The German airline group saw its cargo volumes slide by 5% year on year to 736m revenue cargo tonne km.

This is the airline’s tenth monthly year-on-year decrease in a row. Meanwhile, cargo capacity at the airline edged up by 1.7% compared with February last year, causing load factor to decline to 67.7% compared with 72.5% a year ago.

The airline is in the process of removing two MD11 freighters from service which should impact cargo capacity from March figures.

One of the freighters was used to cover out-of-action freighters and for charters, while the other was used on scheduled services and its withdrawal resulted in the closure of routes to Chongqing, Quito and Bogota.

Finally, Air France KLM added to its monthly year-on-year demand declines as volumes slipped by 9.6% to 656m revenue tonne km — for a fifth month in a row.

Meanwhile, capacity slipped by the lower amount of 6.5% meaning load factor fell to 60.6% compared with 62.7% last year.

To make matters more difficult for the Franco-Dutch airline group, at the start of this month its cargo boss Bram Gräber announced he was stepping down from the role to join Netherlands-based Royal Boskalis Westminster as group director maritime services for its offshore energy division.