European cargo carriers monthly: cargo declines at Lufthansa and Air France

12 / 04 / 2016

IAG Cargo and Finnair both managed to record air cargo demand increases during the first quarter of the year while Air France-KLM and Lufthansa suffered declines.

While all four carriers recorded a spike in demand during March, compared with February, the level of increase was weaker than in previous years, although this can be affected by the timing of the Chinese New Year.

But looking at the first quarter against the previous year shows the airline’s differing fortunes when it comes to cargo demand.

Finnair had the most successful first quarter as it saw cargo demand jump by 10.1% year on year to 198.7m revenue tonne km (RTKs).

The increases come as the airline expands its passenger fleet with the addition of A350 XWB aircraft, increasing cargo capacity by 50% by 2020.

The carrier has previously told Air Cargo News there is no particular reason for its volume increases, just better demand on Japanese and Korean routes.

There also appears to be stronger growth in RTKs than tonnages, suggesting that cargo is being transported over longer distances.

In March, the airline saw demand jump by 6% on last year to 70.7m RTK, its third monthly year-on-year increase in a row.

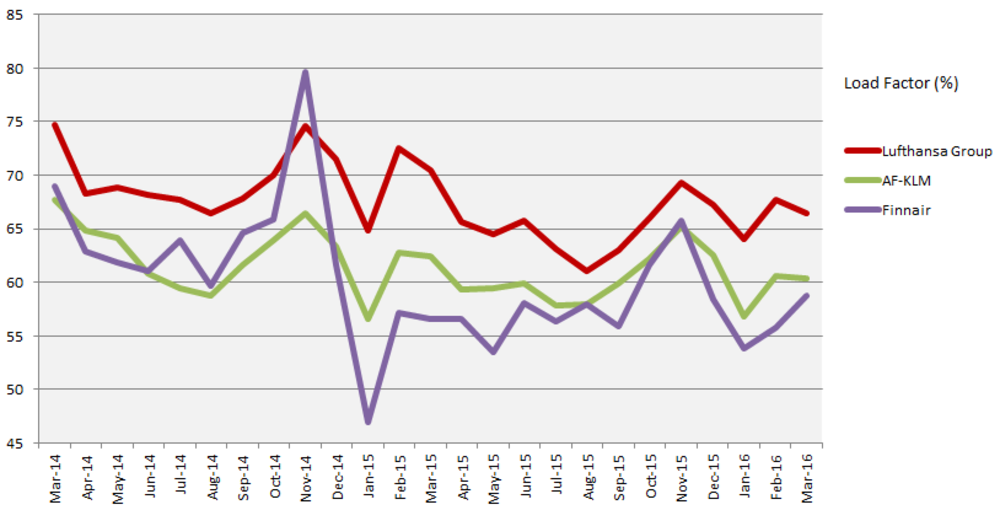

Meanwhile, capacity jumped by 2.2% and as a result its load factor for the month reached 55.8% compared with 56.6% last year.

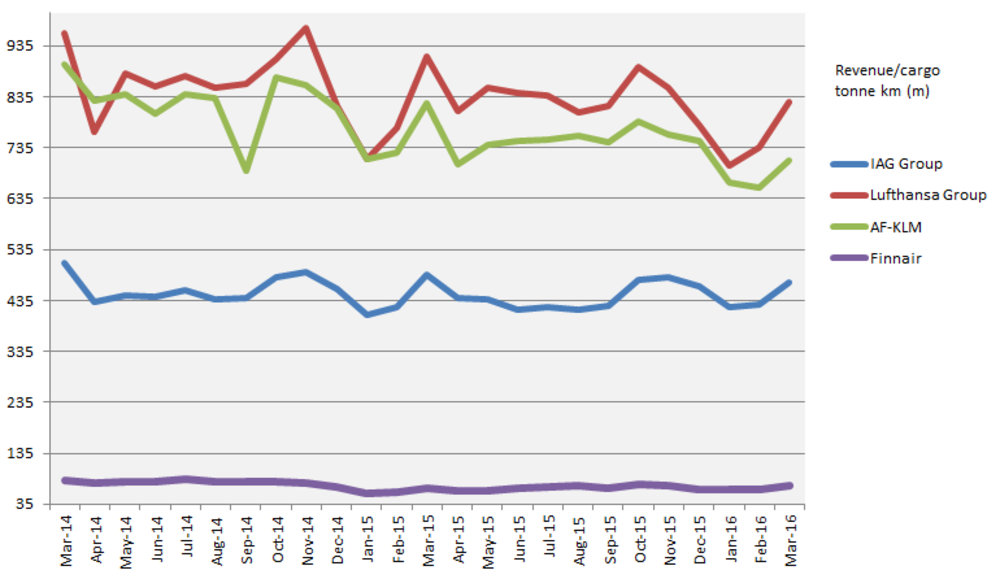

IAG has also seen demand increase during the quarter, jumping by 0.5% compared with the first quarter of last year to 1.3bn cargo tonne km (CTK).

The increases are largely thanks to the acquisition of Aer Lingus and growth at Iberia. In contrast British Airways has suffered demand declines.

However, the airline group hasn’t had it all its own way. In March, it suffered a 3.1% decline in demand to 470m CTK.

This is the first year-on-year decline in demand IAG has registered since November.

In contrast to the quarterly improvements registered by IAG and Finnair, Air France-KLM saw traffic slide by 11.2% during the first quarter to 2bn RTK.

Over the first two months of the year, IATA said European airlines had seen demand increase by 0.9% so the airline group’s first-quarter decrease is likely to be behind market levels.

In March, demand declined by 13.5% to 711m RTK. It is taking measures to protect its load factor though, with capacity reduced by 10.7%.

As a result it was able to minimise declines in its load factor, which slipped to 60.4% compared with 62.4% a year earlier.

Finally, Europe’s largest cargo carrying airline group, Lufthansa, suffered a 5.8% slide in demand during the first quarter to 2.3bn revenue cargo tonne km (RCTK).

Its decline comes in light of the fact it has taken two freighters out of action in response to weak market conditions on certain trade routes.

In March, the airline group recorded a 9.5% decrease in demand to 826m RCTK. This is the eleventh month in a row that demand has declined.

Cargo capacity was down by the lower amount of 3.9% and as a result its load factor slipped to 66.4% from 70.5% in March 2015.