Boeing lowers its expectations for air cargo but remains upbeat

07 / 10 / 2020

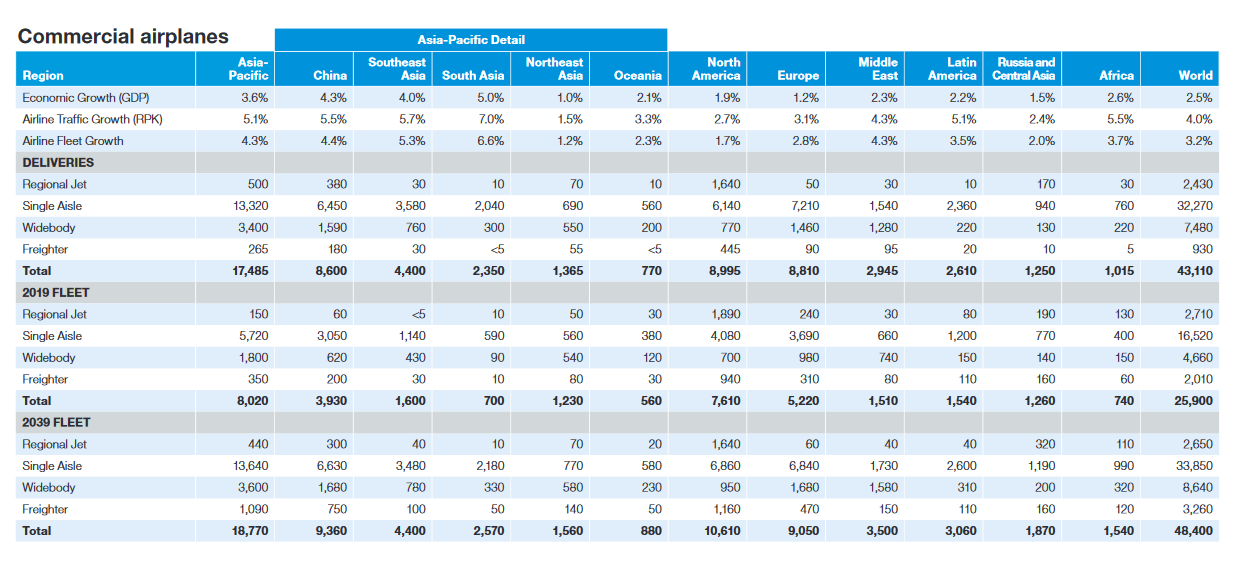

Boeing has lowered its forecast for air cargo growth and the number of new and converted freighters that will be ordered over the coming two decades in its biennial market forecast.

The airframer said that it expected air cargo to grow at a compound annual growth rate of 4% over the next 20 years, which is down on its 2018 forecast of 4.2% per year.

Meanwhile, it is expecting the industry to order 2,430 new or converted freighters, a reduction from the 2,600 cargo aircraft it last predicted would be ordered.

The downgrade comes as the air cargo market has had a difficult couple of years. In 2019, airfreight volumes declined as a result of a series of trade wars while this year demand has been hit by the Covid-19 outbreak and associated reduction in belly capacity.

However, Boeing remained upbeat about cargo prospect’s, driven by e-commerce and “robust markets in east Asia”.

“Air cargo’s importance to world trade is illustrated by the fact that, although freighters carry just 1% of all commodities by weight, the value of those commodities comprises 35% of total trade,” Boeing said in its commercial market outlook report.

“In the coming years, the value of freighters will be increasingly apparent as above-trend growth from e-commerce and pharmaceuticals is expected.

“This will drive new opportunities for air cargo, as only freighters can provide the security, speed and safety needed to transport high-value and time-sensitive commodities to serve those market segments.”

Over the next 20 years Boeing is expecting the all-cargo fleet to expand from 2,010 freighters to 3,260 in 2039, an increase of nearly 60%.

Of the 2,430 cargo planes that will be ordered for replacement and expansion, 930 airplanes will be new widebody freighters and 1,500 will be passenger airplane conversions — made up of 420 widebody conversions and 1,080 standard body conversions.

“Acceleration of passenger-airplane retirements as a result of the impact of the pandemic will provide additional feed stock opportunities for freighter conversions,” the report stated.

In terms of regional fleet growth, Asia Pacific is expected to lead the way with the freighter fleet based in the region increasing from 350 in 2019 to 1,090 in 2039 (see chart below). North America will stay the largest all-cargo market growing from 940 to 1,160 freighters.

Last year, Airbus predicted that 2,500 new and converted freighter aircraft would be ordered by the industry over the next 20 years.

Click chart to enlarge