DSV sees German airfreight volumes take a hit

11 / 03 / 2020

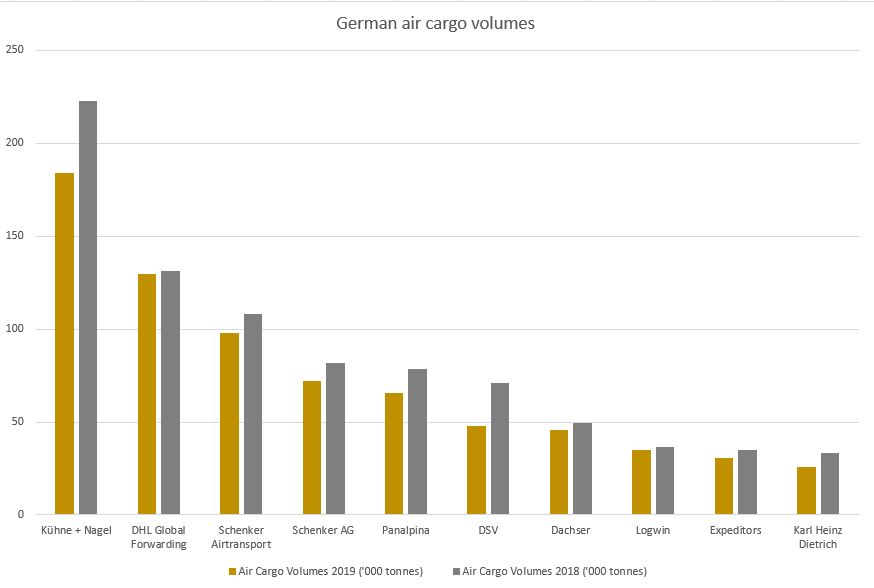

In 2019, the airfreight division of Denmark-headquartered freight forwarding DSV lost around one third of its German airfreight export cargo compared to the previous year, writes Oliver Link from Air Cargo News’ sister title DVZ.

The IATA CASS figures show that DSV Air & Sea suffered by far the greatest loss of volume among the top 10 German airfreight forwarders.

These are the figures of the former DSV, which was merged with Panalpina Welttransport (Deutschland) on January 1 and has only been operating as a joint venture in Germany since then.

DSV Air & Sea ranks sixth in the top 10 with an annual volume of 48,000 tonnes and a marketshare of 3.4%.

It should be noted that CASS generally lists Schenker’s airfreight segment separately as two companies: Schenker Airtransport GmbH (rank 3) and Schenker AG (rank 4). With a combined market share of 11.9%, Schenker ranks behind the leader Kühne + Nagel (market share 12.9%) in second place. DHL Global Forwarding GmbH ranks third (market share 9.1%).

In 2019, the top 10 saw revenues decline by an average of 13.6% compared with the previous year.

Among the top 10 forwarders, DHL performed best with a 1.5% decline in revenue compared to the previous year.

Logwin Air + Ocean also achieved a respectable result with a revenue decline of 3.4%.

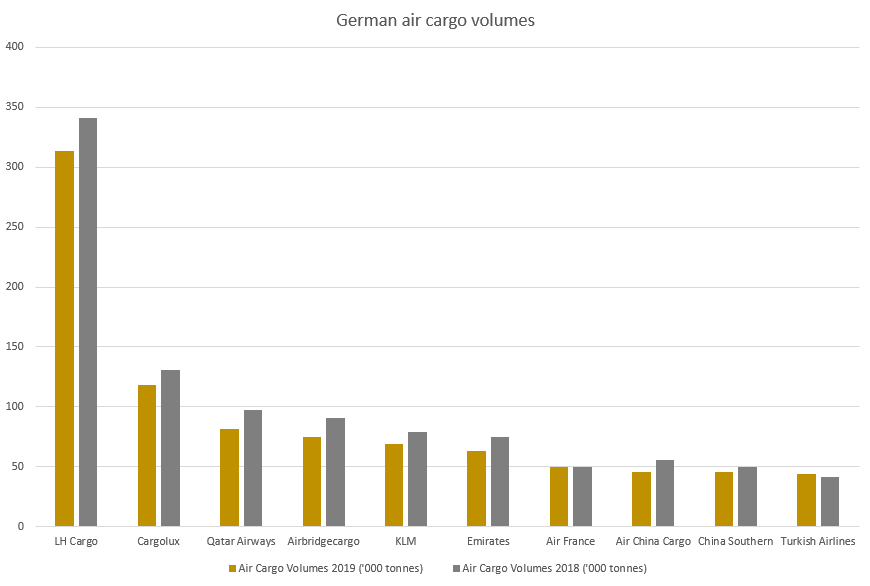

Cargo airlines: Turkish Cargo and Air France on the up

On the airline side, the carriers Turkish Cargo and Air France are the clear winners. Both were able to gain market share despite the weak general conditions.

The Turkish airline was able to increase its cargo volume by around 4.5% compared to 2018 and Air France by 0.5%.

With a tonnage of 43,500 tonnes in 2019, Turkish Cargo will have a market share of 3% on the German airfreight export market and occupies 10th place in the ranking of airlines.

Air France, which is reported separately from its partner airline KLM, achieved a volume of 50,000 tonnes in 2019 and is in 7th place.

Overall, the volume of freight exported from Germany shrank by 12.3% to 1.4m tonnes in 2019 compared to 2018.

It should be noted that Iata does not report the freight transported by the integrators DHL, UPS and Fedex, but only that of the liner carriers.

The top 10 airlines on average lost 11.6% of their revenue last compared with 2018.

With a volume of 313,000 tonnes (-8%) and a market share of 22%, Lufthansa Cargo is the undisputed leader in the rankings, followed by Cargolux with a market share of 8.3% (118,000 tonnes, -9.4%).

Fourth-placed AirBridgeCargo performed worst as its volume shrank by 17% to 75,000 tonnes and its market share dropped to 5.3%.

Air China Cargo (45,900 tonnes, -16.9%; market share: 3.2%), which is in 8th place, and Qatar Airways (81,000 tonnes, -16.6%; market share: 3.7%), which is in third place, also performed worse than the market.