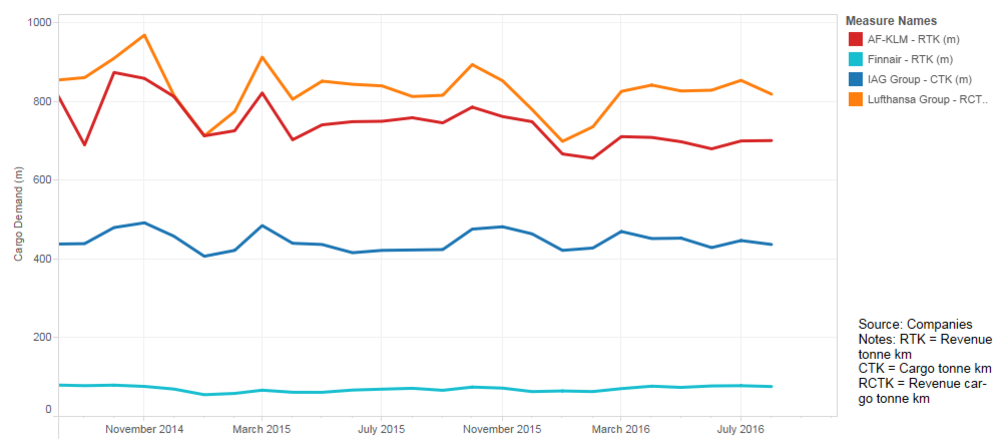

European cargo monthly: Improvements at IAG, Lufthansa and Finnair

16 / 09 / 2016

The cargo divisions of Lufthansa, IAG and Finnair saw airfreight demand continue to increase in August compared with last year, while Air France -KLM recorded another decline.

The monthly cargo figures from Lufthansa show that the German airline group – the largest airfreight carrier in Europe – saw demand increase 0.7% to 819m revenue cargo tonne km in August.

August represents the third month of the year that the Lufthansa Group has seen demand improve on a year ago. It is also the second month in a row that demand has been up.

Traffic from Europe (1.6%) and its largest origin Asia Pacific (4.2%) increased in August, while there was a decline for the Americas (-1.7%) and Middle East/Africa (-6%).

While there has been positive news over the last couple of months, for the year-to-date demand is still behind last year.

Capacity during the month increased by 0.6% resulting in its cargo load factor improving by 0.1 percentage points to 61.8%.

There was also good news at IAG Cargo as demand increased 3.3% year on year to 437m cargo tonne km as it continues to benefit from the acquisition of Aer Lingus. This is the fifth increase in a row at the airline group.

While the Aer Lingus purchase helped improve cargo demand, IAG would still have recorded an increase even with the results of the Ireland-based airline stripped out.

Finnair also continued to grow its cargo volumes during the month, with an August increase of 6.3% year on year to 76m revenue tonne km.

While it has now increased cargo volumes in eight out of eight months this year, the pace of growth slowed in August from the double-digit percentage improvements it reported in April, May, June and July.

The demand in cargo volumes comes as the airline is currently in the process of taking delivery of a series of Airbus 350-XWB aircraft that will result in a 50% increase in cargo capacity by 2020.

In August cargo space was up by 5% while its load factor improved to 58.6% from 57.9% last year.

Meanwhile, cargo demand continued to decline at Air France-KLM, which reported a 7.7% decline to 701m revenue tonne km.

It is the airline group’s fourth cargo demand decrease in a row and its seventh of the year. Last month, the airline was affected by a cabin crew strike running from July 27 to August 2.

Air France-KLM has moved to reduce cargo capacity – down 2.7% in August – but this wasn’t enough to stop its cargo load factor declining to 54.9% from 57.8% last year.