Europe’s top cargo airlines suffer more demand declines in July

13 / 08 / 2015

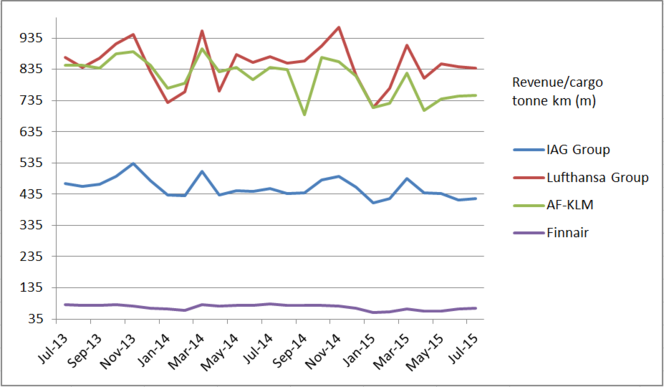

July was another tough month for Europe’s air cargo carriers as Lufthansa, Air France KLM, IAG Cargo and Finnair all reported demand declines as a result of tough market conditions and changes in freighter strategies.

Overall, the four airlines recorded a 7.6% slide in cargo volumes during the month, which compares with a decline of 5.7% during the first seven months of the year.

The largest percentage decline in volumes during July was experienced by Finnair as it recorded a 16.7% year-on-year slide to 69m revenue cargo tonne km (RCTK). It is the second largest percentage decline recorded by Finnair this year.

As well as tough market conditions, the decline is partly explained by the airline’s decision at the end of last year to end its freighter operation to Hong Kong, through 40% owned Nordic Global Airlines, and instead use bellyhold capacity on passenger flights.

Source: Companies

Notes: IAG Group = cargo tonne km, others = revenue cargo tonne km

In July, Finnair’s cargo traffic consisted almost entirely of belly cargo on scheduled flights, although it does still use intra-European freighters.

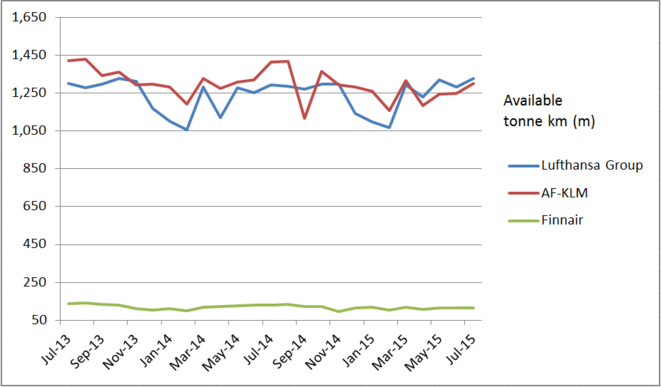

Overall, the freighter withdrawal means capacity at the airline was down by 5.5% on last year to 123m available tonne km (ATK).

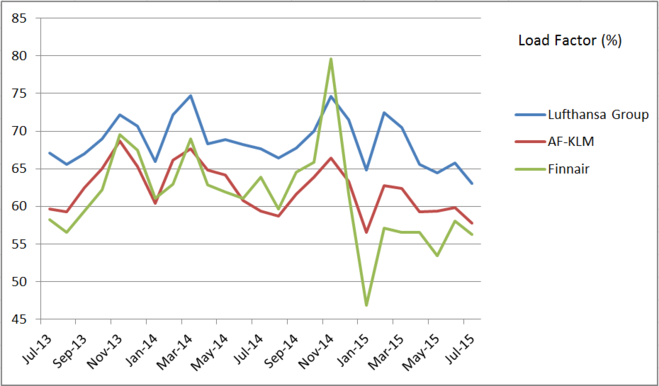

The decline in demand ahead of supply had a negative impact on the airline’s load factors, which slipped to 56.3% against 63.9% a year ago.

Source: companies

The second largest percentage decline in traffic was experienced by Air France KLM, which registered 10.6% decline on a year earlier to 752m RCTK.

This decline is also largely down to a move away from freighters in favour of bellyhold as the airline group’s cargo division undergoes a restructuring.

Total freighter capacity at the group was down by 31% in July on a year earlier, while overall capacity was 8.1% behind a year earlier.

Air France KLM managed to record the smallest percentage point decline in load factors of the three that report this figure as levels slipped to 57.8% compared with 59.4% a year earlier.

IAG Cargo, which includes British Airways and Iberia, registered the next largest decline in volumes during the month, as it recorded a 7% slip to 422m cargo tonne km.

Although the airline decided to stop operating its own freighters, the effect of this withdrawal would not have been felt in the July year-on-year comparisons as the move took place in the second quarter of last year.

The decline is the largest recorded by the group so far this year, just ahead of the 6.1% slip recorded in June.

The Lufthansa Group, which includes Lufthansa Cargo and Swiss Air, recorded a 4.3% year on year decline in traffic to 838m revenue cargo tonne km (RCTK). This represented its second largest percentage decline of the year.

The airline said it was not able to sell all of its additional capacity, which was up 2.7%, which came mostly from capacity growth on passenger aircraft.

The load factor therefore decreased by 4.6 percentage points to 63.1%.

Source: companies