Asia Cargo Monthly: Record week for Cathay Pacific

19 / 10 / 2017

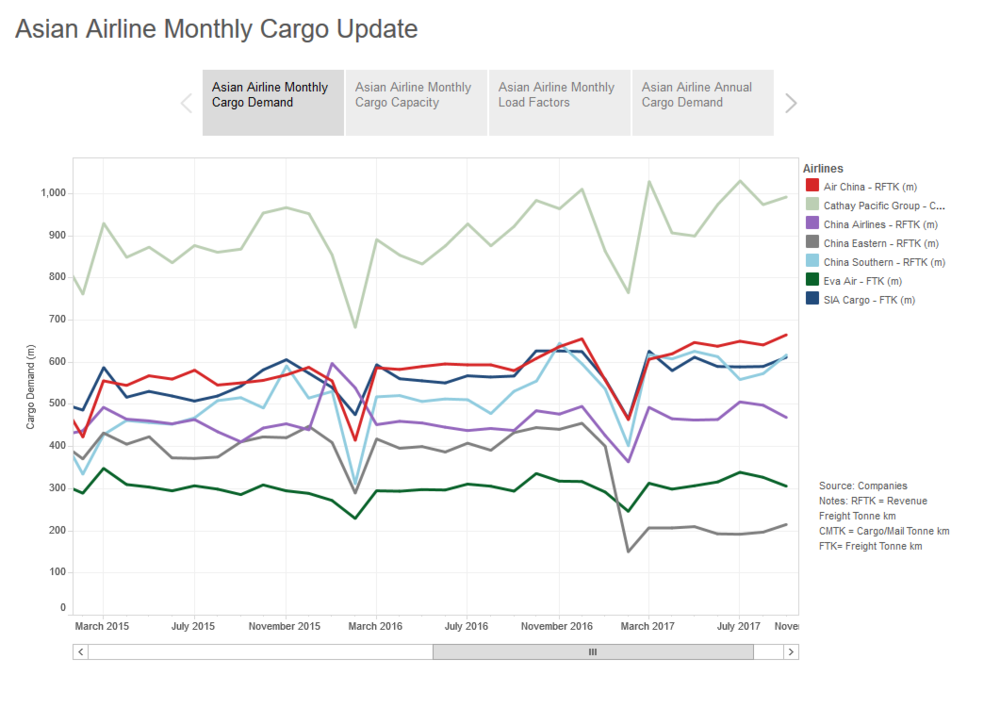

Asian airlines continued to report strong cargo figures in September, with Cathay Pacific breaking a cargo record and reporting improving yields.

The latest figures from airlines in the regions show that there was some slowdown in growth in September at certain airlines but overall cargo continued to improve.

The region’s largest cargo carrier, Cathay Pacific, registered its busiest ever week in September while yields continued to improve.

Cathay Pacific director commercial and cargo Ronald Lam said: “The performance of our cargo business remained robust.

“We ramped up our freighter capacity on transpacific, India and China routes to commensurate with growing demand, and also added a charter operation to the United States.

“Tonnage growth was well ahead of capacity growth, with a commendable load factor achieved on both long-haul routes as well as regional services.

"The week of 17-23 September saw us break the company’s all time weekly uplift tonnage record.

“A high freight load factor has also helped to underpin a sustained recovery in cargo yields.”

Cargo traffic at the airline was up 7.5% year on year during September to 992m cargo and mail revenue tonne kms, slightly behind year-to-date growth of 9.2%.

Cargo load factors for the month reached 68.1% compared with 66.7% last year.

Click on chart for interactive version

At Air China there was a 14.6% year-on-year improvement in cargo demand to 665m revenue freight tonne kms in September. This is ahead of its year-to-date growth of 7.7%.

September also proved to be its busiest month of the year so far and its busiest September since Air Cargo News records begin in 2011.

The growth in traffic comes as the airline continues to expand its international and regional operations, while domestic traffic actually decreased on last year.

Its cargo load factor for the month reached 58.1% compared with 55.7% for September 2016.

At China Airlines there was a 13.2% year-on-year increase in cargo traffic to 496m freight revenue tonne kms, beating year-to-date growth of 8.1%.

The month proved to be the airline’s busiest September on record and the second busiest month of the year so far.

Its cargo load factor for September stood at 72.5% compared with 69.7% last year.

China Southern also continued to see demand grow during the month on the back of international and regional traffic.

The fast-growing airline registered a 16.1% year-on-year increase in demand in September to 617m revenue tonne kms, slightly behind its growth over the first nine months of 16.5%.

Tonnage was up by a much lower amount, reflecting the growth in international and regional routes where traffic is carried further.

Its load factor for the month reached 56.1% compared with 55% last year.

Eva Air saw demand for September improve by 4.1% compares with last year, which also lagged behind its nine month growth rate of 5.8%.

Meanwhile, Singapore Airlines Cargo saw cargo traffic increase by 7.9% year on year in September to 612m freight tonne kms. This is ahead of its nine month growth rate of 4.9% and is also the busiest September on record.

See more air cargo data