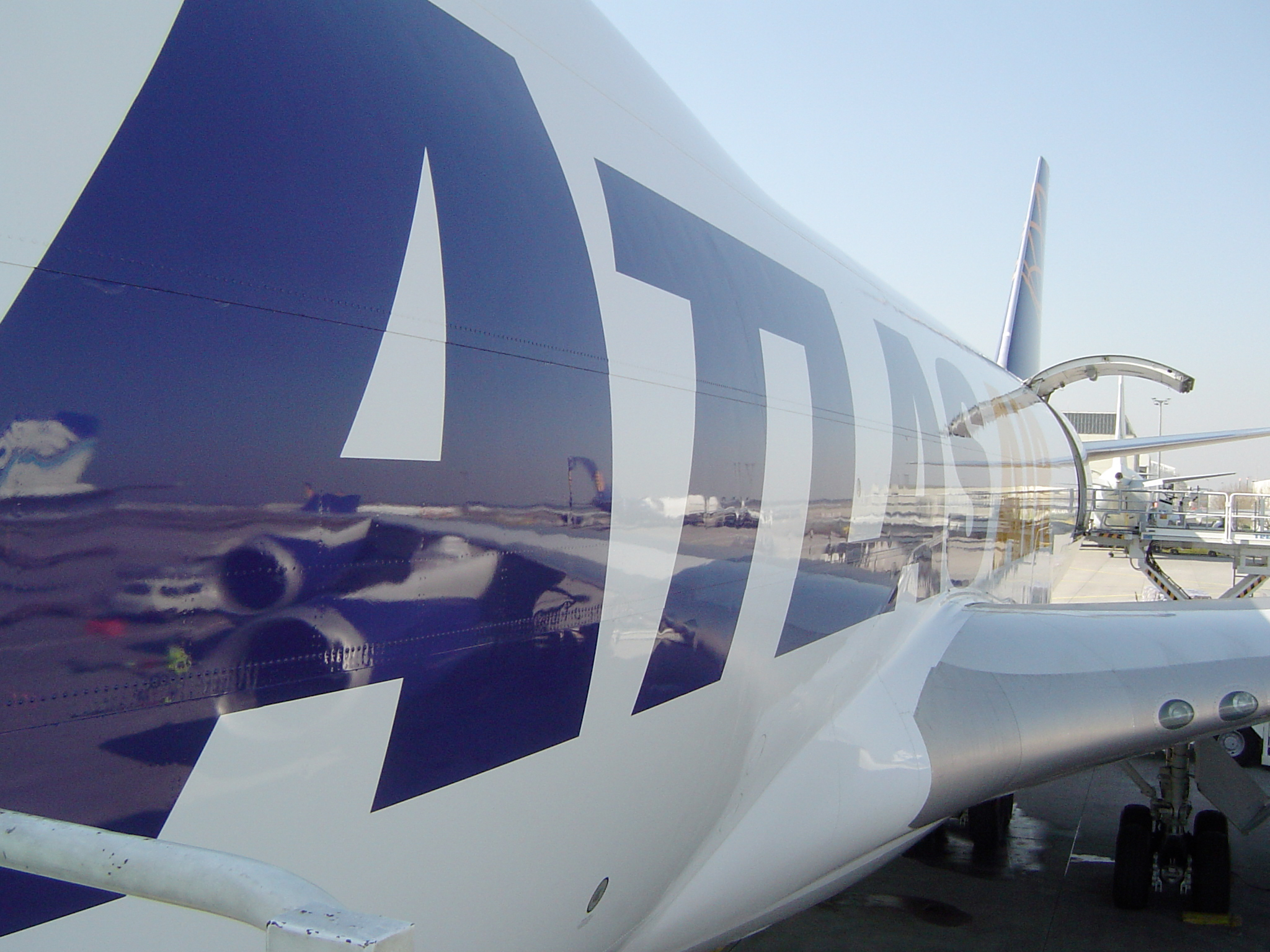

Atlas Air reports strong second quarter despite loss

02 / 08 / 2018

Atlas Air Worldwide Holdings has announced "strong second-quarter" 2018 business growth on the back of increased demand despite recording a loss for the period.

The aircraft lessor saw revenues for the period increase 15.8% year on year to $666.1m, while it registered a loss from continuing operations before taxes of $21.1m compared with a $39m profit last year, and a net loss of $21.1m compared with a $38.9m profit last year.

The company said the losses were down to an unrealised loss on outstanding warrants of $50m in the second quarter of 2018 compared with an unrealised gain on outstanding warrants of $13.8m last year.

Revenues were up on the back of a 19% increase in volumes to 72,660 block hours.

On an adjusted basis, it said income from operations increased by 70.8% year on year to $49.7m

“Our volumes and revenue grew to new records in the second quarter, and while reported results were impacted by warrant accounting, our adjusted income and adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) were sharply higher,” said Bill Flynn, president and chief executive.

He added: “We expect to continue to build on our strong performance in the second half of 2018. Airfreight demand is solid and the global economy is growing. As a result of our strategic initiatives to grow and diversify our fleet, expand our customer base and enhance our business mix, we are meeting the growing needs of our customers, driving our results and extending our leadership in global aviation outsourcing.

“For the full year, we now expect our revenue to exceed $2.6bn. We project adjusted EBITDA to increase to more than $520m. And we anticipate our full-year adjusted net income will grow by 45% to 50% compared with 2017, up from our prior outlook of 35% to 40% growth.”

The company’s ACMI segment saw its contribution for the second quarter remain unchanged as increased block hours and rates were offset by higher heavy maintenance costs and amortisation of deferred maintenance costs.

Block hours were up 19% on the back of increased B767 flying for Amazon and several new B747-400F wins.

Higher Charter segment contribution during the period was primarily driven by increases in military cargo and passenger demand, an increase in commercial cargo volumes, and higher aircraft utilisation, partially offset by the redeployment of B747-8 aircraft to the ACMI segment.

In Dry Leasing, higher segment contribution primarily reflected the placement of additional B767-300 converted freighter aircraft throughout the second half of 2017 and first half of 2018, as well as the placement of a B777-200 freighter in early 2018.

Sign up to receive Air Cargo News direct to your inbox for free