European monthly: A new hope as European airlines return to growth

13 / 05 / 2016

Europe’s major cargo carriers have seen cargo volumes return to growth in April after a difficult start to the year.

All four major European airlines monitored in the Air Cargo News monthly spotlight recorded a year on year increase in demand in April for the first time since March 2014.

It follows a difficult first quarter of the year for the cargo businesses of Air France KLM and Lufthansa, while IAG recorded mixed performance and benefitted from the acquisition of Aer Lingus.

First quarter year on year comparisons may have been slightly effected by the west coast US port strikes, as freighters were moved from European services to US operations, which pushed cargo onto other services.

But this would have had more of an impact on those carriers with a strong market presence across the transpacific and the effects of the strike, which ended in February, would largely have worked their way through the system by April.

Europe’s busiest cargo carrier Lufthansa saw cargo demand increase by 2.5% year on year in April to 842m revenue cargo tonne km.

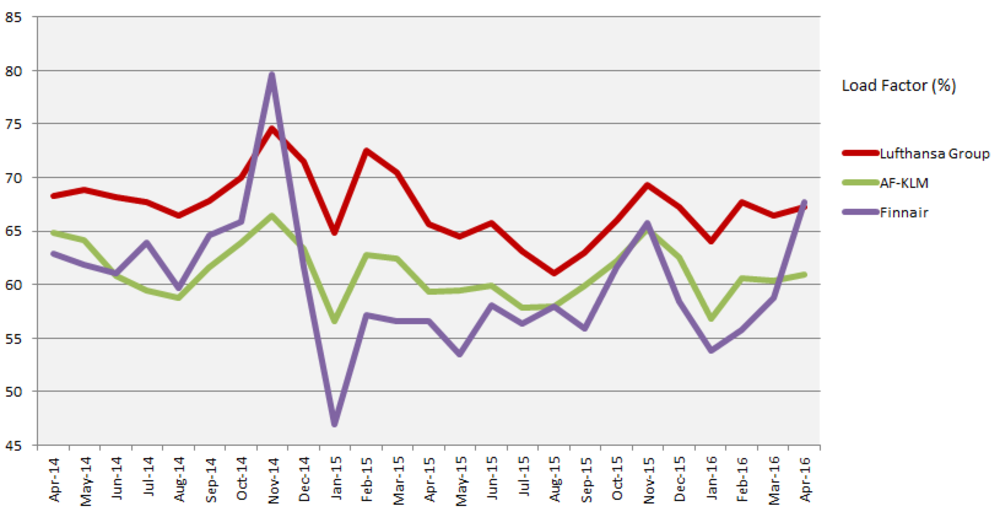

Capacity was up by the lower amount of 2% and as a result its load factor improved to 67.2% from 66.8% a year earlier.

The demand increase registered by the German carrier is its first since April last year, and the increase that month was caused by comparison being affected by strikes in 2014.

The next largest carrier, the Air France KLM group recorded its first demand increase since September last year, although this was again caused by strike action in 2014.

Its volumes increased by 0.9% compared with a year earlier to 709m revenue tonne km.

Meanwhile, it continued to remove capacity from the market, this time recording a 1.9% year on year decline, and as a result the airline group’s cargo load factor improved to 60.9% compared with 59.2% during the previous year.

The IAG Group of British Airways, Iberia and Aer Lingus has fared better this year as the acquisition of Aer Lingus continues to provide a boost.

The 2.7% year on year demand increase registered in April to 452m cargo tonne km was the group’s third increase of the year, mainly fuelled by growth at Iberia.

However, if the Aer Lingus figures from 2015 are included in the comparison, the airline group actually saw demand decrease by 0.4% in April as British Airways and Aer Lingus saw demand slide.

Finally, Finnair recorded its fourth year on year demand increase of the year as it continues to expand its fleet.

The Finland-based airline is taking delivery of a series of Airbus 350-XWB aircraft that will result in a 50% increase in cargo capacity by 2020.

Volumes were up 25.3% year on year in April – its largest increase so far this year –to 76.9m revenue tonne km.

Capacity meanwhile was up by 4.7% on a year earlier and as a result its load factor reached 67.7% compared with 56.6% in April 2015.