FedEx claws back costs in Q2 but Express suffers

20 / 12 / 2023

Source: FedEx

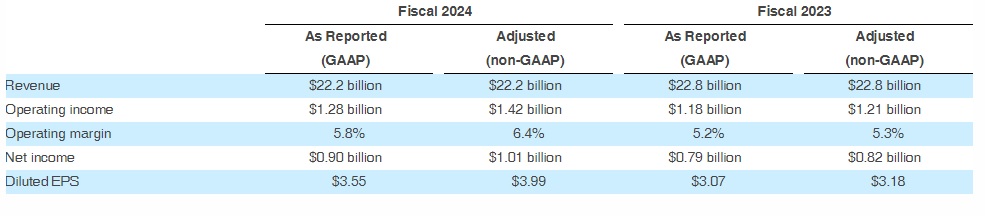

FedEx’s continuing work to trim costs within the business were evident in its second quarter 2024 results, although the Express segment suffered in particular.

Total second quarter operating income for the period ended November 30 was $1.28bn, up 9%. Adjusted operating income increased by 17%.

As with the previous quarter, FedEx said this was “primarily due to the execution of the company’s DRIVE program, and continued focus on service and revenue quality”.

Raj Subramaniam, FedEx president and chief executive officer, noted: “FedEx has delivered an unprecedented two consecutive quarters of operating income growth and margin expansion even with lower revenue, clear evidence of the progress we are making on our transformation as we navigate an uncertain demand environment.”

However, operating income was down 14% on the first quarter 2024.

And FedEx Express revenue was down 6% year on year, while operating income declined 60% during the quarter. This was partially offset by reduced operating expenses.

“The revenue decrease was driven by volume declines, lower fuel surcharges, reduced demand surcharges, and a mix shift toward lower-yielding services,” said FedEx.

FedEx Freight revenue was down 4%, with operating income up 11%.

“FedEx Freight operating income increased despite a decline in revenue. The profit increase was driven by higher yield and increased efficiency, partially offset by lower shipments,” stated FedEx.

Meanwhile, FedEx Ground fared better than the other segments, with revenue up 3% and operating income up 51%.

FedEx commented: “FedEx Ground operating income increased primarily due to yield improvement, cost reductions, and higher volumes. Cost per package declined 2%, driven by lower line-haul expense and improved first- and last-mile productivity.”

Second quarter 2024, ended November 30. Source: FedEx

Reflecting on the overall results, John Dietrich, executive vice president and chief financial officer, said: “With demand continuing to pressure the top-line, we are pleased with our ability to deliver stronger operating leverage and improved profitability, enabling us to maintain our fiscal year adjusted earnings outlook.

“These results are a testament to DRIVE initiatives taking hold, where we are focused on improving margins and driving long-term returns for our stockholders.”

In April, FedEx unveiled plans to consolidate its various divisions as part of efforts to generate cost savings of $4bn.