Strong full year prediction from Atlas Air

30 / 07 / 2015

Freighter aircraft lessor Atlas Air expects to end 2015 with “a strong year and a significant increase in earnings” on the back of a second quarter that saw “contribution and margin strength” in the ACMI, charter and dry leasing sectors.

Bill Flynn, president and chief executive of Atlas Air Worldwide Holdings, said: “We are seeing good demand for our aircraft and services as we enter the second half of 2015, as many of our customers are outperforming the overall market.

“We are working closely with our customers to provide them with the most efficient aircraft and effective operating services for their needs.

“As we gather additional insight into second-half demand, yields and military requirements, we continue to look forward to a strong year and a significant increase in earnings compared with 2014.”

The US-based lessor reported adjusted net income attributable to common stockholders of $29.4m, for the three months ended June 30, 2015, compared with $15.9m for like period 2014.

For the first six months of 2015, adjusted net income attributable to common stockholders totalled $55.2m, compared with $27.1m in 2014.

In June, Atlas announced a ramp up to its fleet, acquiring a new B747-8 freighter from Boeing and to operate two additional B747-400Fs after reporting “good demand for airfreight”.

Flynn added: “Our approach to business growth remains disciplined, and we are managing our fleet accordingly. In addition, we are utilising proceeds from our recent convertible note issuance to refinance higher cost debt, which will reduce aircraft ownership costs, increase fleet flexibility and enhance cash flows.

“Led by the strength of our brand and our global market leadership in outsourced aircraft assets and services, we are taking advantage of market opportunities and continuing to focus on longer-term business growth.”

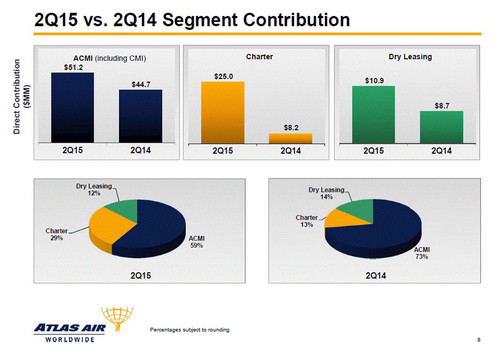

Revenue and direct contribution in ACMI in the second quarter benefited from an increase in block hour volumes, driven by the start-up of four additional 767 CMI aircraft and an improvement in 747 cargo aircraft utilisation. Segment contribution also benefited from lower heavy maintenance expense.

In charter, “significantly higher segment revenues” reflected an increase in commercial cargo demand and improvements in military passenger and cargo demand.

In addition, segment contribution benefited from those higher flying levels and a reduction in heavy maintenance expense. The decrease in revenue per block hour was primarily driven by the impact of lower fuel prices.

In dry Leasing, revenue and profitability grew as Atlas realised revenue from maintenance payments related to the scheduled return of a 757-200 cargo aircraft in April. This aircraft was subsequently leased to DHL Express on a long-term basis during the quarter.

Said Flynn: “We are encouraged by our strong first-half performance. We are seeing good demand for our aircraft and services this quarter and for the remainder of the year. And we continue to anticipate significant growth in adjusted diluted earnings per share in 2015.”