Freighter operators face margin squeeze

07 / 03 / 2024

Copyright: Jaromir Chalabala/ Shutterstock

Operating freighter aircraft has historically been a business with tight margins, a market environment temporarily interrupted by the Covid-19 pandemic. Recent airline financial statements again show (more familiar) marginal profitability levels, despite yields that remain 35%-40% up on 2019 figures.

Slim pickings: turning a profit in air cargo

For the two decades ahead of Covid-19, the air cargo industry faced increasing pressure on yields, as a continuous influx of cargo-friendly widebody passenger aircraft combined with steady additions to the global freighter fleet led to sustained growth of global air cargo capacity.

This in turn gradually worsened the industry’s demand-supply balance. Freighter operations were (on average) marginally profitable, with one cargo-only airline averaging a 2.1% ebitda margin between 2010 and 2019.

Cargo’s Covid era: the biggest bull market in history

The impact of passenger aviation on the cargo industry became more apparent than ever during the outbreak of the global Covid pandemic. Air cargo’s demand-supply balance tipped heavily in favour of airlines as the parking of passenger aircraft massively reduced supply while demand for air cargo soared.

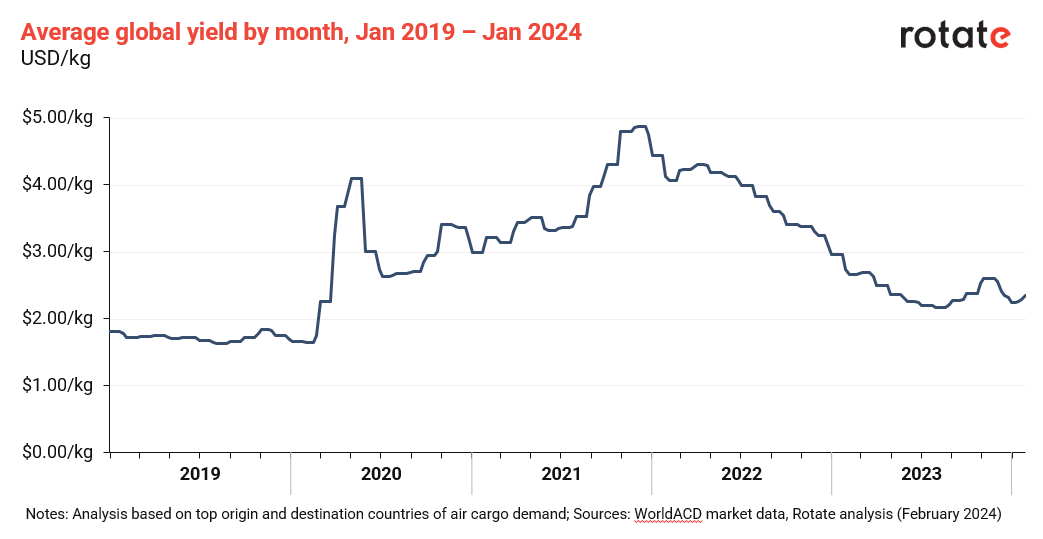

“Cargo yields nearly doubled overnight (see figure 1), with yields on the most affected trade lanes quadrupling,” noted Rogier Blocq of WorldACD, a leading market data provider that provided yield data for this study. “Global yields are still considerably higher than pre-Covid averages”.

Figure 1: Global average air cargo yields in 2019-2024. Following an initial spike in yields in 2020 as mouth masks had to be quickly distributed around the world, air cargo yields peaked in Q4 2021 through a combination of strong consumer demand and congestion in the world’s container ports.

Only half of the story: why looking at profitability matters

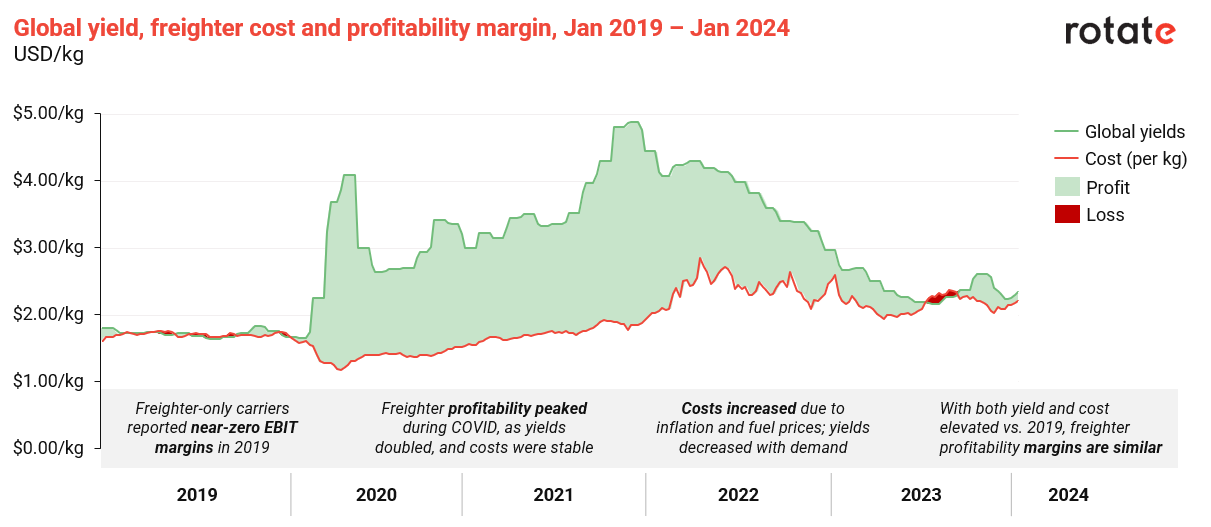

While yields are still elevated versus pre-Covid levels, revenue is only half the story. The recent surge in inflation (OECD indicates combined inflation of 21.6% between 2020 and 2023) has amplified the need to look beyond fuel and consider other costs when studying freighter profitability, with crew, maintenance and airport services also increasing some 25%.

Combining WorldACD’s air cargo yields with Rotate’s freighter cost benchmark model paints a picture of global freighter profitability over time (see figure 2).

Figure 2: Freighter profitability over time, showing the global average yield (green line) compared to estimated average cost per kilogram of large (B747/B777) freighters, assuming an 8,800km flight at 80% load factor.

This analysis highlights that freighter profitability – despite higher yields – did indeed revert to marginal pre-Covid levels, supporting comments by leading industry figures at the back end of 2023. In fact, during the third quarter of 2023 market conditions were temporarily worse than in 2019 (itself not a great year for air cargo).

Since then air cargo saw a rebound in demand (WorldACD figures show demand up +9% in the first two months of 2024 versus the year before), but market conditions are expected to remain marginal going forward.

The Temu effect: advantage Asia

Whilst overall cargo profitability has fallen drastically, these aggregated global figures hide another key trend impacting air cargo in the last 18 months: another incredible rise of e-commerce demand, this time mainly driven by platforms like Shein and Temu.

Online cross-border consumer orders have been a welcome sight as demand for general air cargo lagged, with Shein and Temu expecting to fill (the equivalent of) 90 Boeing 747 freighters out of Southern China every day by the end of the year. For reference, Rotate Live Capacity data only shows around 500 active B747/B777s.

The effect on air cargo has been profound, with WorldACD’s Rogier Blocq observing that “yields out of China and Hong Kong at the beginning of this year were still up +45% vs 2019, whilst yields across the rest of the world are 15% higher than in the same period”.

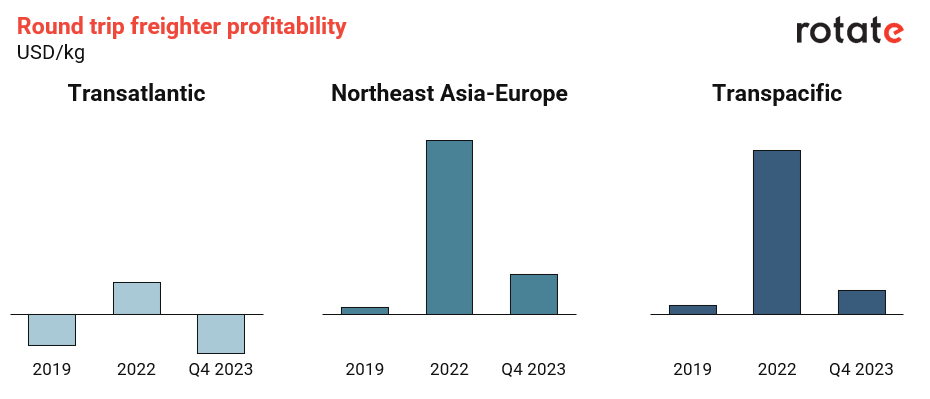

As a result, freighter operations to/from Asia Pacific have maintained higher profitability than those on other trade lanes (see figure 3), and conversely freighter operations on the Transatlantic are challenging again.

Rotate’s Live Capacity data confirms that Transatlantic freighter capacity was indeed down -15% in January 2024 versus the year before, while more cost-competitive passenger belly capacity grew +5%.

Figure 3: Estimated contribution per kilogram of large (B747/B777) freighters for three round trips in 2019, 2022 and Q4 2023. Whilst contribution on all trade lanes has dropped since 2022, those to/from Asia Pacific still exceed 2019 levels.

How a return to marginal freighter profitability may impact airline decisions in 2024

The return to pre-Covid profitability levels should impact airline decisions in 2024, ranging from difficult freighter fleet decisions for some airlines to a renewed focus on planning and optimisation for all.

Whilst some airlines may still target growth in 2024 (exploiting pockets of growth on various trade lanes, including those driven by eCommerce demand), others will pull all available levers to meet their budgets and manage the (often high) expectations of airline executives that grew accustomed to double-digit cargo margins during Covid.

These levers include optimisation in (freighter) network planning, sales steering towards an airline’s optimal commercial mix, faster and sharper pricing to ensure capacity is visible on all distribution channels at the right price, and a data-driven approach to sales initiatives.

Longer term strategic considerations include those on fleet, with several airlines already cancelling orders for (conversion) freighter aircraft (replacing these with passenger aircraft orders) or studying the potential of partnerships to supplement the current network and fleet. eCommerce may again influence airlines’ (fleet) decisions, with its different density profiles influencing the attractiveness of freighter types.

Add these pending decisions to a seemingly constant stream of disturbances for airlines to deal with, and 2024 looks like another interesting year for air cargo.

Tim van Leeuwen is a strategy consulting project manager at Netherlands-based Rotate, the go-to team in the cargo industry for commercial decision-making.

Rotate would like to thank WorldACD Market Data for their input to this article.