German airfreight market registers 22% decline in 2020

18 / 02 / 2021

Image source: Shutterstock

Last year, in the wake of the coronavirus pandemic, global airfreight traffic fell by 10.6% year on year, according to IATA; this is the biggest decline since records began in 1990.

But how did the year go for market participants in Germany? How did the top 10 airfreight forwarders and airlines fare in 2020?

Freight forwarders: Mixed signals for DSV

Note: data does not include charter and direct freight sales

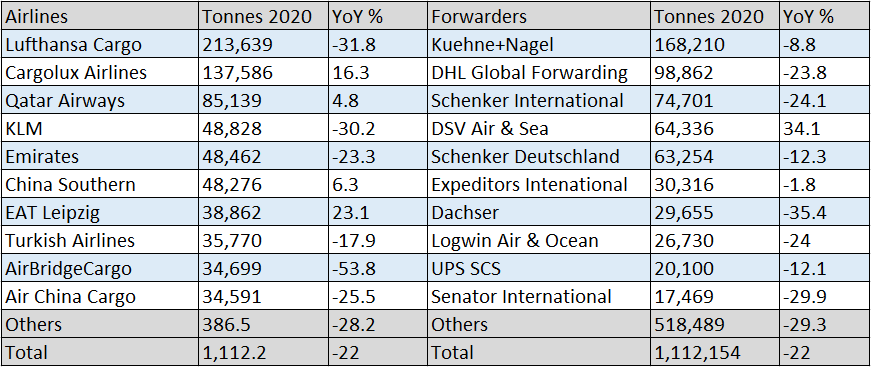

At first glance, Danish freight forwarder DSV appears to be the big winner in the German airfreight market in 2020, with an increase of 34% compared to 2019 (see table at end of article).

But a closer look at the data shows the opposite: DSV actually lost marketshare when the integration of Panalpina is taken into account.

Compared to the cumulative freight volumes of DSV and Panalpina in 2019 (around 113,700 tonnes), DSV, saw volumes decline by more than 43% to 64,300 tonnes — almost twice as much as the overall market (22%).

The new DSV has less freight than Panalpina in 2019 alone (65,700 tonnes).

This puts DSV in fourth place, but it has lost almost 2.2 percentage points of market share compared to the cumulative DSV/Panalpina figures for 2019.

Kuehne + Nagel (KN) and Schenker, on the other hand, are among the winners of 2020. Both forwarding companies lost volumes (KN: 8.8% compared to 2019; Schenker, when combining Schenker Deutschland (JetCargo) and Schenker, 19.4%), but they were able to increase their marketshares.

KN increased by 2.2 percentage points to 15.1% and Schenker has a market share of 12.4% (up 0.4 percentage points).

DHL Global Forwarding lost almost 24% of its volume compared to 2019 and is still in third place behind KN and Schenker with a market share of 8.9% (minus 0.2 percentage points).

The biggest winner amongst the main freight forwarders is Expeditors International: In 2020 it will lose just 1.8% of its volume compared to the previous year and is the only one of the smaller airfreight forwarders within the top 10 to increase its market share (2.7%/up 0.6 percentage points).

With this result, the company climbed four places to fifth ahead of Dachser.

Airlines: high-flyer Cargolux

Cargolux is the big winner of 2020 among the top 10 airlines. The Luxembourg-based carrier was able to increase its freight volume by 16.3% compared to 2019, clearly beating the overall market, which registered a 22% decline.

In 2020, Cargolux will have a market share of just under 12.4% with around 138,000 tonnes, an increase of four percentage points compared to 2019.

Although three other airlines in the top 10 increased their freight volumes in 2020 (Qatar Airways, China Southern Airlines, European Air Transport Leipzig), none matched the increase registered by Cargolux.

Overall, the top 10 carriers registered a 28.2% decline, which lags behind the overall market.

Lufthansa Cargo is the market leader in Germany with almost 214,000 tonnes, but its lead is shrinking.

Compared to the previous year, the carrier lost almost a third of its tonnage and its marketshare dropped by 1.8 percentage points to 19.2%.

AirBridgeCargo registered the largest drop in 2020: The Russian cargo airline recorded a fall in volume of 53.8%, its marketshare fell by around 2.2 percentage points and the airline fell five places to ninth place in the ranking.

KLM reported the third largest drop off in the top 10 with a fall in volume of 30.1%. Its marketshare fell to 4.4%.

IATA CASS. Data does not include charter and direct freight sales