IAG Cargo traffic up on shipping disruption but revenues slide

17 / 06 / 2017

IAG Cargo saw revenues decline in the first quarter of the year due to challenging market conditions but it registered an improvement in traffic partly driven by container shipping disruption.

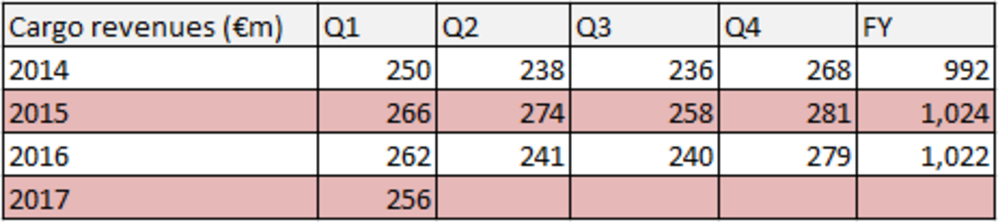

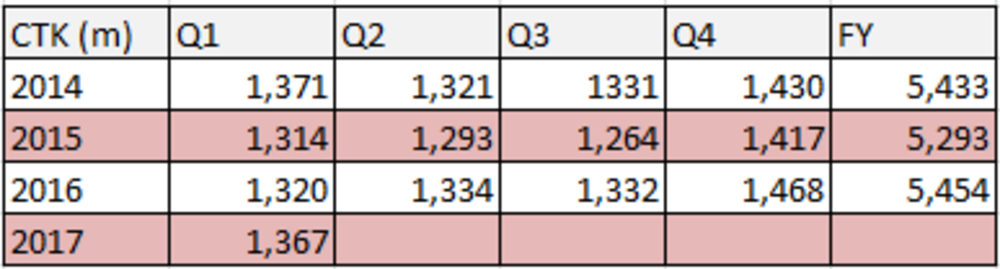

The cargo arm of IAG, which owns British Airways, Iberia and Aer Lingus, recorded a 2.3% year-on-year decrease in first-quarter cargo revenues to €256m, while traffic increased by 3.6% to 1.4bn cargo tonne km (CTK).

It is the division’s fifth quarterly year-on-year decline in revenues in a row and the fifth increase in traffic against the previous year’s results, thanks in part to its purchase of Aer Lingus last year.

Lufthansa saw cargo traffic increase by 6.3% during the first quarter.

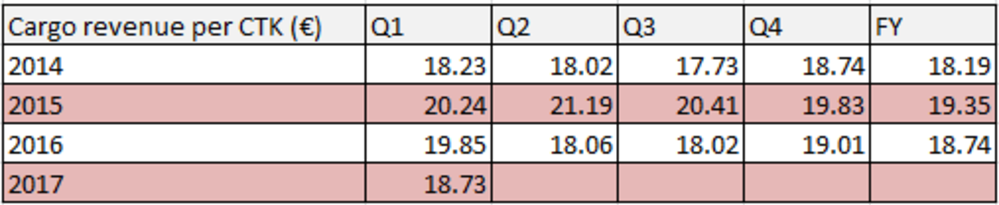

Cargo tonnes carried up slightly at 171,000 tonnes and cargo revenue per CTK slipped to 18.73 cents against 19.85 cents last year.

It should be noted that IAG has re-stated cargo tonnes carried for the period in 2016, reducing the figure from 205,000 tonnes to 170,000 tonnes.

IAG Cargo chief financial officer Lewis Girdwood said the year had got off to an “encouraging start” but also acknowledged difficult market conditions.

Traffic growth was driven by increased demand from Asia Pacific but also disruption in the box shipping market caused by the break up and re-formation of carrier alliances.

“Increased demand from Asia Pacific and Europe has led to a growth in airfreight volumes between the two regions, driven in part by sea freight constraints,” said Girdwood.

“With over 150 flights per week to and from 15 Asian destinations, we are well placed to work closely with our freight forwarding partners to help alleviate this pressure and ensure shippers’ supply chains remain uninterrupted.

“Through the first quarter of the year we saw a 34% rise in volumes from Europe to Asia Pacific when compared to the same period in 2016, with fashion, spare parts, fresh fish and leather goods performing particularly well.

“UK and European markets have also performed well throughout the first quarter of the year, with notable strong North American demand from the perishables and aerospace sectors.

“However, the global airfreight market remains challenging overall, with poor weather conditions in Latin America affecting substantial fresh produce flows and a continued oversupply of capacity in the market, placing pressure on yields.”

To meet the challenging market conditions, IAG is investing in new products and a new website, whilst also focussing on cost.

Girdwood said: “Conscious that a volatile market place remains a consistent possibility, we remain focused on the continued development of our products and services that enhance our customer offering.

“We are pleased with the development of our newest product, Critical, which has now surpassed 1,000 shipments since its launch helping meet the demands of the emergency shipment market.

“The second quarter of the year will see us introduce a new website for our customers, which will greatly simplify the way forwarders book airfreight with IAG Cargo.

“This will be accompanied by an enhanced proposition specifically for our smaller and medium-sized forwarders.

“Our continued focus on cost management combined with premium product growth has enabled us to offset some yield pressure.

“Throughout 2017 we will continue to bring further benefits to our customers by understanding their needs and investing in key areas of our business, such as IAGCargo.com.

“We will be introducing a number of new innovations to help drive forward the digitisation of cargo and will continue to improve our customers’ shipping experience”.