IATA: Cargo declined in January but COVID-19 impact yet to be felt

04 / 03 / 2020

IATA has warned that the full extent of the coronavirus’ impact on the airfreight sector is yet to be determined, while demand declined by 3.3% year on year in January.

IATA suggested that the timing of the Chinese New Year Holiday, which took place in late January, as well as eased tensions between the US and China amid their trade war were the cause of the January decline.

They also contributed towards “the bulk of the negative impact of the coronavirus on air cargo” shifting until February.

Alexandre de Juniac, IATA director general and chief executive, explained: “The air cargo industry started the year on a weak footing.

“There was optimism that an easing of US-China trade tensions would give the sector a boost in 2020. But that has been overtaken by the COVID-19 outbreak, which has severely disrupted global supply chains, although it did not have a major impact on January’s cargo performance.

“Tough times are ahead. The course of future events is unclear, but this is a sector that has proven its resilience time and again.

De Juniac added: “January marked the tenth consecutive month of year-on-year declines in cargo volumes.”

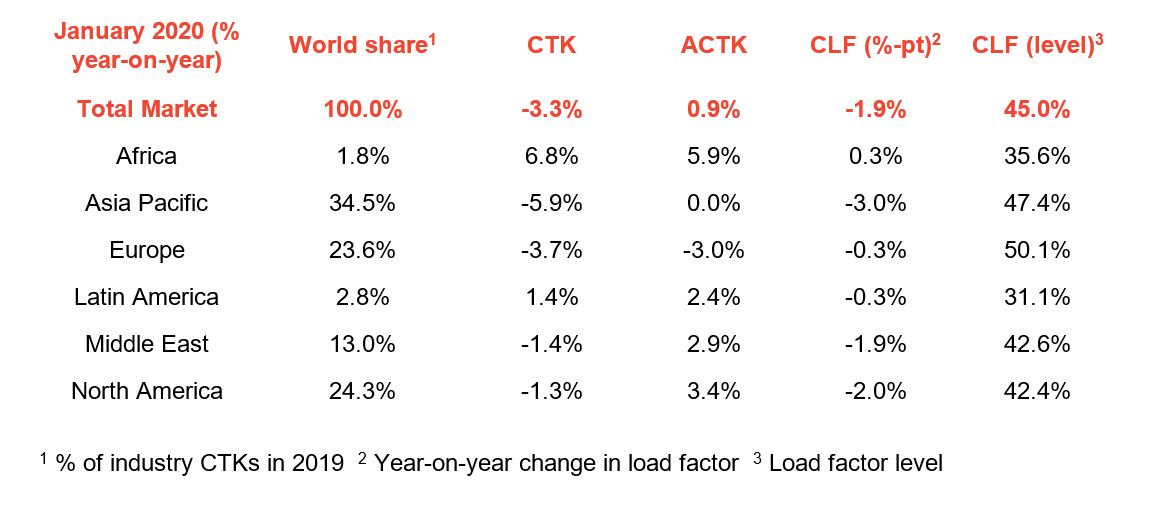

In January, total market available cargo tonne kms (ACTKs) decreased 0.9%, down from 3.8% in December. Meanwhile load factors fell by 1.9 percentage points compared with a year ago to 45%.

Regionally, Africa-based airlines experienced growth for the eleventh consecutive month, making it the best-performing region in January. However, the region’s 6.8% growth represented “a sharp slowdown from December and a softer pace compared with H2 2019, which had an average of 11%”.

In January, airfreight demand for Latin America-based airlines increased 1.4% year on year. This compared with a 2.5% decrease in December 2019 and was the best-performing month for the region since mid 2019. Capacity for the region’s airlines also increased by 2.4% year-on-year.

Demand in January for Middle East-based airlines declined by 1.4% and capacity increased 2.9% compared with the same period in 2019.

Commenting on the region’s performance, IATA noted: “Given the Middle East’s position connecting trade between China and the rest of the world, the region’s carriers have significant exposure to the impact of COVID-19 in the period ahead”.

North America-based airlines saw demand decrease by 1.3% in January 2020, compared with the same period in 2019. Capacity meanwhile increased by 3.4%.

IATA pointed out that: “Seasonally-adjusted cargo demand rose slightly however, amid a more supportive operating environment and following the thawing of US-China trade relations.”

Europe-based airlines experienced a 3.7% decline in cargo demand in January year on year – a slide from the 1.1% decline noted in December 2019.

Capacity also decreased by 3% year on year. Seasonally-adjusted demand also dropped sharply, disrupting the positive trend that started mid-2019.

IATA suggests that the presence of the coronavirus in the region will put pressure on its performance in the months to come.

Finally, the Asia Pacific was the worst-performing region in January, with a year-on-year decrease in demand of 5.9%.

Seasonally-adjusted cargo demand rose slightly, due to thawing of US-China trade relations.

Similar to its comments about Europe’s expected performance, IATA highlighted that the Asia Pacific region’s performance is likely to suffer because of disruption caused by the coronavirus.