IATA: Peak season off to a disappointing start

04 / 12 / 2019

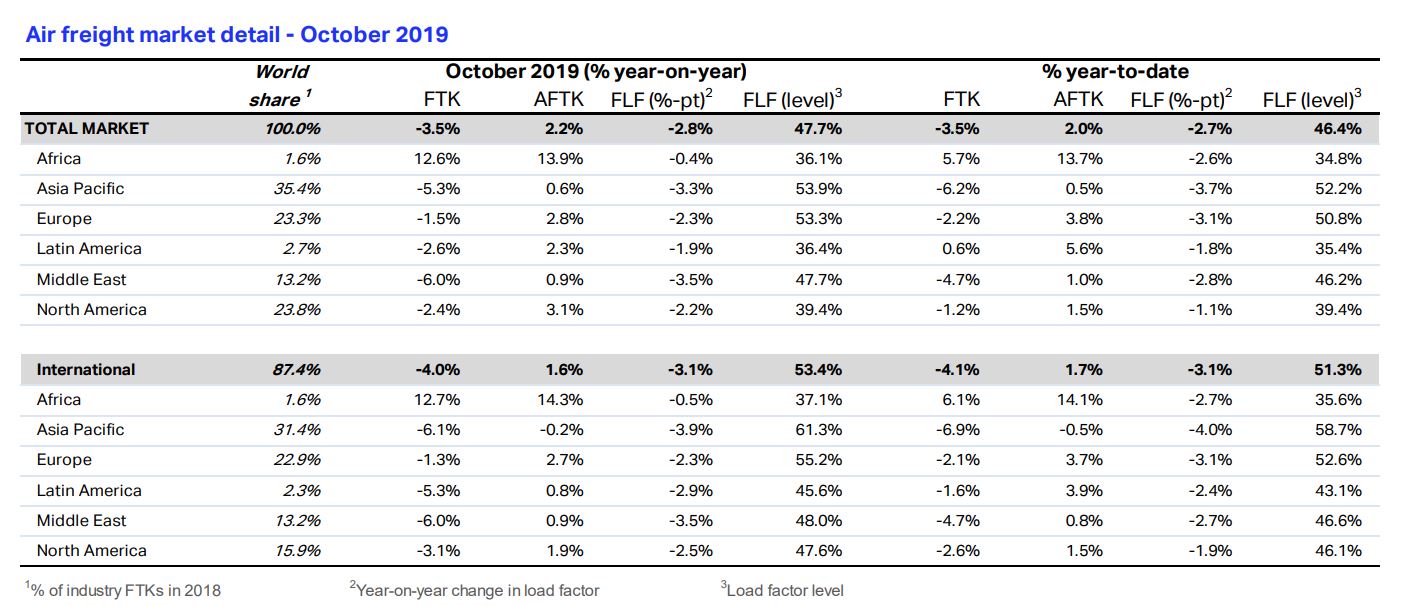

It’s a slow start for peak season, but key market drivers show signs of stabilising, IATA has reported in its October airfreight market analysis report.

Despite peak season being dominated by consumer-led holidays that impact the airfreight market – such as Singles Day, Black Friday, Cyber Monday and Christmas – October 2019 saw industry-wide freight tonne kilometres (FTKs) slide.

“Air cargo’s peak season is off to a disappointing start, with demand down 3.5% in October,” said Alexandre de Juniac, director general and chief executive of IATA. “Demand is set to decline in 2019 overall – the weakest annual outcome since the global financial crisis. It has been a very tough year for the air cargo industry.”

IATA’s analysis added: “While not as bad as last month’s 4.4% decline, the global airfreight market remains weak; this is the twelfth consecutive month of falling annual volumes.”

Freight capacity, measured in available freight tonne kilometers (AFTKs), increased by 2.2% year-on-year in October.

“Capacity growth has now outstripped demand growth for the 18th consecutive month,” IATA reported.

“Airfreight volumes look set to record a year-on-year decline in 2019 and the worst annual outcome since the global financial crisis,” IATA commented.

More positively, however, it hinted the the worst could be over, although the market outlook remains uncertain. “There are some tentative indications of modest improvement or stabilisation amongst some of the key demand drivers. It remains to be seen whether these will be more than transitory developments,” it added.

Regions continue to display varying performances, impacted by factors such as Brexit in Europe; the US-China trade war, which has impacted North America’s performance; and political unrest in Hong Kong which has hit Asia Pacific.

African carriers experienced the highest regional growth as FTKs increased by 12.6%. “This trend is underpinned, in part, by large-scale foreign investment, in particular from Asia, which creates new business and trade opportunities,” IATA explained.

For European airlines, FTKs declined by 1.5% year on year, which was an improvement over the 3.3% decrease in September. IATA attritbuted this improvement to “better than expected economic activity in Q3 in several of the region’s large economies”.

Similarly, airlines in the North American region reported a 2.4% year-on-year fall in FTKs in October, which was a slight improvement from the 4.2% year-on-year decline in September.

“While annual growth remains in line with that observed in the past six months or so, seasonally adjusted (SA) volumes are currently trending sideways,” IATA explained. “SA traffic on the largest routes to/from the region is showing a modest upward trend over recent months.

“Combined with the recent positive signs on the trade front, this may bode well for the performance in coming months,” it added.

In October, Latin American airlines reported a 2.6% year-on-year decline of FTKs. The Asia Pacific region’s airlines, meanwhile, posted a 5.3% year-on-year decrease in demand, which IATA puts down to disruptions caused by ongoing protests in Hong Kong, a key hub for the region.

Middle East carriers experienced the largest annual fall (6%) in FTKs (in October). However, on a more positive note, IATA explained that: “seasonally adjusted volumes in the region appear to have resumed a modest up-trend.”