Lufthansa tops the cargo pile in Europe for 2015 despite demand declines

14 / 01 / 2016

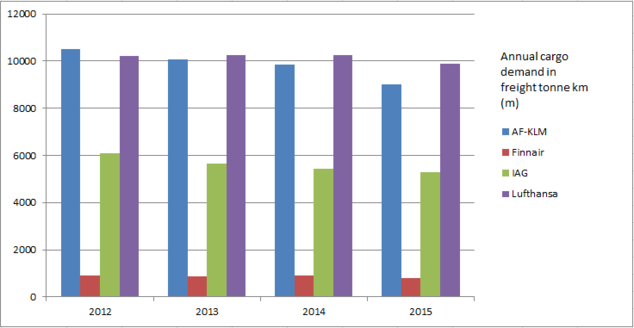

Europe’s major combination carriers saw cargo volumes decline in 2015, with Lufthansa maintaining its position as the busiest of the airlines.

The German carrier group was the busiest of the airlines that report monthly statistics for the third year in a row.

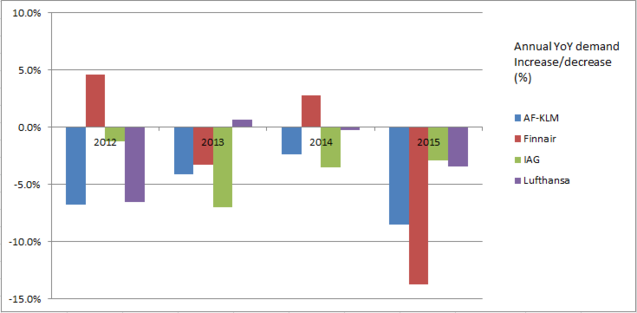

However, it was not all good news for Lufthansa as the airline registered a demand decrease of 3.4% year on year to 9.9bn revenue cargo tonne km.

The largest percentage declines came in its Middle East/Africa region (-7.9%), followed by Europe (-5.3%), Americas (-2.6%) and Asia Pacific (-2.5%).

Source: companies

The decline comes as competitor carriers ramp up services and the world’s economy continues to grow at a lower level than in the past, turbulence in the Chinese market and the strong US dollar all affected its cargo division.

However, other factors also had an impact on the German carrier group. Strikes called by the Vereinigung Cockpit pilots’ union and the cabin crew union UFO also weighed heavily on Lufthansa Cargo.

On the capacity front, Lufthansa, unlike its main rival Air France-KLM, increased capacity by 2% through the year.

As a result of supply increasing ahead of demand, Lufthansa saw its cargo load factor decline to 66.1% from 69.7% in 2014.

Lufthansa will be taking action to reduce freighter capacity this year and will withdraw two MD-11 freighters.

Its all-cargo fleet will consist of five Boeing 777 freighters as well as twelve MD-11Fs.

Source: companies

The second largest European combination carrier for the third year in a row – since it lost its place at the top of the pile in 2013 – was Air France-KLM.

The Franco-Dutch carrier recorded an 8.5% decline in cargo volumes – the second highest of the four carriers analysed – to 9bn FTK.

It has now recorded annual cargo demand declines for the past four years – since Air Cargo News records began – but 2015 was the largest registered over that period.

While the airline would have undoubtedly been affected by the general market conditions that took their toll on all airlines, there were also other factors to consider.

Firstly, the airline group has been reducing freighter capacity as the year has progressed. In December, for example, full freighter capacity was down by 29% year on year.

The airline was also affected by a slowdown in demand in November as a result of the Paris attacks.

While freighter capacity declined by double-digit levels in 2015, overall cargo capacity at the airline was down by 4.5% against the previous year.

As a result of demand decreasing ahead of supply, its load factor slipped to 60.5% from 63.2% a year earlier.

While Air France-KLM saw its load factor slide in 2015, the decline was not as bad as that experienced by Finnair.

The Helsinki-headquartered airline saw its cargo load factor for 2015 slip to 57.1% from 64.5% a year earlier.

The reason for the fall was a double-digit decline in demand while a reduction in freighter capacity was not enough to offset bellyhold additions.

Overall demand was down by 13.7% on 2014 levels to 787m FTK, reflecting Finnair’s decision to exit from the intercontinental freighter market at the start of last year when it ended its Helsinki-Hong Kong service.

Deliveries of its first A350 XWB (extra widebody) aircraft will start to add capacity back.

Finnair deployed its inaugural A350 on the Helsinki-Shanghai route in November, followed by Bangkok and Beijing.

The Hong Kong and Singapore routes will be upgraded as more of the new aircraft type enter service ─ Finnair has so far received four out of a total order of 19.

These aircraft will offer an additional capacity per plane of 16-20% and will increase total cargo capacity by 50% when all are delivered.

Finnair Cargo and IAG Cargo also announced a freighter deal with DHL in July that will see the two airlines share space on a DHL flight between London Luton and Helsinki.

IAG, meanwhile, recorded the smallest demand decrease of the four carriers. The British Airways, Iberia and Aer Lingus parent saw traffic slip by 3% year on year in 2015 to 5.3bn FTK.

It has also withdrawn from the freighter market, in favour of partnerships, as it looks to soak up belly capacity.

Its December, figures were boosted by the acquisition of Aer Lingus. In fact, in December it recorded its first monthly demand increase since April and only its fourth increase in the last three years.

However, if Aer Lingus’ figures were included into the December 2014 performance, IAG would have once again have recorded a monthly decrease.

Source: companies