Lufthansa’s cargo arm records another ebit loss

29 / 10 / 2015

Lufthansa’s cargo and logistics division reported an operating loss for the second quarter in a row as impairment costs and tough market conditions took their toll.

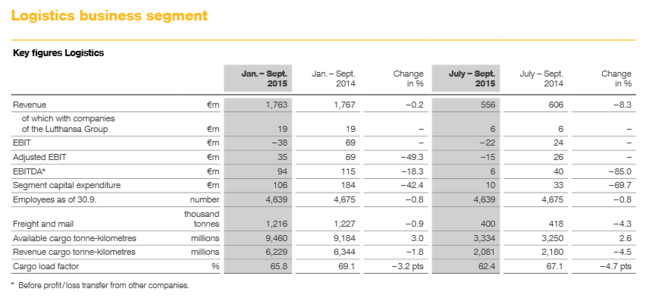

The airline’s logistics division, which includes Lufthansa Cargo, ULD specialist Jettainer and its Aerologic investment, saw revenues for third quarter decline by 8.3% year on year to €556m, while for the first nine months income is 0.2% behind a year earlier at €1.8bn.

Earnings before interest and tax (Ebit) fell into the red for the second quarter in a row, reaching a loss of €22m compared with last year’s profit of €24m.

For the first nine months of the year the company recorded an Ebit loss of €38m compared with a profit of €69m in 2014.

Results for the first nine months have been negatively affected by impairment losses, increased staff costs and increased depreciation on new Boeing 777 freighter aircraft.

The impairment includes €73m on project costs in association with the postponement of its planned freight terminal at home hub Frankfurt and planning costs for the construction of an administration centre.

During the quarter, a strike was held by the Vereinigung Cockpit pilots’ union on September 9, affecting all short-haul routes at Lufthansa passenger airlines and Germanwings, which followed a strike on long-haul flights by Lufthansa passenger airlines and Lufthansa Cargo the day before.

The decline in revenues and Ebit also comes as traffic and load factors decreased on 2014 levels.

Lufthansa Cargo recorded a 4.5% year on year decline in third-quarter revenue cargo tonne km to 2.1bn, while available cargo tonne km increased by 2.6% on a year earlier to 3.3bn.

As a result of supply increasing ahead of demand, its 2015 third-quarter cargo load factor slid to 62.4% from 67.1% a year ago.

It said the cargo market this year had been highly competitive with increasing belly capacity putting pressure on rates.

To mitigate these challenges, the airline aims to create more partnerships following its ANA model, be flexible with capacity and focus on specialist segments.

The division has also adopted a new cost-cutting programme. Annual operating expenses, mainly staff costs, are to be reduced by at €40m by 2018.

“Demand on global airfreight markets picked up in the first quarter of 2015, but lost momentum in the second and third quarters,” it said.

“Competition on global airfreight markets remains intense. Airlines from the Middle East and Turkey especially are increasing their freight capacities, particularly due to their many new passenger aircraft.

“Faced with these market conditions, Lufthansa Cargo focuses on the highest quality and flexible capacity management.”

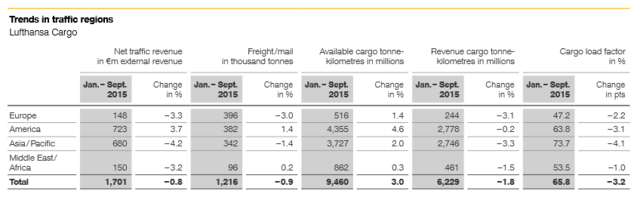

In terms of volume performance in tonnage terms for the first nine months, freight volumes in the Americas traffic region went up year on year by 1.4%, with growth on North American routes generated by increased freighter capacity. South Atlantic route belly capacity increases were offset by a reduction in freighter capacities.

Freight volumes in the Asia/Pacific region were down 1.4% year on year, while in the Middle East Africa region there was a slight 0.2% increase. Freight volumes within Europe declined by 3%.

Lufthansa also provided updates on the delayed Frankfurt freight centre, its new IT platform and its fleet.

“In April 2015, the decision on the construction of the LCCneo logistics centre was postponed by at least two years," it said.

“Steps are now being reviewed as a result to improve the efficiency of the existing freight centre.

“Progress is being made on implementing a new IT infrastructure for freight handling. The biggest IT project in the company’s history is to be completed by the end of the year.

“In view of the still difficult economic conditions Lufthansa Cargo will nonetheless trim its fleet slightly.

“In addition to the five B777 freighters, the number of MD-11s flying in the Lufthansa Cargo route network is to be reduced from 14 to twelve.”

The overall Lufthansa Group saw revenues increase by 5.7% year on year during the third quarter to €8.9bn, while its net profit jumped by 41.5% year on year to €794m.

Revenues were up on increases in passenger traffic and exchange rate effects while profit jumped on earnings improvement is mainly attributable to "strong summer business at the Group’s passenger airlines and continuing low oil prices".