Lufthansa’s cargo profits tumble in Q3

02 / 11 / 2023

Source: Lufthansa Cargo/Oliver Roesler

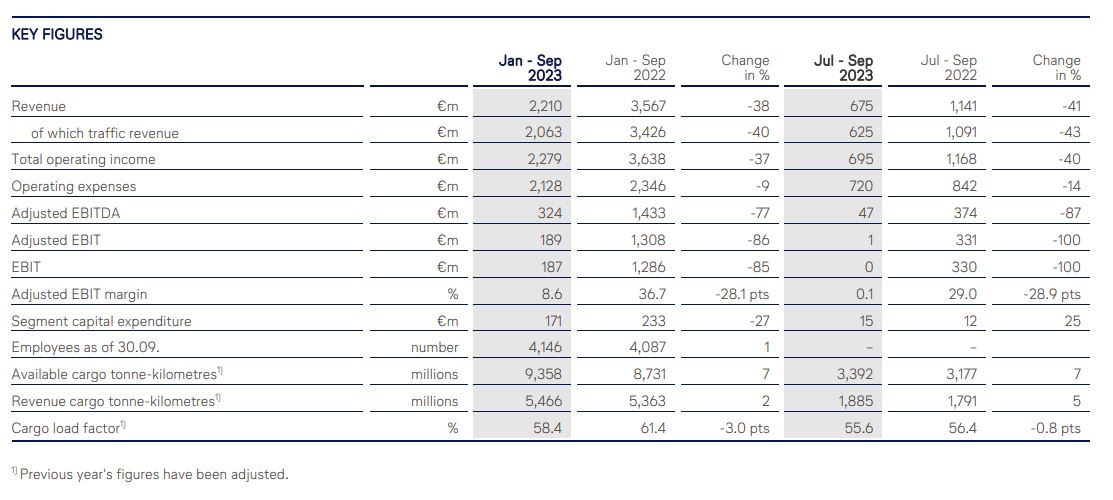

Lufthansa’s logistics business was unable to make an operating profit in the third quarter of the year as the market normalised following the Covid pandemic.

The logistics division, which includes Lufthansa Cargo, time:matters, Jettainer, HeyWorld and a 50% stake in AeroLogic, saw third-quarter earnings before interest and tax (ebit) fall to €0 compared with a profit of €330m a year earlier.

It is the first time since the first quarter of 2020 that the carrier has failed to report an ebit profit, although the third quarter does tend to be one of the weaker times of year for the air cargo industry.

For comparison, in the third quarter of pre-covid 2019, the carrier reported a cargo ebit loss of €49m.

Meanwhile, third-quarter cargo traffic was up 5% to 1.9bn revenue tonne kms, revenues declined 41% to €675m and the cargo load factor slipped 0.8 percentage points to 55.6%.

Like many carriers with a passenger fleet, the airline has seen cargo revenues decline in line with a drop off in rates this year while volumes have increased as passenger operations – and therefore bellyhold operations – have been getting back underway.

Cargo capacity for the period was up 7% in the third quarter to 3.4bn available cargo tonne kms.

The airline group said that its cargo business was impacted by weak demand in the global air cargo market in a seasonally weak quarter.

It added that the stabilisation of cargo yields and volumes indicates a bottoming out of the market.

The airline said of performance over the first nine months: “The operating performance in the logistics business segment returned to normal in the reporting period compared with the record levels seen in the previous year.”

It added: “Yields fell in all of Lufthansa Cargo’s traffic areas and were 41% down on the previous year, although they were 45.6% above the 2019 pre-crisis level.”

“Operating expenses decreased by 9% to €2.1bn (previous year: €2.3bn); reduced charter expenses, lower fuel expenses and efficiency-boosting and cost reduction measures largely compensated for inflation effects.”

Lufthansa is not the only airline to have seen its cargo performance come under pressure this year due to lower rates.

Air Canada and IAG have also reported declining cargo revenues in the third quarter of the year, although they do not provide operating profit figures for cargo.

Lufthansa Cargo equips another freighter with fuel saving tech