Seabury highlights a mixed picture for air cargo

09 / 11 / 2022

Sander Schuringa. Source: Air Cargo News

While the air cargo industry faces dark clouds there are reasons to stay positive, according to Accenture’s Seabury Cargo.

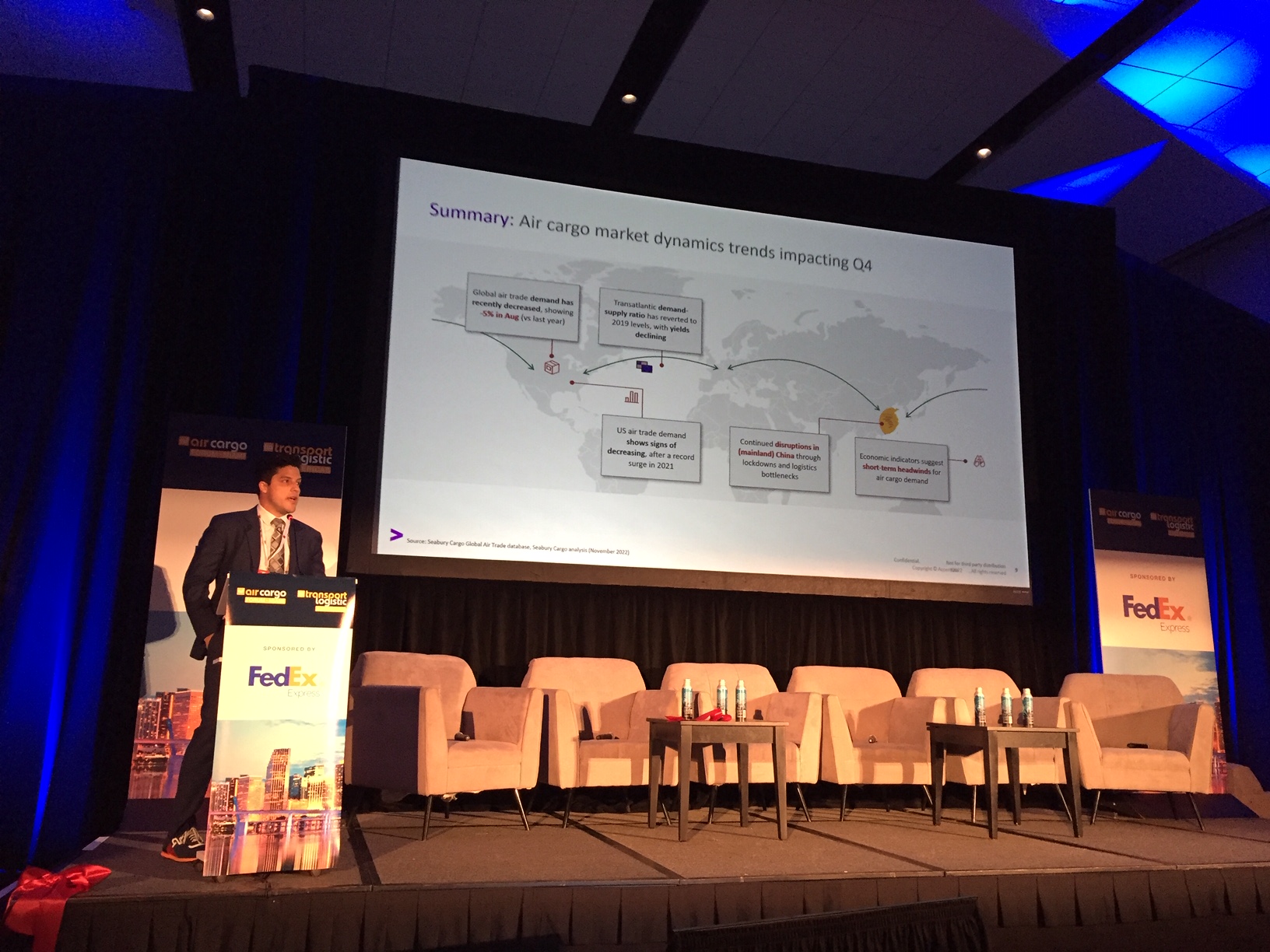

Speaking at the TIACA Air Cargo Forum, the consultant’s commercial manager Sander Schuringa highlighted the current headwinds facing the air cargo sector.

He pointed to air cargo demand being around 5% down year on year in August; the transatlantic supply ratio dropping back to 2019 levels with yields declining; US air trade showing signs of decreasing, continuing lockdowns and bottlenecks in China; and the impact of economic headwinds on air cargo.

Schuringa highlighted that in August demand was down year on year on most major trade lanes: volumes were down 15% from Asia to North America, down 6% from Asia to South America, down 15% intra-Asia and 9% behind from Asia to Europe, he said.

The only major trade lane showing year on year growth in August was the transatlantic where demand is up 10% to North America and 3% to Europe.

Elsewhere, he said that the supply demand balance had at the start of the summer flipped, with capacity now growing at a faster rate than demand each month. This meant lower load factors and rates. Capacity is up by 8% since the start of the year, he added.

However, it isn’t all doom and gloom for air cargo and the year-on-year figures only tell some of the story.

Schuringa explained that total air cargo capacity was still down around 6% compared with pre-Covid 2019 levels while air trade is up by 5% compared with two years ago.

Broken down, airline freighter capacity is up by around 9% on pre-Covid levels, integrator freighters are up around 29%, but bellyhold space is down around 29%.

Freighter capacity overall now represents around 63% of total market capacity compared with around 50% pre-Covid.

Another emerging trend highlighted by Schuringa is the entry into the market of ocean shipping lines with air cargo operations.

He said that ocean shipping lines had doubled their capacity since the start of the year but still only represented around 0.1% of the market.

He also pointed out that in that time, integrators had added five times more intercontinental air cargo capacity than ocean shipping lines active in airfreight.