Top 25 air cargo carriers for 2021 revealed

18 / 08 / 2022

B777F. Copyright: FedEx

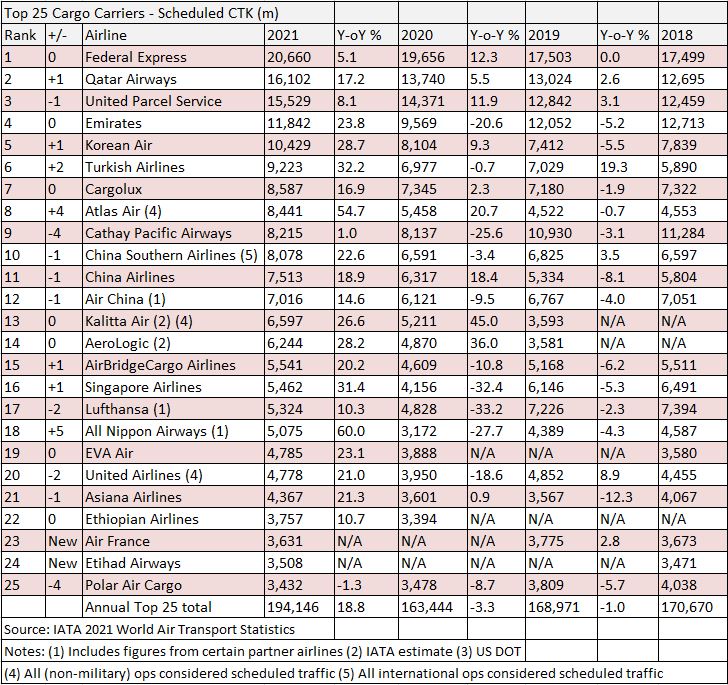

IATA World Air Transport Statistics (WATS) data for 2021 showed the top 25 cargo airlines last year had strong volume growth following a tough first pandemic year (full chart at end of article).

Overall traffic in scheduled cargo tonne km (CTK) terms increased by 18.7% year on year in 2021, a drastic improvement on 2020’s decline of 10.6%.

Demand was also up 6.9% on the pre-Covid year of 2019.

Performance at the top 25 airlines was roughly in line with the overall market, as those leading carriers saw cargo volumes increase by 18.8% year on year.

Full chart at end of article

Federal Express (FedEx) retained its position as the top cargo airline in 2021, albeit with a lower growth level than many of the other top-performing airlines.

The US express giant saw its volumes increase by 5.1% year on year to 20.7bn CTK.

However, volume growth weakened compared to 2020, when the company recorded a 12.3% year-on-year increase over 2019.

FedEx benefitted from strong demand for e-commerce, Covid vaccines, PPE and related supplies, plus international export and US domestic package volume growth.

Pandemic-related cargo charters and the resumption of passenger operations helped Qatar Airways move into second place in 2021 with a volume increase of 17.2% year on year to 16.1bn CTK.

The carrier also took delivery of three new B777 freighters at the start of last year.

United Parcel Service (UPS) saw growth of 8.1% to 15.5bn CTK last year, but the express operator dropped one place to third position.

UPS’s large fleet enabled it to make the most of demand but like FedEx, it wasn’t as able to capitalise on demand from freight forwarders and shippers for dedicated operations unlike others in the top 25.

The company added that growth in e-commerce growth slowed as the year progressed as covid restrictions were lifted and access to retail stores became easier.

Emirates benefited from the return of passenger operations to retain fourth place, but Cathay Pacific Airways’ capacity suffered due to quarantine requirements for Hong Kong-based pilots and cabin crew.

Meanwhile, cargo airline and aircraft lessor Atlas Air picked up both market growth and additional charter demand, and All Nippon Airways (ANA) also prospered, with demand for e-commerce and electronics serving it well while it added larger aircraft.