US port chaos boosts ex-Asia Pacific air cargo revenues

20 / 03 / 2015

Inbound US west coast container port congestion provided a November boost for transpacific air cargo revenues out of Asia to North America, although ex-US revenues fell.

WorldACD’s latest monthly market data found that the transpacific was the best of the large markets in November.

The Netherlands-based research house posed the question: “Did the problems in the western US ports play a role? Judge for yourselves: Air cargo revenues ex-US dropped by nine per cent month-over-month (MoM) across the Pacific.

“From Asia Pacific to North America, however, we recorded an impressive 17 per cent growth in revenues MoM, thanks also to a nine per cent yield increase.”

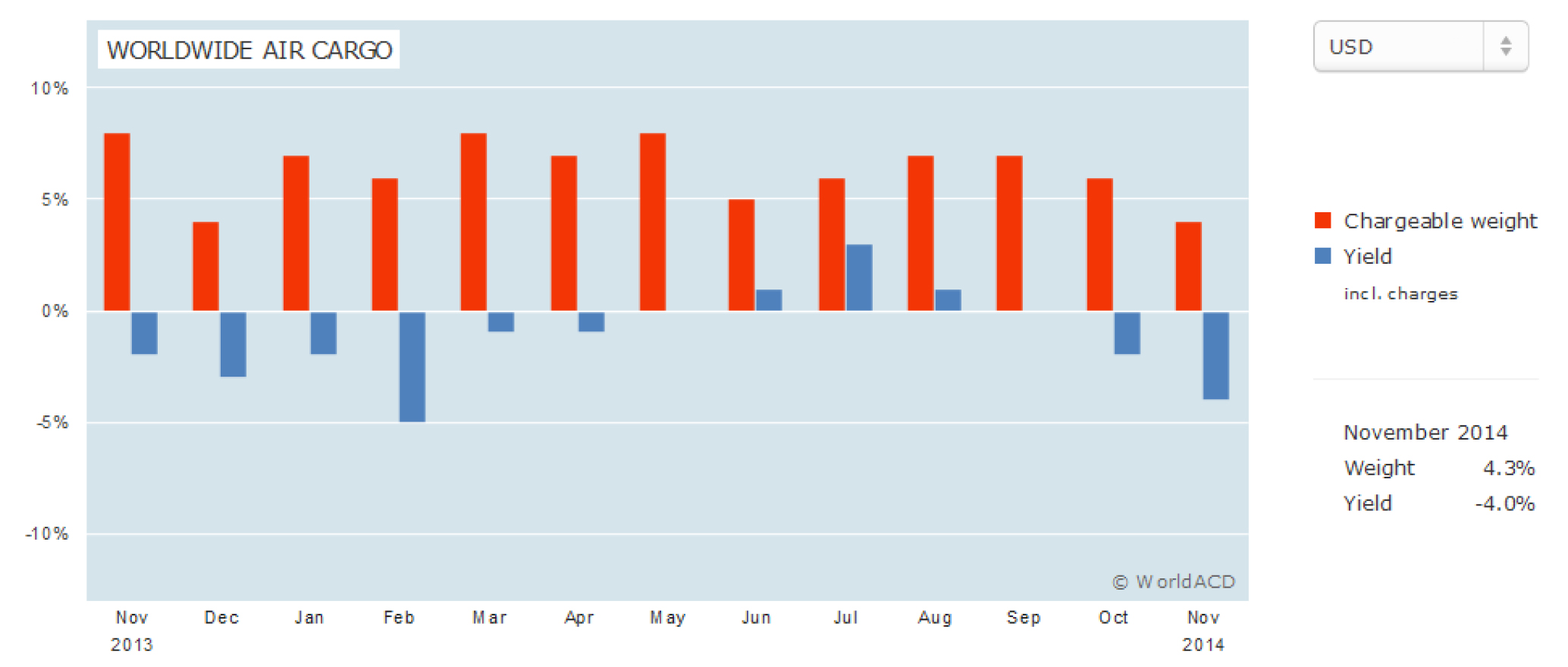

WorldACD, using primary data supplied from airlines, said that November did not disappoint for global air cargo, although year-over-year (YoY) growth slowed compared to earlier months.

“The lower figure of 4.3 per cent volume growth was influenced by the fact that, in 2013, November had shown a large jump over October. Worldwide November-yields again topped those for October, this time by growing 1.7 per cent (in US$).

“Yet, people predicting declining yields were also right: worldwide yield went down by four per cent YoY. Interestingly, yield excluding surcharges dropped less, a sign that changing fuel surcharges may begin to have an influence.”

After Asia Pacific, the African and Latin American markets were the next best performers, with YoY volume growth of over seven per cent.

Latin America “crowned its achievement” by keeping yields almost level. Europe suffered with revenues declining by more than five per cent, both MoM and YoY, though YoY revenue and yield increased when measured in Euros.

Middle East & South Asia (MESA) further consolidated its second position in pharmaceuticals (after Europe), by showing a YoY revenue growth in this category of 17 per cent, with slightly climbing yields.

In the perishables markets, Africa “easily outperformed” the other origin regions, registering a 15 per cent revenue growth, versus a combined growth for the other regions of around five per cent, said WorldACD.

According to the research house, smaller forwarders performed “a bit better” YoY than the world’s largest. The top-five forwarders: DHL Global Forwarding, Kuehne + Nagel, DB Schenker, Expeditors and Panalpina, “did not fare too well”.

At the other end of the range, Hellmann and Fashion Logistics did particularly well, whilst large Asian forwarders, especially Yusen, Sinotrans, Beijing Global Sky Horse and CTS Intl “had a ball” thanks to the strong growth ex-Asia Pacific.

Did you find this article of interest, if so why not register for a FREE digital subscription to Air Cargo News? – Find out more