Air cargo improvements push shippers to longer term deals

05 / 10 / 2023

Source: Xeneta

The air cargo market continued to find its way out of the doldrums in September, resulting in an increase in longer term deals.

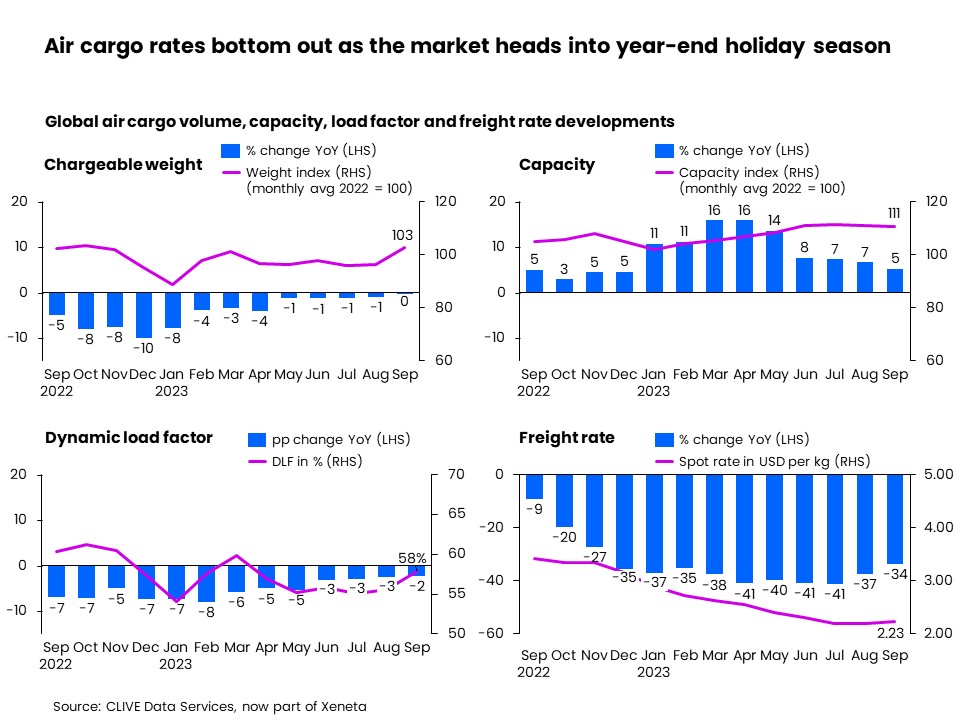

The latest figures from Xeneta show that air cargo volumes in September were flat on a year ago and spot rates were down by 34% – the lowest level recorded this year.

Compared with August, volumes increased 6%, spot rates improved by 2% and the dynamic load factor – using both volume and weight – improved by two percentage points to 58%.

While the figures hardly indicate a huge improvement in air cargo’s fortunes, market declines to appear to have flattened out.

Meanwhile, the increase in rates was largely driven by capacity additions easing, rather than a surge in demand, Xeneta said.

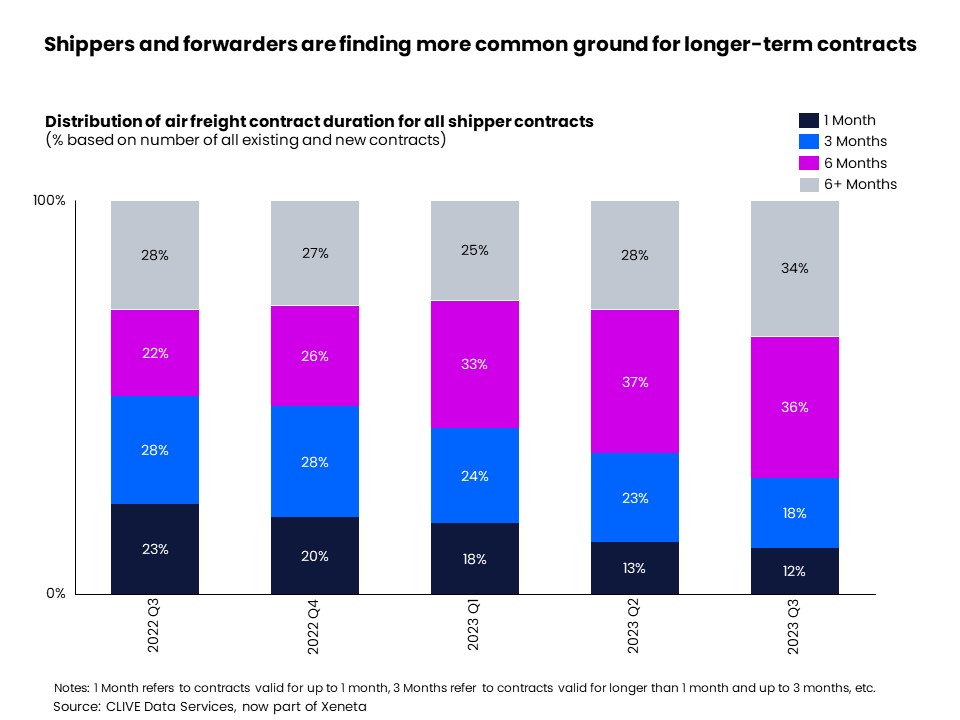

Xeneta chief airfreight officer Niall van de Wouw said that the improved demand figures had resulted in shippers looking for longer term deals.

The number of shippers committing to airfreight contracts of more than six months in the third quarter rose to 34% from 28% in the previous three-month period.

“This is not a peak season, it is a sign that airlines, freight forwarders, and shippers are finding more common ground to enter longer-term agreements,” van de Wouw said.

“We previously referenced no macro and market currents to support an expectation of a peak season, and this is still the case. We also said if there was to be an uptick in rates, we would expect this to be mainly driven by the supply side than the demand side, and this also still holds true.

“The general air cargo market is entering a new phase where parties are not expecting the market to go much higher or much lower. It is finding its feet again.

“We see more longer-term contracts being signed and this only happens when people feel more comfortable about the now and the foreseeable future. It is easier to make a commitment now than when the market is on a sharp downward or upward trajectory. There is a firmer floor in place.”

Source: Xeneta

Looking at regional performance in September, the rush ahead of China’s Golden Week holiday helped support an 11% month-on-month increase from China to Europe to $3.19 per kg, while China to the US was up 9% to $3.63 per kg.

“Staying in the region, Southeast Asia to Europe and to the US spot rates grew considerably by 22% month over month to $2.29 per kg) and 16% to $3.14 per kg respectively,” the data provider said.

“Within the region, Vietnam spot rates to Europe and the US rocketed 54% and 32% to $3.00 per kg and $3.70 per kg respectively.

“These higher growth ratios are partially due to rates growing from a low base and, on these trades, returning air cargo spot rates to the pre-pandemic levels seen earlier this year.”

It wasn’t all good news from the data provider – spot rates on the transatlantic declined and the performance of advanced economies remained weak.

Van de Wouw added: “The global air cargo market is still muted and has been flat at a global level now for three months in a row. September produced no surprises, with traditional seasonality pushing up demand over what we saw in August, and we would expect a similar trend in October with less capacity flying around.

“But in my conversations with shippers, forwarders, and airlines, I still hear very little hope of demand growth before Q3 2024 and for that to happen, we still need to see stronger consumer confidence and economic activity.”

Top 25 air cargo carriers: Cargo airlines tackle tough times