Air cargo rates continue to soften

23 / 09 / 2022

Image: Shutterstock

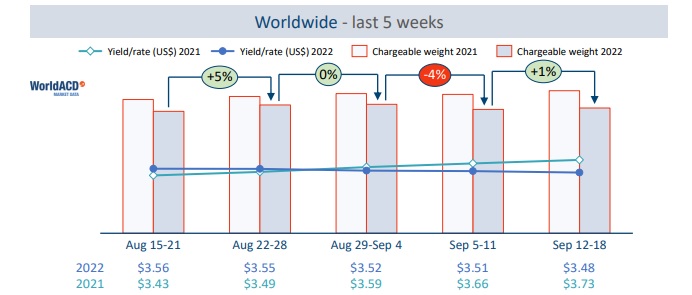

Global air cargo rates have continued to soften in September, according to the latest figures from WorldACD Market Data.

WorldACD said that air cargo prices continued their gradual decline in the first two full weeks of September, while volumes increased slightly in the second week after a drop in the first full week.

This follows a drop in worldwide cargo volumes in chargeable weight in August.

Looking at September 11 – 18 (week 37) alone, worldwide chargeable weight increased +1% compared with the previous week, based on the more than 350,000 weekly transactions covered by WorldACD’s data.

But comparing weeks 36 and 37 with the preceding two weeks (2Wo2W), volumes in the last two weeks combined dropped -3% on a 2Wo2W basis, while average worldwide rates declined -1%, with a decrease in capacity of -2%.

Across that two-week period, tonnages showed a declining trend from the main air cargo origin regions, except for flows ex-Europe, which showed an increase of +2%.

Notably, volumes ex-North America displayed a -10% drop that can also be seen on a lane-by-lane basis, with significant decreases from North America to Asia Pacific (-17%), to Europe (-10%) and to Central & South America (-9%).

Chargeable weight out of the key Asia Pacific origin region also declined (-4%) on a 2Wo2W basis, including on the big lanes to North America (-6%) and Europe (-5%).

Other notable lane-by-lane changes include a -17% drop in chargeable weight from Middle East & South Asia to Asia Pacific and a +8% increase from Europe to Middle East & South Asia, on a 2Wo2W basis.

Looking at year-on-year comparisons, WorldACD said after remaining above last year’s levels for the first seven months of 2022, worldwide rates are softening week over week, to currently -7% below their level this time last year, despite the buoying effects of higher fuel surcharges compared with last year.

Capacity from all of the main origin regions, with the exception of Asia Pacific (-9%), is now significantly above its levels this time last year, including double-digit percentage rises from Africa (+14%), Europe (+11%) and North America (+12%).

Last month, WorldACD said that it had found that the 4% year-on-year decline in chargeable weight registered at a global level over the first seven months of 2022 is largely the result of a drop-off in eight origins, in particular those located in North Asia.

Source: WorldACD

WorldACD finds reasons to be cheerful in air cargo volume figures

WorldACD: Air cargo demand flat in Q1 as lockdowns take their toll