Apex acquisition helps K+N to rapid airfreight growth

02 / 03 / 2022

Image: Shutterstock

Kuehne+Nagel (K+N) saw its airfreight volumes increase by more than half last year as industry-wide demand soared and the company benefitted from its acquisition of Apex.

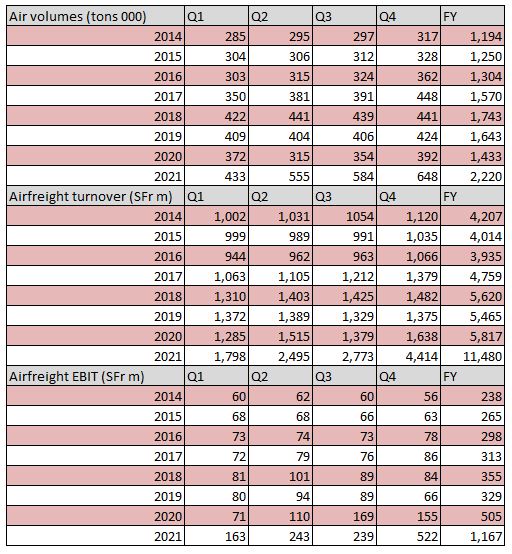

The forwarder’s total airfreight volumes for 2021 were up by 54.9% year on year to 2.2m tonnes, air revenues increased by 97% to SFr11.5bn and earnings before interest and tax (ebit) improved by 131.1% to SFr1.2bn.

The improvements come as the air cargo industry registered strong growth and rates were on the rise due to capacity shortages.

The first-time consolidation in May 2021 of airfreight provider Apex Logistics accounted for around half of the growth. At the time of acquisition, K+N said Apex handled around 750,000 tonnes of air cargo per year.

“Limited global freight capacity in 2021 called for customised solutions from the Air Logistics business unit,” K+N said. “Demand remained strong for K+N’s services in areas such as pharmaceuticals, essential goods and e-commerce. This enabled the business unit to gain significant market share.”

It added: “In 2021, the increased demand for air transport services was generated from a solid economic rebound but also from challenges in seafreight supply chains; this in combination with an extended period of low availability of belly capacity due to low frequency of passenger travel has led also in the airfreight market to capacity shortage and high freight rates.

“Similar to the situation in seafreight, a favourable service mix, strong development in the trans-pacific market, unprecedented access to charter capacity and operational efficiency under the difficult circumstances contributed to significantly increased margins.”

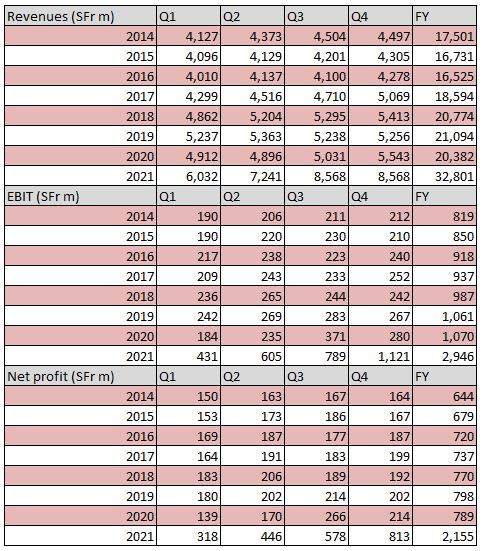

The overall group saw revenues for the year increase by 60.9% to SFr32.8bn, ebit improved by 175% to SFr2.9bn and net profit hit SFr2.1bn, up 173% on year earlier.

Detlef Trefzger, chief executive of K+Nagel International, said: “In 2021, Kuehne+Nagel proved itself an important and reliable logistics partner in a challenging market environment. Our 78,000 colleagues worked relentlessly to support customers with a winning service offering.

“Once again, we focused on customers, systems and employees, we accelerated strategic initiatives and we far surpassed our ambitious financial targets. Thus far in the current year, the business outlook has been favourable. However, Russia’s acts of war highlight the unpredictable nature of geopolitics – the effects of which on economic development cannot yet be assessed.”

In its annual report, the forwarder added: “Logistics operations were shaped by disruptive events in global supply chains – some due to the Covid-19 pandemic and some due to operational bottlenecks in carrier, port and trucking operations.

“On the sea and airfreight carrier side, the market in 2021 was characterised by a significant increase in freight rates caused by capacity shortages due to supply chain disruptions and operational inefficiencies. This drove a severe cost increase effect with respect to the Group’s operational efforts to execute shipments, but also a significant expansion of gross margins.”