DB Schenker sale process underway as firm is officially on the market

19 / 12 / 2023

Photo: DB Schenker

Deutsche Bahn has confirmed that subsidiary DB Schenker is officially up for sale a year after it began examining the possibility of selling its freight forwarding and logistics business.

The state-owned German railways giant said in a statement this morning that it has launched the sales process for the world’s fourth-largest airfreight forwarder.

Deutsche Bhan said that the process would be “open and non-discriminatory” and the condition for the sale is that it must have “apparent economic advantages for Deutsche Bahn in all respects”.

Funds raised from the sale will be used to reduce debt and invest in its rail business.

“The international logistics market offers excellent prospects for long-term growth. As one of the world’s top 4 logistics companies, DB Schenker has a solid position within the market,” Deutsche Bahn said.

“DB Schenker has contributed very positively to the DB Group’s economic growth over the years. However, the DB subsidiary will need more capital and flexibility for its own growth.

“The DB Group will retain all proceeds from a sale, a large part of which will be used to reduce debt.

“A sale would significantly accelerate Deutsche Bahn’s focus on its core business and the implementation of the Strong Rail strategy.”

Copyright: Announcement Wall Street Journal/DB AG

A year ago, the supervisory board of Deutsche Bahn assigned the management board the task of examining the case and preparing for a potential sale of its entire shares in DB Schenker.

The company employs some 76,600 employees at over 1,850 locations in more than 130 countries and is one of the world’s largest logistics providers.

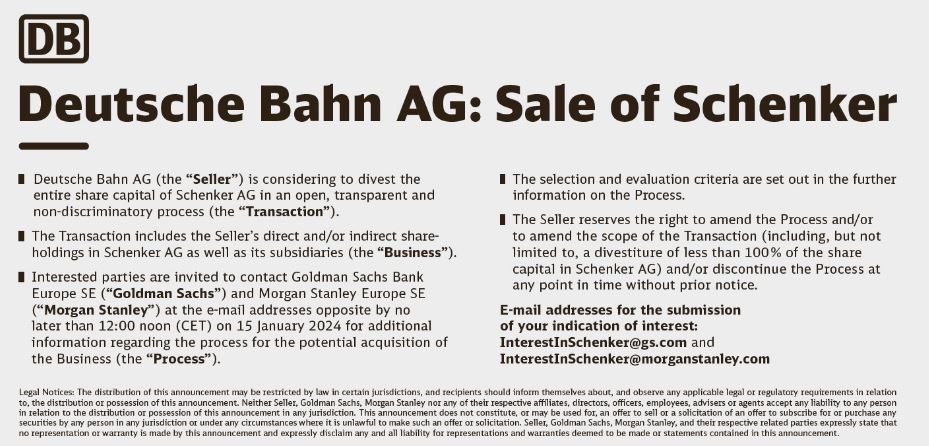

Deutsche Bahn said it would divest the entire share capital and the sale would include its direct and/or indirect shareholdings in Schenker as well as its subsidiaries.

Interested parties are invited to contact Goldman Sachs and Morgan Stanley by no later than 12 noon (CET) on January 15 for additional information regarding the acquisition process.

“The final decision on a sale of DB Schenker will be based on a separate resolution adopted by the Supervisory Board of Deutsche Bahn AG at the end of the sale process.”

“The process is also subject to general capital market developments.”

It is estimated that the company has a value of between €12bn-15bn, although this is down on the €15bn-€20bn value placed on the company two years ago during the height of the pandemic.

Attention will now turn to which companies could potentially buy the forwarding giant.

Two obvious candidates are DHL and DSV. DHL has said that it would examine the potential of buying DB Schenker but any deal must meet three criteria: “Does that company make DHL better, is it easy to integrate and is it accretive?

“If these three questions are answered, yes, then we probably would put in a bid. If one of these questions is answered, no, we will not put a bid in,” former DP DHL chief executive Frank Appel said in March of last year.

DSV has in the past stated it would examine a potential bid for DB Schenker.

More recently, German newspaper Handelsblatt reported that Abu Dhabi wealth fund ADQ could also be interested in bidding for the logistics giant.

But the potential bid from ADQ has some in the German government concerned over ownership of the company transferring to a Gulf state fund given the critical nature of transport services.