DSV airfreight volumes up 2.3% in Q1 but profit falls with rates

24 / 04 / 2024

Source: DSV

DSV’s airfreight volumes benefited from strong demand out of Asia in the first quarter of the year, although revenue and profit fell as rates dropped in the market.

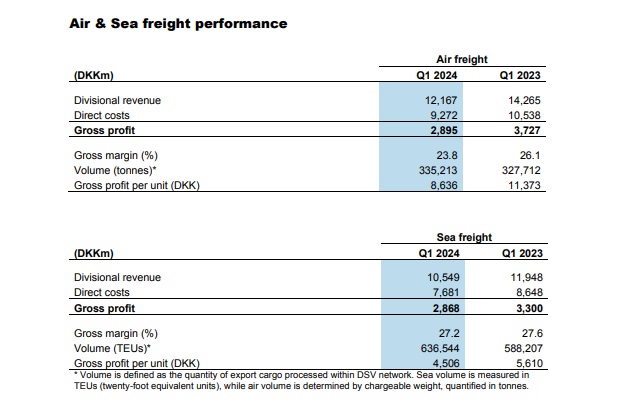

The forwarder’s airfreight volumes increased 2.3% in the first quarter of 2024 to 335,213 tonnes. This is compared to 327,712 tonnes in the same period last year.

The company attributed this growth to strong Asia Pacific export volumes.

“The air freight market is impacted by continued high growth in e-commerce volumes from China, driving both market volumes and rates up.”

DSV noted that the airfreight market is dealing with overcapacity, but reflected that it expects that retirement of old aircraft will offset some of this excess capacity.

However, airfreight revenue dropped -14.7% and airfreight gross profit fell 22.2%.

Source: DSV

Overall, the Air & Sea division recorded a 11.5% decline in revenue for the first quarter. “Revenue was impacted by higher volumes in both air and sea, but this was offset by lower average freight rates,” said DSV.

Plus, gross profit for the division fell 16.2%, reflecting a normalisation of freight rates and yields, said DSV. “This was caused by lower gross profit yields, partly offset by volume growth for both air and sea,” noted the company.

There was also a 26.% decrease in EBIT before special items for Q1 2024 compared to the same period last year.

Across the whole group, revenue declined 5% to Dkr38.4bn and gross profit declined 8.6% to Dkr10.3bn.

Jens Lund, group chief executive, said: “We are off to a good start delivering strong financial results in the first quarter of 2024, and I’m particularly satisfied that we are gaining market shares in all three divisions. We do this in a market that is normalising after a few very volatile years following the COVID pandemic.

“We have also completed the leadership changes, the organisation has settled, and together with the new but highly DSV-experienced leadership team we are fully focused on executing on our strategy supporting organic growth as well as M&A. Doing this, we ensure a clear continuation and maintaining the DNA that has always been a driving force in DSV.”

In terms of future focus, the company said: “While M&A continues to be at the core of our strategy, we are strengthening our operational and commercial focus.”

On its NEOM logistics joint venture, DSV said: “The project is mobilised and ready to go live in Q2 as planned.” It added that it expects the joint venture activities to “ramp up over the next 3-4 years”.