Dubai drives October’s cargo surge

25 / 02 / 2015

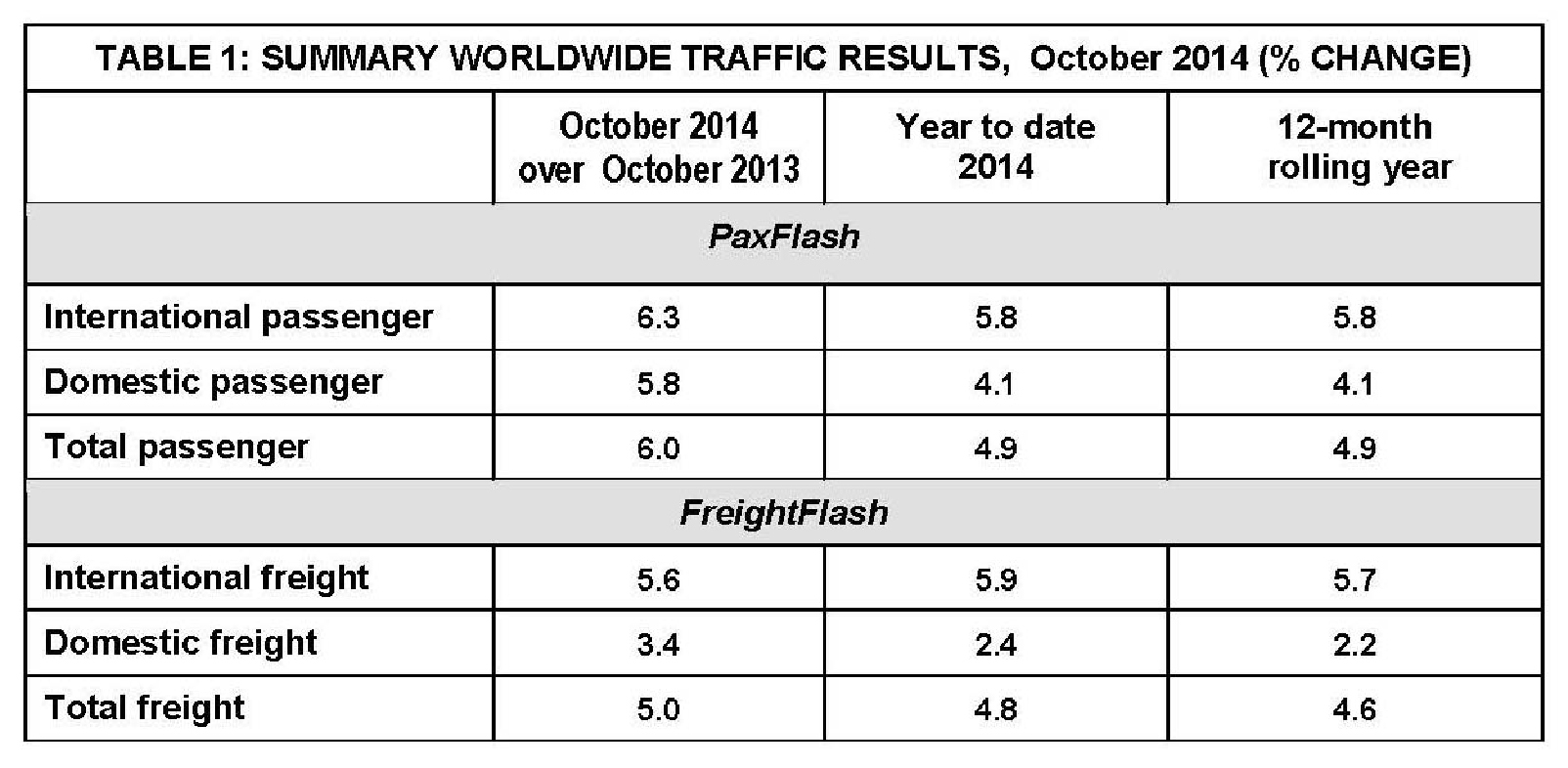

A Dubai cargo surge helped global air freight traffic maintain an upward trend in volumes with a year-over-year growth rate of five per cent for October, reports Airports Council International (ACI).

Overall worldwide accumulated volumes for the last twelve months rose by 4.6 per cent. International freight volumes jumped up by 5.6 per cent, whereas domestic volumes increased by 3.4 per cent.

Global air freight is set to grow by over four per cent this year compared with 2013, said the association of 591 member airport authorities, which operate 1,861 airports in 177 countries,

The Middle East posted the greatest increase in freight volumes at 13.7 per cent year-over-year for October. Dubai World Central (DWC) is now “a major contributor to overall increases in freight volumes for the region,” said ACI, adding: “Air freight volumes at DWC have increased by over 331 per cent as compared to the previous year.”

Part of the reason for the massive uptick is that DWC has benefited from a switch of freighter operations from Dubai International Airport.

Africa also achieved double digit growth of 10.7 per cent for the month of October. Johannesburg (JNB), Africa’s largest freight hub, moved up by 7.6 per cent in terms of freight volumes.

Asia-Pacific posted increases in volumes of 4.8 per cent in of October, which is slightly below the twelve-month growth trend of 5.7 per cent: “Nevertheless, the region’s largest freight hubs continue to report gains in volumes. Hong Kong (HKG), Shanghai (PVG) and Incheon (ICN) saw volumes increase by 4.3 per cent, 7.5 per cent and 1.7 per cent respectively for the month.”

North America also experienced growth of over four per cent following a weakened air freight market in 2013. Memphis (MEM), North America’s busiest freight airport and FedEx hub, and Louisville (SDF), the UPS hub, grew by 2.2 per cent and 4.2 per cent during October.

Europe experienced “more moderate growth” of 3.6 per cent year-over-year. However, results were mixed across airports in the region.

Frankfurt (FRA) grew only slightly (0.7 per cent), while Paris (CDG) had a decline of one per cent. Amsterdam (AMS) and London (LHR) grew by 7.7 per cent and 8.3 per cent respectively.

With ongoing weakness in the Brazilian and Argentinian economies, freight volumes in Latin-America-Caribbean increased only slightly, by 1.7 per cent for October.

ACI world economics director Rafael Echevarne said: "Although there has been improvement in the US economy, coupled with greater momentum in international trade volumes in Asia-Pacific, downside risks continue to persist in other regions, particularly in the Euro area."

Echevarne continued: “The German economy has experienced weak industrial production and export growth, which may translate into weakness across its economy. Japan, Russia and Brazil are also stagnating. Many of these factors combined may adversely affect air transport demand."

Did you find this article of interest, if so why not register for a FREE digital subscription to Air Cargo News? – Find out more

Life Sciences and Pharmaceuticals Conference 2014, to be held in London during December. To register and find out more…