Shipping doldrums hit German bank DVB but aviation remains stable

31 / 08 / 2017

Volatile container and tanker shipping markets saw German finance house DVB Bank Group (DVB) register a 2017 half-year pre-tax consolidated net loss of €506.3m, while the demand forecast for the aviation markets “remains stable”.

The specialist in international transport finance said: “Shipowners remain under pressure from low charter rates and competition for employment. Against this background, owners of vessels and drilling rigs adjusted their capacities, through lay-ups, restructuring or consolidation.”

It added: “Excess capacity remained a major challenge on shipping markets throughout the first half of 2017. Container carriers, bulk carriers and tankers are the three most important sectors for the maritime industry, in terms of transport volumes and services.

“Especially in container shipping, persistently difficult market conditions have burdened performance among shipowners. In this context, increasing consolidation of shipping lines is set to intensify competition among shipowners chartering their vessels to line operators."

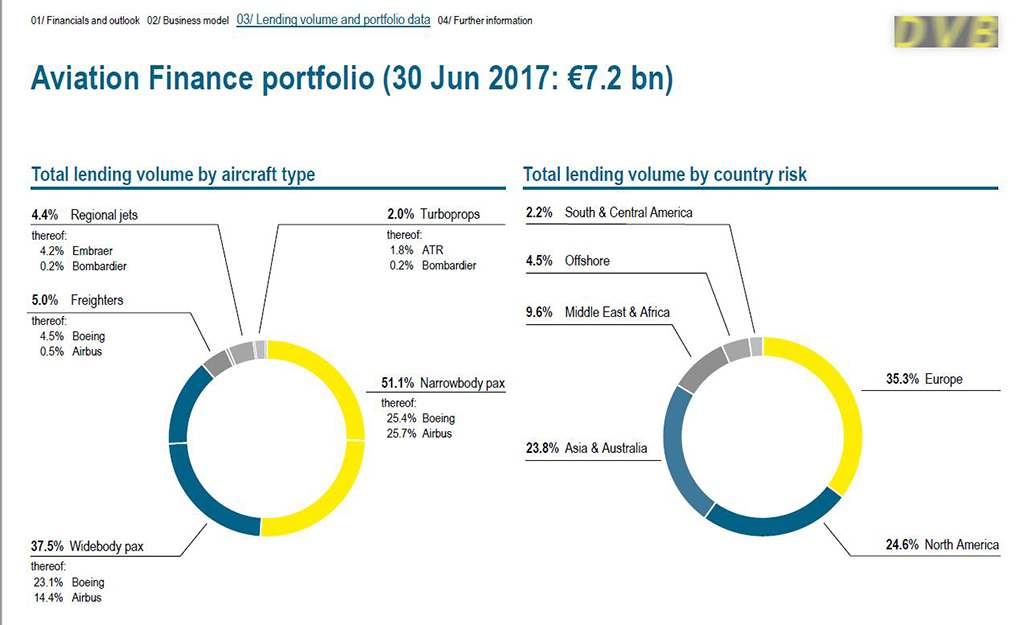

DVB’s aviation finance portfolio stood at €7.2bn at the end of June this year, compared with €11bn for shipping finance in the same period.

Freighter aircraft, primarily Boeing, account for 5% of the total DVB aviation portfolio.

In its half year report, DVB said: “The demand forecast for the aviation markets remains stable. Worldwide, airlines have benefited from low oil prices and high load factors, and are reporting good results.”

It added: “We plan to sustain the positive business development in Aviation Finance as well as in Land Transport Finance, and strengthen the earnings power of these businesses.”

DVB said that “structural changes with differing characteristics” can be observed in the sub-markets of the global transport sector: “Whilst aviation and land transport markets are predominantly shaped by high excess liquidity together with strong margin and competitive pressures, the shipping and offshore industries have yet to see the end of the ongoing consolidation phase.”