CLIVE Data Services: Airline cargo load factors 35% higher than reported

20 / 01 / 2020

The global utilisation of air cargo capacity is 35% higher than the traditional industry indicator suggests, according to a new data services company.

CLIVE Data Services has called on the industry to “refresh” the way it views cargo load factors to strengthen the airlines’ voices with all stakeholders, not least airports, slot coordinators, legislators and aircraft manufacturers.

Underpinning this new way of thinking is that air cargo load factors based on weight utilisation paint a misleading picture of how full flights really are.

“This is caused by the methodology used,” said CLIVE’s managing director, Niall van de Wouw.

“Traditionally, the amount of cargo flown in kgs is divided by the level of cargo capacity in kgs. But, the reality for the vast majority of widebody and freighter flights is that it’s the cargo capacity in cubic meters which is the limiting factor, not the cargo capacity in kgs.

“Consequently, existing load factors, based only on weight, underestimate how full planes really are, and thus give a distorted picture of how the industry really is performing.

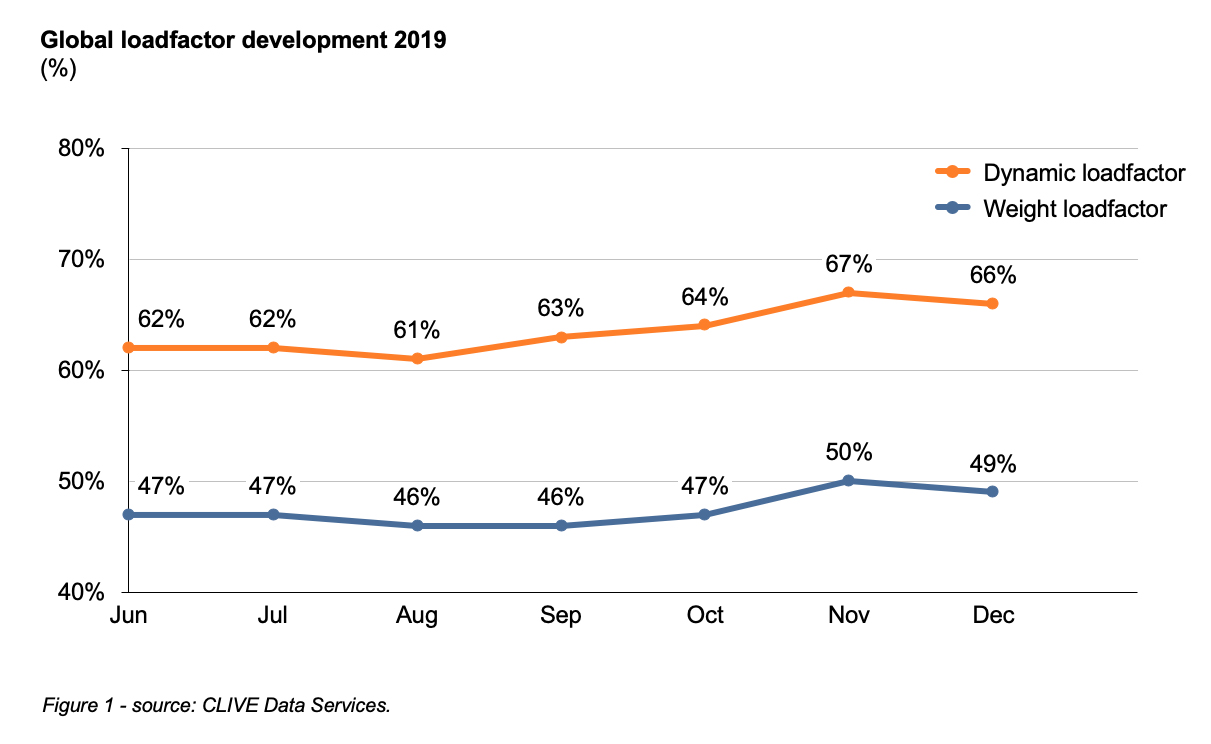

According to CLIVE data aircraft load factors when using its dynamic loadfactor using space reached 66% in December and 67% in November – the peak season for air cargo.

When using weight as the basis for load factor, the figure for November stood at 50% and the figure for December was 49%.

“The fact that flights nearly always ‘cube out’ before they ‘weigh out’ is a result of the aircraft’s higher capacity density (available kgs per cubic meter) than the average density of the goods moved by air.

“Looking ahead it is very likely that this discrepancy in capacity density and cargo density will further increase. On the capacity side, we have new planes entering the market which can lift more kgs of cargo per cubic meter than ever before. And, on the cargo side, the surge in e-commerce traffic will further decrease the average density of the cargo flown.”

“We therefore believe it is time for a new yardstick: the dynamic load factor. To support this change in thinking, we will now be publishing this dynamic load factor analyses each month. It considers both the volume and the weight perspective of the cargo flown and capacity available.

The analyses are based on flight data shared by a representative group of airlines operating to all corners of the globe.

Each month, the company will report an overview of the load factor trends for the previous month.