IATA: Airlines to return to profit next year but cargo under pressure

06 / 12 / 2022

Photo: Jaromir Chalabala/ Shutterstock

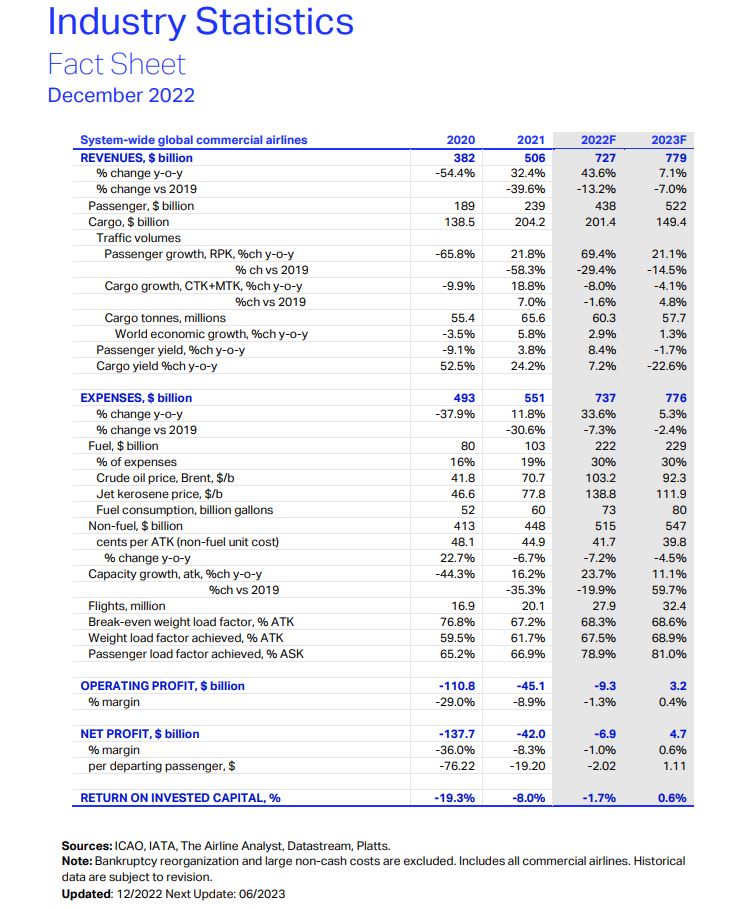

Airline association IATA is expecting airlines to return to profit next year after three years of losses due to the outbreak of Covid but cargo volumes, yields and profits are set to decline.

IATA said that in 2023 it expects airlines to post a “small” net profit of $4.7bn, which equates to a 0.6% net profit margin and will be the first profit since 2019 when the industry made $26.4bn.

The association said that this year it expects airlines to post a loss of $6.9bn, following on from a $42bn deficit last year a $137.7bn loss in 2020.

The improved profits stem from improved yields and cost control in the face of rising fuel prices.

IATA said that air cargo revenues had played a key role in cutting losses with revenues this year expected to reach $201.4bn, which is in line with 2021, and more than double the $100.8bn earned in 2019.

However, next year cargo markets are expected to come under increased pressure in 2023.

Revenues are expected to be $149.4bn, which is $52bn less than 2022 but still $48.6bn stronger than 2019.

Economic uncertainty means cargo volumes are expected to decrease to 57.7m tonnes, from a peak of 65.6m tonnes in 2021 and 60.3m tonnes this year.

“As belly capacity grows in line with the recovery in passenger markets, yields are expected to take a significant step back,” the association said.

“IATA expects a fall of 22.6% in cargo yields, mostly in the latter part of the year when the impact of inflation-cooling measures are expected to bite.

“To put the yield decline in context, cargo yields grew by 52.5% in 2020, 24.2% in 2021 and 7.2% in 2022. Even the sizable and expected decline leaves cargo yields well-above pre-Covid levels.”

IATA director general Willie Walsh said: “As we look to 2023, the financial recovery will take shape with a first industry profit since 2019. That is a great achievement considering the scale of the financial and economic damage caused by government-imposed pandemic restrictions.

“But a $4.7 billion profit on industry revenues of $779bn also illustrates that there is much more ground to cover to put the global industry on a solid financial footing.

“Many airlines are sufficiently profitable to attract the capital needed to drive the industry forward as it decarbonises. But many others are struggling for a variety of reasons.

“These include onerous regulation, high costs, inconsistent government policies, inefficient infrastructure and a value chain where the rewards of connecting the world are not equitably distributed.”

Source: IATA