Top 25 air forwarders 2019: DHL leads the pack in a tough year

03 / 06 / 2020

Top 25 Forwarders

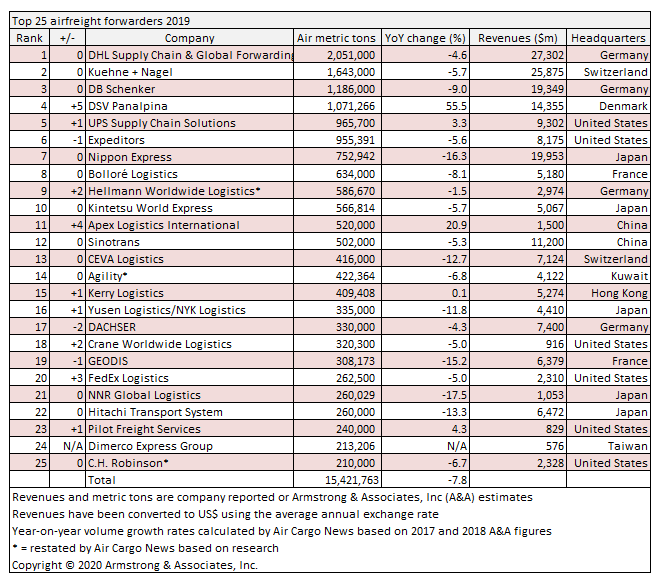

In a year marked by an ongoing trade war between China and the US, DHL Global Forwarding extended its lead as the world’s busiest airfreight forwarder in 2019 ahead of Kuehne+Nagel (K+N) and DB Schenker, while DSV Panalpina pushed into the top four (full table at the end of article).

According to figures from consultant Armstrong & Associates, the air cargo volumes recorded by the top 25 airfreight players demonstrated how tough the year was, with demand declining by 7.8% year on year to 15.4m metric tonnes.

This is ahead of an estimate market decline of around 4%.

The top airfreight forwarder, DHL Global Forwarding, saw its volumes decline by 4.6% year on year to just over 2m metric tonnes.

This was a better result than K+N and DB Schenker, reversing the trend seen in recent years where the company has been outperformed by its nearest rivals in terms of percentage volume growth.

Second-placed Kuehne+Nagel was down 5.7% on 2018 levels to 1.6m tonnes and DB Schenker slid by 9% to 1.2m metric tonnes.

On its airfreight division’s performance last year, DHL Global Forwarding said in its annual report: “Airfreight volumes decreased by 4.7 % in the reporting year, due mainly to declining market volumes on key trade lanes.

“As a consequence, airfreight revenues also declined, posting a decrease of 3.1 %. Despite the volume decline, gross profit from airfreight increased slightly by 0.7 % thanks to better margins.”

It added that the development of the global airfreight market had been weak since the second quarter of 2019.

As a general rule, freight forwarders tend to see margins improve in a declining market as the lower rates they pay carriers take a while to wash through to their customers.

Of its performance in 2019, K+N said in its annual report: “In 2019, the challenging market environment and the resulting softening demand in some key industries led to a decline in [airfreight] turnover to SFr5.5bn and earnings before interest and tax (ebit) to SFr329m.

“Thanks to focusing on the expanded service portfolio and continuing the development of eTouch solutions, an optimised cost structure and the successful integration of Quick International Courier, Kuehne + Nagel’s airfreight business once again concluded a successful year.”

Logistics Trends & Insights (LTI) founder and president Cathy Roberson says it was not just the China-US trade war that put the brakes on air cargo volume growth last year.

“Increased risks in a global environment have certainly not helped whether they were natural disasters, economic or political risks.

“While the US-China trade war took centre stage, there were other trade battles that occurred throughout the world impacting commodities as steel and airplanes.

“Brexit for example, has been a concern for many shippers as well as North American Free Trade Agreement (NAFTA) revisions that have since culminated into US-Mexico-Canada Agreement (USMCA), which is expected go into effect on July 1.”

Roberson says that certain sectors were affected more than others. This would have put forwarders with a strong presence in those markets under extra pressure.

“Agriculture and manufacturing were impacted the most. The uncertain global economy and increasing trade barriers were blamed by most freight forwarders for 2019 air volume declines,” she says.

“The automotive industry downturn seemed to have impacted the major freight forwarders in varying ways but in particular K+N, which noted that its airfreight volumes were highly exposed to the automotive and high-tech industries.”

Regionally, the Japanese forwarders also appeared to be hit extremely hard last year.

Of the five forwarders from the country included in the list, four reported a double-digit percentage drop off in demand in 2019.

To read the full analysis in next month’s issue, sign up for free to receive Air Cargo News every month.