US cargo-focussed airports report rapid growth in 2020

26 / 03 / 2021

Copyright: Shutterstock

US airports with a cargo focus last year saw their freight volumes grow rapidly as consumers switched to e-commerce, according to new research by Chaddick Institute for Metropolitan Development.

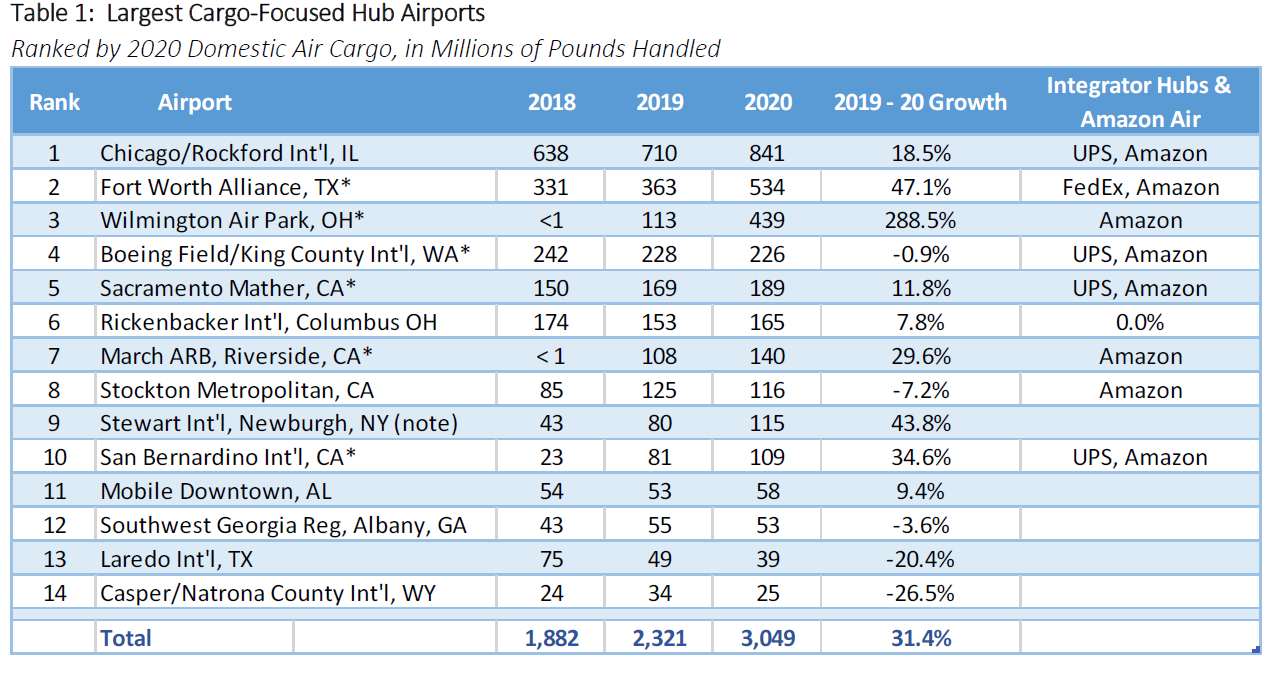

The report, written by Joseph Schwieterman and Euan Hague, found that freight volumes at cargo-focussed airports last year increased by an average of 31.4% compared with 2019.

Meanwhile, the top 10 mixed purpose airports that are an operational focus for DHL, FedEx and UPS saw their volumes increase by 9%.

“The year 2020 was a time of substantial growth at airports that are hubs for companies specialising in air cargo. Surging volumes of traffic from the fulfilment centers of online retailers to homes and businesses have greatly altered the way our country uses its highways, streets, and airports,” the report said.

“In the process, cargo-focused hub airports have shouldered a much heavier burden than in the past, with tonnage growing much faster than at mixed purpose airports. More growth is expected throughout 2021.

“The rapid growth of cargo-focused hubs stems from a variety of factors, including the growing ease and decreased cost of at-home package delivery, a dramatic shift in consumer behavior as a result of the pandemic, and a shift to airborne commerce due to the relatively low price of jet fuel in recent years.”

The report also found that half of the largest ten cargo-focused hubs airports grew by 25% or more between 2019 and 2020. Chicago Rockford, which handled the greatest tonnage, grew 18.5% and Wilmington Air Park had the greatest growth (289%) in percentage terms as Amazon ramped up its presence.

Four the five fastest growing cargo-focused hub airports when measured in percentage terms, are cargo-only airports.

While cargo-focussed airports are growing quickly, they still lag behind their larger mixed-focus rivals when it comes to total volumes.

The report said: “Despite the substantial growth at cargo-focused hubs through 2020, these facilities do not yet handle nearly as much cargo as air freight integrator ‘megahubs’ such as Cincinnati/Northern Kentucky International (CVG), Louisville, and Memphis. Chicago Rockford is about one tenth as large as Memphis and about a third as large as CVG.”

The increase in air cargo demand due to changing consumer behaviour does come at a cost. The report pointed out that the move to e-commerce results in higher green-house gas emissions than traditional stores, results in more trucks and vans on the road and out-of-town warehouses are harder to access for workers than city centre stores.

Source: Chaddick Institute and Bureau of Transportation Statistics