Air cargo in stable condition following coronavirus crisis

20 / 05 / 2020

CLIVE managing director Niall van de Wouw provides an update on the latest market statistics

When the status of a patient submitted into hospital is described as ‘stable’ it often means that they are not well at all, but that, for the time being, their condition is not getting worse. The same diagnosis can be applied to the current state of the air cargo market.

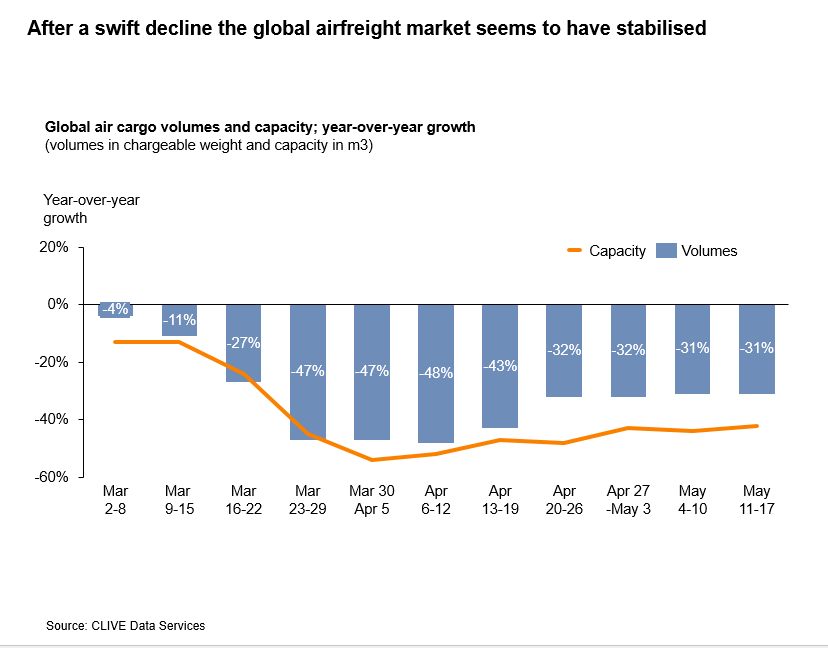

An examination of global air cargo growth rates indicates that ‘stable’ seems to be about as good an analysis as we can offer for the industry as a whole right now.

Volumes that are around 30% less than a year ago are by no means a healthy situation but at a time when we’re all trying to look for positive news, we can at least remind ourselves that just a few weeks ago, the outlook was far worse.

And, because this reduction in demand is still being overtaken by the reduction in supply, our ‘dynamic loadfactor’, based on both the volume and weight perspectives of cargo flown and capacity available, remains high.

For last week (May 11-17), it was 70% – and that is just the average. Strong trade imbalances – mainly to and from Asia Pacific – caused a lot of pressure on the front-haul flights.

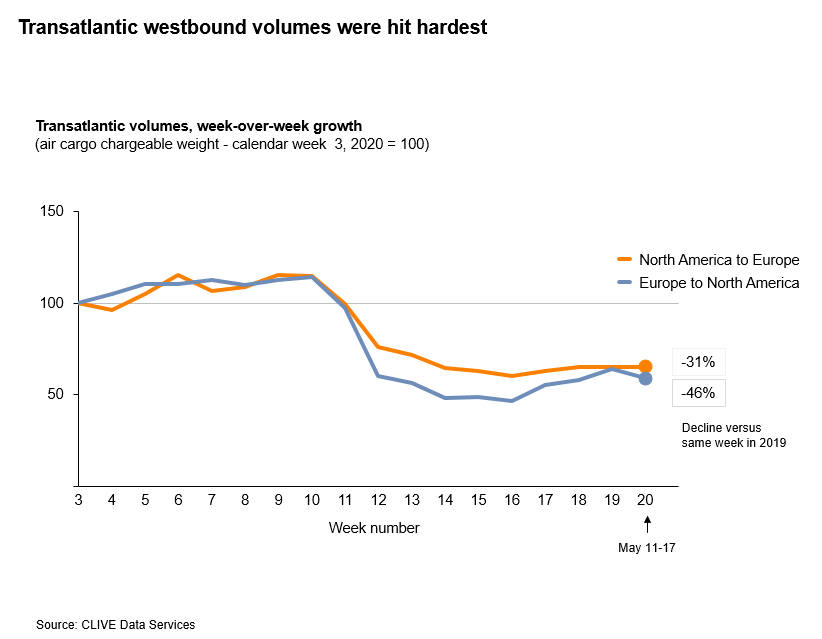

If we zoom in to take a closer look at the transatlantic trade lane, we clearly see that the impact of the recent crises was not evenly shared across both directions.

The volumes from Europe to North America took a deeper dive than the flows from North America to Europe. Despite a recent ‘recovery, the westbound flows are still at roughly half the volume of the same week in 2019, while comparative eastbound volumes reduced by around 30%.

In absolute terms, the westbound decline is even greater, as the westbound flow is roughly 30% larger than the eastbound flow.

What both flows do have in common is the increase in dynamic loadfactor. In the May 11-17 period, both were 24 percentage points higher than in the same period in 2019; with the westbound flights at 91%, and the Eastbound flights at a still respectable 73%.

With more transatlantic cargo capacity coming online at the same time as Federal Reserve data shows US factory production plummeted in April by the highest level since 1919, the one certainty is that the air cargo industry faces more uncertainty and it’s condition is very likely to fluctuate week-by-week.

We will continue to keep the patient’s temperature in the weeks to come and will be the first to report any changes in its condition, good or bad.