Are recent air cargo improvements the start of a full market recovery?

12 / 10 / 2023

Source: Shane Hoggatt/Shutterstock

There is no doubt that the air cargo industry has seen some improvement over the last few weeks but there is debate over whether this represents the start of a full recovery for the market.

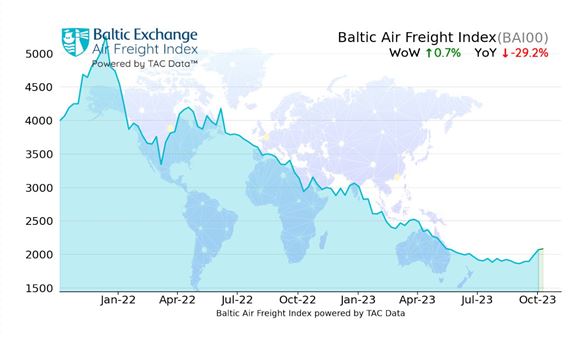

The latest rate figures indicate a tightening of supply and demand with last week’s numbers from the Baltic Exchange Airfreight Index (BAI) based on TAC Index data showing an increase.

The overall BAI was up 0.7% in the week to October 9, cutting its year-on-year decline to -29.2% and “adding a little further evidence of a genuine peak season bounce this year”, TAC Index said in its weekly market update.

“The latest rise was again led by higher rates out of China, with the index for outbound Hong Kong routes gaining a chunky 6.3% week on week to trim its year-on-year fall to only 20.2% – with strong increases on rates to Europe as well as on transpacific routes.

“There were also further rises on rates in both directions from Shanghai, with a week-on-week gain of 2.6%, cutting the year-on-year decline to 22.4%.”

TAC editor Neil Wilson is positive about the outlook and said that the industry is seeing a “genuine peak season bounce” that could extend into next year.

He quoted airline sources that have suggested major product launches – such as the new iPhone – would boost demand.

Other sources, he admitted, were more sceptical describing the current market conditions as a “dead cat bounce”.

Source: TAC Index

Wilson said that some forwarders had seen this bounce coming and had moved to secure capacity going forward while others, such as e-commerce firms, had preferred to keep paying spot prices and could soon be “scrambling for shrinking capacity”.

Meanwhile, Bruce Chan, director and senior research analyst covering global logistics and future mobility at investment bank Stifel, was more cautious about recent market improvements.

“While recent increases are a positive indication that could suggest a stabilising market, we think it may be premature to celebrate,” said Chan.

“Rates are still well-below where they were last year and where they started this year, and supply continues to enter the market.”

As well as returning capacity, Chan pointed out that average fuel prices had risen and accounted for roughly half of the overall rate increases on certain lanes in September.

Chan also pointed out that FedEx and UPS had predicted a flat peak season this year.

“Could we be seeing emerging evidence of a better-than-expected finish to 2023?” he asked.

“Potentially, but with inflationary pressure and rising energy prices putting a strain on consumer discretionary spending, the likelihood of a breakaway restocking is unlikely in our view.

“While we think inventories have for the most part bottomed, we also think the risk of fundamental demand grinding lower, coupled with the memory of last year’s overstocking will likely lead shippers to position conservatively.”

Xeneta chief airfreight officer Niall van de Wouw is also cautious about the recent market improvements and said they reflected normal seasonal trends.

“We previously referenced no macro and market currents to support an expectation of a peak season, and this is still the case. We also said if there was to be an uptick in rates, we would expect this to be mainly driven by the supply side than the demand side, and this also still holds true.

“The general air cargo market is entering a new phase where parties are not expecting the market to go much higher or much lower. It is finding its feet again.”

He added that it would be well into next year until we would start to see a full-blown recovery.

“The global air cargo market is still muted and has been flat at a global level now for three months in a row. September produced no surprises, with traditional seasonality pushing up demand over what we saw in August, and we would expect a similar trend in October with less capacity flying around,” said Van de Wouw.

“But in my conversations with shippers, forwarders, and airlines, I still hear very little hope of demand growth before Q3 2024 and for that to happen, we still need to see stronger consumer confidence and economic activity.”